Are lifestyle retirement funds right for the 100-year life?

21st February 2023 09:36

by Nina Kelly from interactive investor

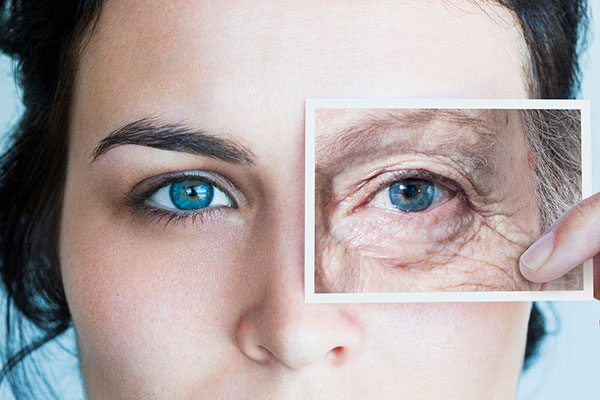

If we are living longer and retiring later, and in different ways, are lifestyle pension funds the best option?

If you knew the date of your death, how would you live? This is the question posed by the 2018 novel The Immortalists, and it could well be modified for the purposes of this article to ask: if you knew the date of your death, how would you invest your pension?

Knowing how long you were going to live would certainly make financial planning for your golden years easier. You’d have a clearer idea of how much you needed to save in a pension, as well as how many items you could feasibly tick off your personal bucket list before you kick said bucket.

- Invest with ii: Open a SIPP | Best SIPP Investments | SIPP Cashback Offers

Clearly few of us know when our time on Planet Earth will expire, but there’s a “fun” life expectancy calculator published by the Office for National Statistics (ONS). My own life expectancy is 87 years, according to this tool, but there’s a 25% chance that I will live to 96, and a 9.1% chance that I will make it to 100. If I live to be a centenarian, or even close to it, will my pension pot stretch to fit?

The reality is that people are living longer and alongside the changing face of retirement, which I discuss below, and the fact that most Britons with workplace pensions will need to play an active role in managing their own pension (even though many may not realise it yet), I wonder how good a fit “lifestyle” or target-date pension funds are.

How do lifestyle pension funds work?

Lifestyle funds automatically start ‘de-risking’ roughly 10 years before the retirement age you selected when you applied to join your workplace pension scheme.

De-risking in a pension involves shifting the weighting to ‘safer’ assets, such as bonds, rather than shares. While this de-risking process is designed to protect your pension from suffering a precipitous fall in a stock market crash just before retirement, it effectively hobbles the growth of your pension.

Millions of Britons own a few lifestyle pension funds, me included. How about you? You can often spot such funds because they have words such as ‘conservative’, ‘moderate’ or ‘aggressive’ in their name to indicate the fund’s risk level, or they include descriptors such as: “target retirement 2045”, which relates to your retirement age. It is worth reviewing your retirement age on workplace pensions to check that it is in line with your current expectations on retirement.

- In your 40s? Eight tips to reach your retirement goals

- Single? Six dos and don’ts for retirement

- Pensions: is 12% the new 8%?

While lifestyle and target-date funds offer a simple solution to saving for retirement, the default ‘conservative’ lifestyle fund, for example, could leave you with an underfunded nest egg because of its low-risk approach, and your pension may not last long enough to keep the lights on in your old age.

It’s worth doing a bit of digging to find out what the risk level of your workplace pension is and decide whether it makes financial sense, especially if you are in your 20s and 30s and have a long investment horizon during which you can take a bit more calculated risk for the chance to grow your money faster.

Another problem is that millions of workers like me with defined contribution, or DC workplace pensions are likely to use an element of income drawdown in retirement. This is where you take some money from your pension to live on each year and keep the rest invested, so the investment growth compensates for the withdrawals. In theory, your money lasts for as long as you need it. But, if we are likely to be living longer, do you want to rely on a lifestyle pension fund whose growth has been choked? What if you run out of money? In reality, pensioners are likely to want to choose to remain invested in higher-risk assets to some degree for growth.

Fees, fi fo fum

Lifestyle pension funds may also come with expensive fees, so it’s worth checking what you are paying – you might have to be persistent to find out the figure.

Although pension fund fees may sound like a boring aspect of planning for your future self, they have a big impact on the amount of money you eventually end up with, as the charges are a percentage figure and will take a bigger bite out of your pension pot as it grows.

Alice Guy, personal finance editor at interactive investor, says: “Shopping around for cheaper investment fees is an easy way to stretch your retirement savings. Withdrawing £12,000 per year from a £300,000 pension pot could mean your pension pot lasts for 30 years, assuming 5% investment growth, 1% fees and 3% inflation. But if your fees reduced to 0.5%, that same pension pot could last for 33 years - another three years.”

The changing face of work and retirement

Something else to be aware of is that retirement is evolving and will not necessarily mean a “hard stop” from full-time work for everyone when they reach their late 60s. So, beware of de-risking too soon.

In future, people may shift from full-time work to full retirement very gradually, meaning they work for longer, and presumably pay into a pension for longer.

Writing for the Stanford Centre on Longevity, Carol Hymowitz, journalist and author, says: “Retirement is no longer a one-time, enduring occurrence. Increasing numbers of Americans are retiring from jobs when they turn 60 or 65 only to boomerang back to work after a pause. Some return to their former workplaces as either part-time or contract employees, while others find new jobs. An abrupt retirement, in fact, that continues for the rest of one’s life is becoming the exception rather than the rule.”

Hymowitz cites the example of an optometrist, who retired three times, first when he was 70. Bored, he went back weeks later and worked a four-day week until he was 72. This later moved to three, and then two, days a week. He finally retired at 84 after his health declined owing to chromic pulmonary disease. Hymowitz says that “his choice to work for longer than planned – but less and less as he aged – could become a new blueprint for retirement”.

Not everyone wants to work until they are 84, of course, but if Britons need to fund decades in retirement, they may have to work beyond their ideal cut-off point, and a lifestyle fund may not be able to deliver the pot size they need.

One alternative to lifestyle funds

Consolidating your workplace pensions into a self-invested personal pension (SIPP) could offer a solution to some of the drawbacks of lifestyle funds.

With a SIPP, there is no automatic de-risking of your fund(s), and an investment platform normally offers you access to the whole universe of funds, so you have the power to choose the appropriate risk level. You could also save on fund fees by consolidating multiple pension pots into one place.

When it comes to a SIPP, though, you do need to be confident enough to manage your own investments, and ensure that your pension is suitably diversified.

- ii SIPP customer stories: four ii customers share their views

- Don’t be shy, ask ii…should I put money into a SIPP or an ISA?

Before rushing to consolidate, it’s important to check whether you might miss out on any important guarantees by consolidating, such as a guaranteed retirement age, etc.

The good news is that pensions dashboards are coming to a screen near you soon. Current indication from government on access for the public is mid-2024, but that could change. This will allow savers to monitor all their pension pots in one place, and, crucially, offer them greater transparency on costs.

In the meantime, why not check your own pension(s) to see if you have any lifestyle funds? If so, check their risk levels, and the fees, and consider whether they are the best option for you.

I’d urge anyone, whatever age you are, to engage with your pension regularly. It’s not as ‘boring’ or complicated as you might fear, and it pays to have greater control of your financial future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.