Dow Jones: Is dramatic recovery sustainable?

14th January 2019 08:59

by Alistair Strang from Trends and Targets

As US fourth-quarter results reporting season kicks off in earnest, technical analyst Alistair Strang names the big levels to watch over the next few weeks.

A DOW Big Picture update

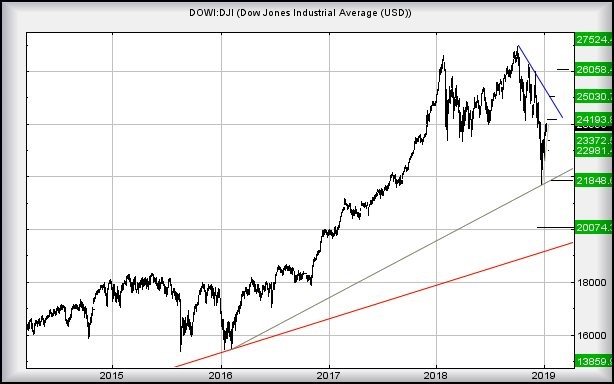

When we last viewed the Dow Jones, we 'warned' of the dangers if the index exceeded 26,770 points. Guess what it did! Then it went and turned around quite spectacularly. But, quite insanely, it remains within the zone where strong future growth is probable.

We hate describing the recent 6,000-point reversal as a 'blip', but such was the pace of ascent, wild sounding statements like this are possible...

Essentially, the Dow Jones requires below the red uptrend on the chart below to justify mindless panic, or even an iota below 21,848 points as this would preclude an express ride down to the 20,000 level.

For the present, the big picture suggests moves now above 24,025 points should attempt an initial 24,193 points. This is fairly important, due to our secondary calculating at the 25,000-point level and a challenge of the immediate downtrend.

Near-term, any attempt to slow things down looks like having potential should the US market wander below 23,570. This takes the index into a position where anything below risks triggering a sharp 200-point fall. Our secondary is at 22,970, a point where we shall start wondering if some real reversals await.

Source: Trends and Targets. Past performance is not a reliable indicator of future results

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.