Commodities Focus: No copper respite as gold struggles

10th September 2018 17:03

by Rajan Dhall from interactive investor

Industry analyst Rajan Dhall discusses where investors should expect oil, gold and copper prices to move this week.

It's been another negative week for copper as Donald Trump shows that there are no signs that he is willing to slow down on introducing tariffs on China.

For many, this is getting long in the tooth and we are looking to see when the market will actually start to price in the total amount of this negativity.

China accounts for roughly half the world's copper consumption but this usage should remain high. We have seen few, if any, estimates on how much the tariffs will damage this level and much of this demand is internal, or infrastructure related.

Reuters reported that on-warrant stocks of copper available to the market in LME-registered warehouses rose by 850 tonnes to 147,450 tonnes but are still down from more than 234,000 tonnes in mid-August, signalling a tightening market.

Chinese stockpiles on the Shanghai futures exchange also fell, so there are indications that demand is high.

From a price perspective, there are no signs of a slow down. At the end of the summer holidays, there was evidence that sell-side volume was starting to dissipate.

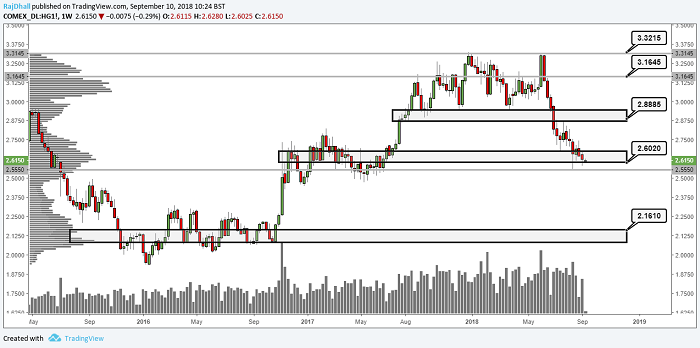

Last week more selling volume came in towards the end of the week and then we dropped closer towards the $2.60/lb support.

Past performance is not a good to future performance

This week we will get some comments from the OPEC monthly meeting.

In the last couple of meetings, we have heard that global demand is falling slightly due to trade protectionism. This time we are looking to hear more details about Iran and what problems it could pose in regards to sanctions and additional supply.

There are rumours doing the rounds that a few select countries are trading with each other away from the USD. Turkey, Iran, and Russia are the touted nations, but there is no official confirmation.

A dangerous precedent is being set and if we get wind of more countries getting involved the US may retaliate with more sanctions.

From a weekly chart perspective, we are still in a consolidation phase, unless we get a firm break of the $71.40/bbl level on the daily chart, we can expect the range to hold for now.

Past performance is not a good to future performance

Gold is struggling on two fronts right now.

The USD is being looked at as the go-to safe haven for emerging market flows and US economic data is still coming up 'trumps'. At the end of the week, the US jobs report sent gold spiralling as 201,000 jobs were added to the US economy along with wage growth as mentioned above.

This also sent the relatively strong USD to rally into the end of the session and gold dipped back below the $1200/oz mark once more. As the market is currently fully pricing in this month’s rate hike (just above 71% for December), where does this positivity (reflected in the USD) end? When is it all priced in?

Past performance is not a good to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.