Can Rockfire Resources extend phenomenal rally?

This analyst chooses a different 'oddball' stock each day to illustrate a near-term trade possibility.

2nd December 2019 08:48

by Alistair Strang from Trends and Targets

This analyst is choosing a different 'oddball' stock each day to illustrate a near-term trade possibility.

Rockfire Resources (LSE:ROCK)

As it's December, and sometimes share prices can do silly things, we're choosing a different oddball every day to hopefully illustrate a near-term trade possibility.

When we open the Advent Calendar, Rockfire Resources (LSE:ROCK) are behind the second door and, thankfully, it indeed has some potentials showing.

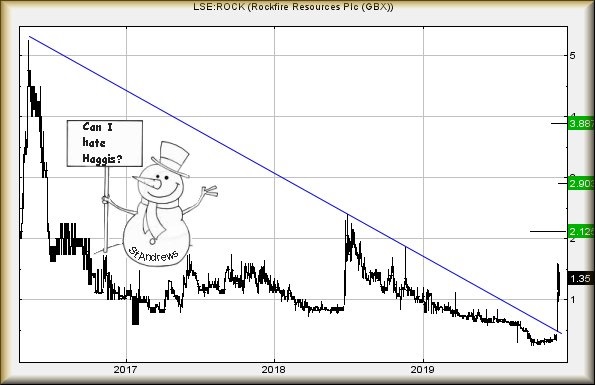

Rockfire closed last week at 1.35p and, visually, now needs above just 1.6p to make further growth likely. Such a scenario calculates with an initial target at 2.12p, an ambition which makes sense from a charty perspective. As can be seen quite clearly, the share has experienced a glass ceiling just above the 2p level since August 2016.

This time, if the usual nonsense of "the third break is the keeper" proves correct, above 2.12p computes with 2.9p but, to be honest, if positive news is involved (or indeed positive sentiment in internet chatrooms) the share price could easily accelerate to a silly sounding 3.88p, several magnitudes above the current share price.

Unfortunately, there is plenty of room for the market to play games, thanks to the price requiring drill below 0.5p to utterly stuff the growth potentials.

If we were to identify a price level which should give early warning of looming trouble, it appears below 0.89 should justify some real concerns.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.