Don't judge ambitious Dixons Carphone on these Q1 results

Shares offer a high yield and look cheap, but there's still lots to do before confidence is restored.

5th September 2019 13:02

by Graeme Evans from interactive investor

Shares offer a high yield and look cheap, but there's still lots to do before confidence is restored.

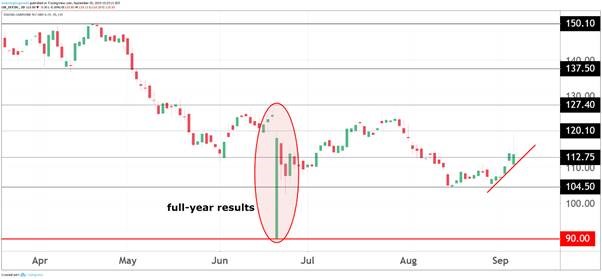

Investors remained cautious about Dixons Carphone (LSE:DC.) as a recovery play today after the retailer revealed another big slide in sales at its loss-making mobile phone arm.

Dixons has warned since December that it will need another two years to get the division into break-even territory, as it adapts to a changing marketplace where customers have increasingly moved away from two-year contracts to SIM-only deals.

While the impact of this restructuring meant that another slide in mobile phone sales in the UK and Ireland was inevitable, analysts were surprised by today's 10% decline. The consensus for the first quarter of the financial year to July 27 had been for a 6% drop.

There was better news from UK and Ireland electricals, which grew like-for-like sales by 2% rather than previous expectations for a flat performance. This meant there were no revisions to the overall 2019/20 guidance given by the company in June, when shares slid 25% on the back of a previously announced dividend cut and warning of a £90 million loss for mobile this year.

The scale of an ambitious five-year transformation plan being carried out by CEO Alex Baldock contains many promises and targets, but it is still far too early to gauge whether these are achievable. He is forecasting headline profits of £210 million for this year, rising to over £300 million by 2022 as the turnaround and planned mobile division recovery kick in.

Investors have largely remained on the sidelines so far, with today's update resulting in a modest 1% improvement to 115.15p. The stock was trading as low as 105p last month. Current conditions in UK retail, particularly in relation to Brexit and the economic climate, mean the caution of investors is understandable.

For now, Baldock said that the long-term transformation was on track with electricals continuing to grow and win market share in all territories. He added that this was likely to be the trough year for mobile losses:

"The mobile market is as challenging as expected, underlining the need for the decisive actions that we set out in June."

Source: TradingView Past performance is not a guide to future performance

Last year, the company renegotiated all its legacy network contracts so it can give customers a better choice of connectivity and networks, as well as more SIM-only products. Under the old contracts, Dixons faced large penalties for missing volume commitments, while it experienced a cost base that was inflexible and too high.

Mobile is still the most important category for Dixons, which remains number one in the market. It expects its new offer to be making a meaningful contribution in FY21, when post-pay volume commitments are due to lift.

It said in June:

"We expect Mobile will at least break even within two years, and beyond that, equipped with a stronger and unconstrained offer, we will of course aim to do better. In any case, cash generation from Mobile will be strong."

The company expects over £1 billion of free cash flow over the five years of its transformation plan, with confidence in this projection supported by a recent pledge to keep this year's dividend unchanged at 6.75p a share. Even after the pay-out was cut last June, Dixons shares are offering a forward dividend yield of 5.9%.

Based on consensus forecasts, Dixons is trading on 7x 2020 earnings, which compares with 12.7x for the wider general retail sector. Analysts at Morgan Stanley have a price target of 220p, while counterparts at UBS are at 200p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.