Buyers chase N Brown's 10% dividend yield

28th August 2018 15:35

by Lee Wild from interactive investor

It's one of the highest-yielding shares around, even after rocketing as much as 9% during Tuesday's session. Lee Wild explains why and discusses potential.

It feels like the calm before the storm, certainly for local stockmarkets. Most companies have already published latest results, so there's very little by way of new numbers to digest, and what figures there are do not set the market alight.

Bunzl's half-year figures are good enough – stable margins, 9% dividend increase and another acquisition - and the share price ticked higher in early deals, yet they are hardly cheap and the yield is not especially attractive.

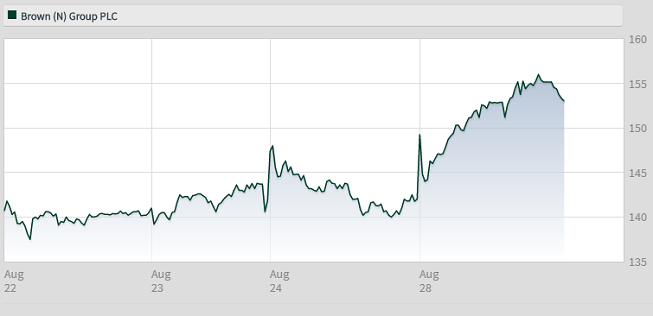

Far more impressive in terms of price movement Tuesday is N Brown, the home shopping retailer whose shares have been a real handful in recent years.

Brown has lost three-quarters of its value since 2014 and last year's impressive recovery had completely unwound by the first quarter of 2018, the shares registering a new low just a couple of weeks ago.

Source: interactive investor Past performance is not a guide to future performance

They're up 9% Tuesday, but, with no fresh news to digest, the catalyst must still be a research note on the retail sector issued by Peel Hunt late last week.

N Brown was among two stocks upgraded on valuation grounds from 'hold' to 'add'.

"Given the flat profit outlook, we believe N Brownshould be trading on a sector discount, say 9-10x in [price/earnings (PE)] terms, which would imply a share price of 225p and a yield of c6%," writes the broker. "On a current PE of c6x, with a 10% yield, we believe the shares are looking heavily oversold."

Autumn's half-year update could also be a positive catalyst, it adds.

Source: interactive investor Past performance is not a guide to future performance

N Brown's so-called power brands – JD Williams, Simply Be, Jacamo - are not a problem, it's the legacy brands where results remain mixed, which has eaten away at profit margins. Don't expect much in terms of profit growth, warns Peel Hunt, while the outlook for the bottom line has also "flattened off" at the financial services operation.

"However, while we believe there are better growth opportunities elsewhere, N Brown remains a specialist retailer in a growing niche. Recent store losses are to be eliminated as the final shops close and there remains scope to step up US growth on the new platform," writes the broker. There's a well-controlled credit book, too.

Such a modest PE ratio and headline-grabbing dividend yield certainly warrant further investigation. Brown held the dividend at its previous set of results – the full-year figures published in April – and the City expects bosses to leave the payout alone at the interims on 11 October.

If shareholders receive the same 14.23p they did in the year to March 2018, and if the share price does achieve Peel Hunt's downgraded target of 225p, from 250p, Brown shares would still yield over 6%.

However, eye-catching numbers like these often spell trouble and could well be a trap for investors. Industry conditions are tough right now, and the dividend is compensation for the very high risk involved in owning N Brown shares.

That might be enough for some investors. Others may decide to wait for further evidence that a sustained turnaround is underway.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.