Could Barclays share price really halve from here?

After optimism in July turned to tears in August, our chartist looks for signs of an end to the selling.

28th August 2019 09:07

by Alistair Strang from Trends and Targets

After optimism in July turned to tears in August, our chartist looks for an indication of when the rapid decline might end.

Barclays PLC (LSE:BARC)

When we last reviewed Barclays (LSE:BARC) the share price appeared to be showing signs of escaping a path which led to 134p.

Our naive optimism fell apart at the start of August as the price once again indulged in some miserable behaviour! Sometimes, paying attention to the trend is important.

Source: Trends and Targets Past performance is not a guide to future performance

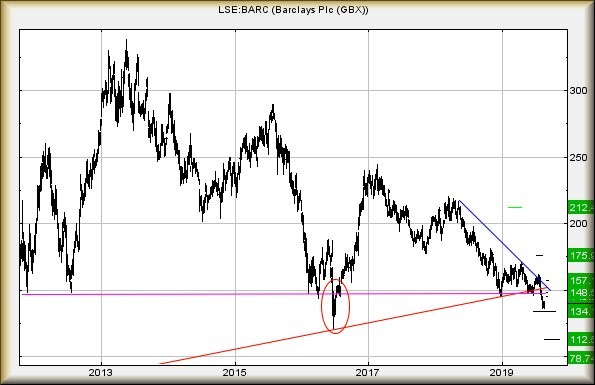

As the cut-outs above show, Barclays' share price paid considerable respect to the downtrend, for a week anyway. Then the market ensured the share rejoined the trend and headed down on a path to our 134p ambition, once again.

Of course, if there is any real strength, the price should bounce before our target level, ie; now! At present, we calculate the price needs to exceed 142p before any rebound dare be taken seriously.

Such a movement calculates with an initial target of 145p with secondary, if bettered, at 148.5p.

The secondary is critically important as closure beyond this point should make travel to 157p possible, along with relative safety above the historical red uptrend.

Unfortunately, there is a purple problem showing on the chart. Since 2011, Barclays' share price has tended to prefer spending time above the purple line with each bonk against this horizontal trend providing reasonable recovery.

During this year, repeated attempts at purple exhibited weaker recovery, and now the share price has remained below this trend line for most of August. This is not behaviour which will cheer an optimist as it suggests 134p will probably be broken.

This being the case, further reversal down to 112p becomes probable, along with a doubtless short-lived bounce. Secondary calculates at a bottom, finally and hopefully, at 78p.

Generally we'd suggest advocating a FTSE 100 share price almost halving from current as an absurd scenario.

We suspect the threat of Brexit is nudging the door open to a marked profit - for those with any funds to take advantage if prices drop to silly levels.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.