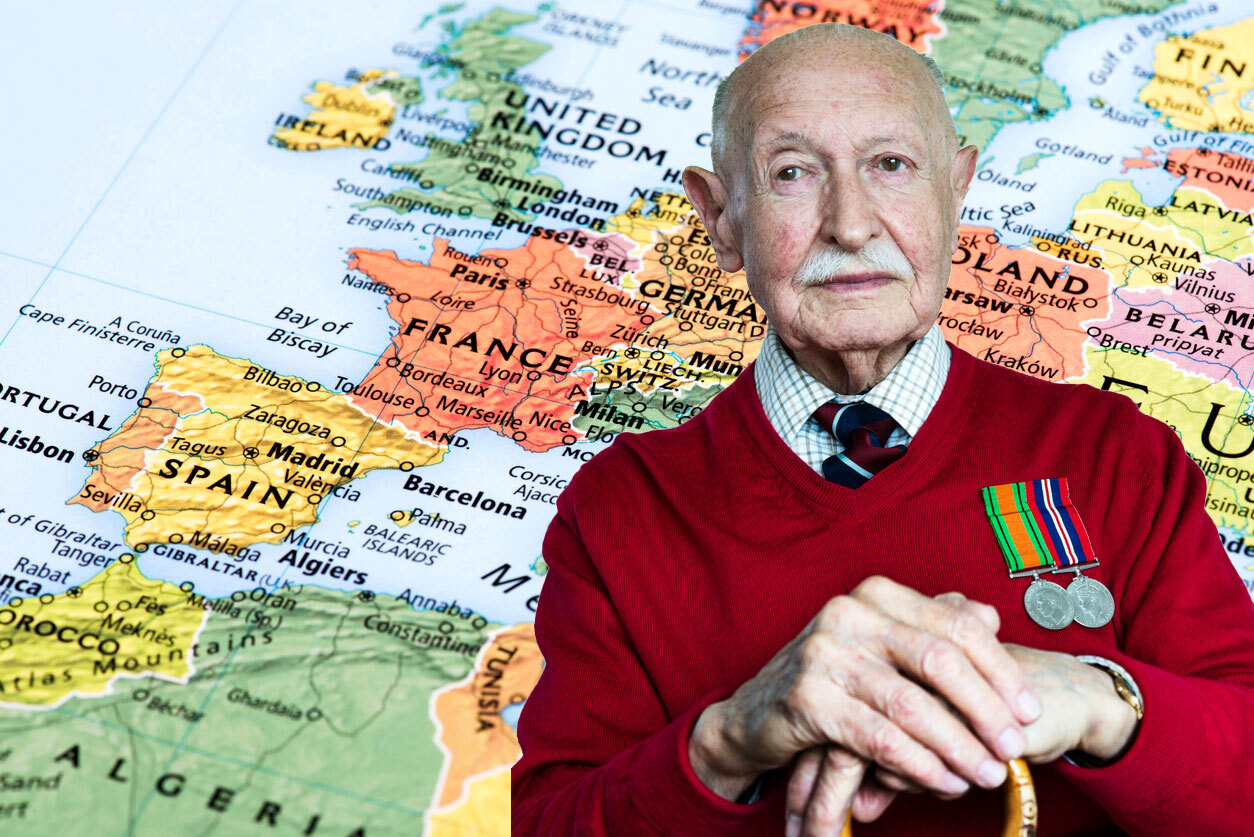

Campaigners call to end frozen pensions for Second World War heroes

Thousands of retired servicemen and women who moved abroad have to live on as little as £40 a week

7th May 2020 12:21

by Stephen Little from interactive investor

Thousands of retired servicemen and women who moved abroad have to live on as little as £40 a week

Campaigners are calling for the Government to stop freezing state pensions for elderly people who live overseas, many of whom served in the armed forces.

Retirees who live in the UK and the EU see their pensions go up each year.

However, for those that have left the UK, the value of their pension is frozen at the date they arrived in their new country.

This means their pension payments effectively decline in value during their retirement, and can leave them facing poverty in old age.

Some that moved abroad many years ago have pensions that are as low as £40 per week.

One of those affected is Patricia Coulthard, 98, who nursed troops evacuated from Dunkirk and served in India and Burma during the Second World War.

She receives a pension of just £46 per week after moving to Australia with her children.

She says: “Like many of my generation, I am not one to overly complain about the circumstances in which I find myself, but the outbreak of coronavirus has brought into sharper focus the absurdity and immorality of the UK Government’s approach to frozen pensions.

“I made my contributions expecting that I would be able to live a comfortable life in retirement. Instead the paltry pension that I receive means that I am unable to afford the help that I need during this crisis including paying for someone to do my shopping and to help with cleaning tasks.

“Each and every frozen pensioner is more than a number on a spreadsheet in Westminster, we are proud British people who paid into our pensions and expected equal treatment. That many are trying to live through this crisis on scandalously low pensions should leave our politicians deeply ashamed and should act as the final nail in the coffin of the unjust frozen pensions policy.”

Over 500,000 Britons living overseas have seen their pensions frozen as a result of the policy and it is estimated that a fifth of these served in the armed forces.

For people that reached the state pension age before 6 April 2016 the basic state pension is £134.25 a week. Those who retired after 2016 are paid a state pension of up to £175.20 a week.

Under the present system, called the state pension triple lock, the UK basic and new state pension increases every year by either 2.5%, average wage growth or by prices growth as measured by the consumer price index – whichever is highest. This process is known as uprating.

Anne Puckridge, 95, served in all three armed forces during the Second World War. She moved to Canada 20 years ago and receives a pension of £72.50 a week.

She says: “I call it fraud. We paid for our pension on exactly the same terms as every other pensioner, and yet without being warned - and because we have come to a Commonwealth country - we receive no further indexation until we die.

“I cannot understand why the country I served has failed me."

Campaign group End Frozen Pensions wants the Government to end its freeze on pensions for people living abroad and bring increases in line with inflation.

Paul Gaffney, spokesperson for End Frozen Pensions, says that many of the affected pensioners cannot recall even being told that their pension would not be uprated.

He says: “These brave pensioners exemplify the gross injustice of the UK Government’s frozen pensions policy, which is being exacerbated by the current Covid-19 pandemic."

There are more than 100 countries where the UK pension is currently frozen, including Australia, Canada, New Zealand and South Africa.

The UK has reciprocal arrangements with the EU as well as a number of other countries, including the US, Switzerland and Portugal.

Surprisingly, Commonwealth countries such as Australia and New Zealand where the greatest number of affected pensioners reside, are not included.

A Department of Work and Pensions spokesperson says: “We understand that people move abroad for many reasons and that this can impact on their finances.

“The Government continues to uprate state pensions overseas where there is a legal requirement to do so – for example in countries where there is a reciprocal agreement that allows for uprating.”

This article was originally published in our sister magazine Moneywise, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.