Commodities outlook: Gold rockets, but copper's in trouble

Up over 30% since late last year, the gold boom is in stark contrast to out-of-favour base metals.

29th August 2019 13:19

by Rajan Dhall from interactive investor

Up over 30% since late last year, the gold boom is in stark contrast to out-of-favour base metals.

Gold rallied as the great trade war between the US and China stepped up a notch last Friday.

For those of you that didn't catch the events, China slapped retaliatory tariffs on the US, hitting everything from oil imports to car parts. The US then gave China a taste of their own medicine, and some. All this tit for tat tariff tennis made financial indices sell-off and gold rally, but industrial products like oil and copper really suffered.

Now, after the bank holiday, the situation appears to have calmed slightly. World leaders arrived at the G7 meetings, and there was no real talk on trade that moved the markets. And, just today, China says it has been in contact with the US about the September meeting that has not yet been arranged.

So, while gold rallied, copper sank, hit hard by the trade war, manufacturing slowdown and weaker yuan.

As you can see on the weekly copper chart below, the long-term consolidation low was taken out by traders who saw the increased escalation. If there is no meeting next month, the base metal could sink toward the $2.40 per pound area.

Right now, traders have found support at $2.50 per pound on the hope that the talks will indeed take place. From a technical viewpoint, when a major trendline breaks as it has done on the chart, there is often a retest, and this could be the scenario playing out now.

Below the $2.50 per pound level marked on the chart, the next support level is $2.30 per pound. But it would take a negative result from the talks for that to get hit.

Source: TradingView Past performance is not a guide to future performance

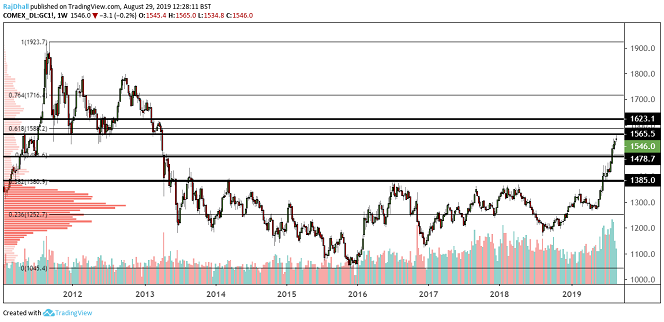

On the weekly gold futures chart below, we are currently at the major resistance level of $1,565 per ounce. Slightly above that is the 61.8% Fibonacci resistance level but, as it is in such close proximity, it could easily be spiked.

Stocks are rallying on any bit of good news, but gold is not reacting in the same way on the downside.

Source: TradingView Past performance is not a guide to future performance

There is a major dollar shortage globally as central banks rush to move deposits to safe-haven currencies. Gold is now being stockpiled by central banks at record levels as the trade war intensifies and serious questions are being asked of the US Federal Reserve.

Futures markets are now pricing in a 25 basis-point cut in US interest rates when the Fed meets in September, although there are some outside bets for an even larger cut. Fed chair Jerome Powell and Co have been playing hardball, saying they will wait for the data to turn before taking a more dovish approach, so the next meeting will be very interesting indeed.

Rajan Dhall is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.