Brexit: An investor's strategy as deadline approaches

The Brexit process has made it hard for investors, but the Salty Dog analyst sees reason for optimism.

18th March 2019 12:03

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The Brexit process has made it hard for investors, but the Salty Dog analyst sees reason for optimism.

Déjà vu

As we approach the 29th March deadline it would be nice to think that there will be some clarity over Brexit. Unfortunately, that doesn't appear to be the case. The uncertainty is unhelpful for businesses and it doesn't make our lives as investors any easier.

This time last week we were waiting for the outcome of potentially three votes in the Houses of Commons. One to approve 'May's Deal', if that wasn't passed then one to rule out a 'No Deal', and then one to seek an extension to the Brexit process.

Well, as expected, the Prime Minister's deal was rejected, as was leaving without a deal, and so we're now looking for an extension. How long we need will depend on whether Mrs May can finally get her deal approved.

Once again, we're waiting for a 'meaningful' vote - it's starting to feel like Groundhog Day.

In the last week we haven’t really moved an awful lot further forward. We're still sitting tight with our investments for a few more days and hope that we will then get a clearer picture of the UK's exit plans.

In the final quarter of last year stock markets around the world went down, and we dramatically increased the amount of cash that we were holding in our portfolios. Since Christmas there have been signs of a recovery, and so we started to reinvest.

We still have relatively high levels of cash in the portfolios, especially in the Tugboat portfolio which is aimed at cautious investors, and are holding a mixture of funds, some which invest in the UK and others which invest overseas.

Putting Brexit to one side for a minute, global stock markets have had a pretty good start to the year.

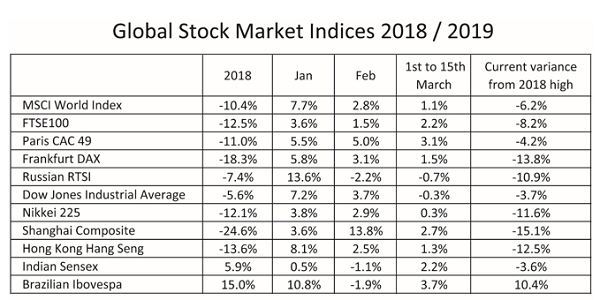

Data source: Morningstar

The table above shows a number of major stock market indices. Most of them went down in 2018. The notable exceptions were the Indian Sensex and the Brazilian Ibovespa.

As you can see most of these indices then went up in January, February and have made gains in the first half of March. They've also still got some way to go to get back to the highs that we saw in 2018.

It's quite possible that in 2019 we could see most of the losses from 2018 reversed.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.