Deal or no deal: What's next for the FTSE 100?

23rd November 2018 08:46

by Alistair Strang from Trends and Targets

The blue-chip index is struggling again below 7,000 as sterling gains strength from Brexit talks. Our man with the plan, chartist Alistair Strang, reveals where his software predicts the market is heading next.

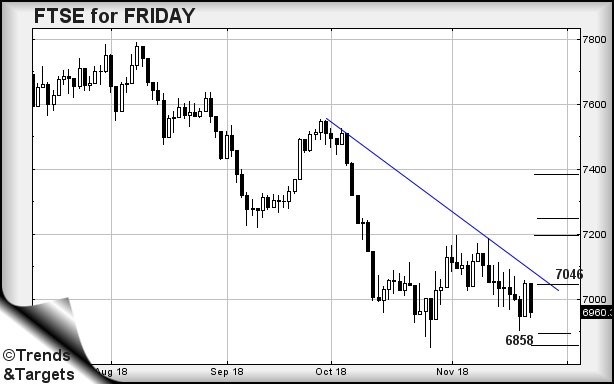

FTSE for FRIDAY (FTSE:UKX)

With a wry smile, a newspaper headline suggesting politicians plan to panic both the stockmarket and currency markets to instil fear, should their Brexit plans fail acceptance, came as no surprise. Didn't the Tesla guy use a similar gambit prior to losing his job? Probably a win-win scenario for those involved in Brexit.

To suggest the FTSE 100 is confusing at present risks understating the situation. From an immediate perspective, there's the threat of weakness below 6,940 bringing traffic down to an initial 6,895 points. If broken, secondary is at 6,858 points. If triggered, stop needs to reside at 7,018 points.

The other side of the coin is a little more interesting!

Should the market (it closed at 6,960 points) manage above 7,018 points, further recovery to 7,046 looks viable. While perhaps sounding useful, the market actually requires better than 7,081 currently to enter a cycle toward an initial 7,195 points. If exceeded, longer term surprises await at a less likely 7,382 points.

The reason for mentioning this is fairly straightforward. Should our incompetent politicians somehow manage to produce agreement which the markets look favourably on, only above 'blue' shall we dare take is seriously.

For now, we suspect the absence of positive sentiment will provide a further bottom at 6,858 points.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.