Dow Jones issues this warning sign

Wall Street could go sharply lower, according to our analyst's charts. Here's why.

7th October 2019 09:56

by Alistair Strang from Trends and Targets

Wall Street could go sharply lower, according to our analyst's charts. Here's why.

The Dow Jones (DOWi:DJI)

Something important happened in the last few days.

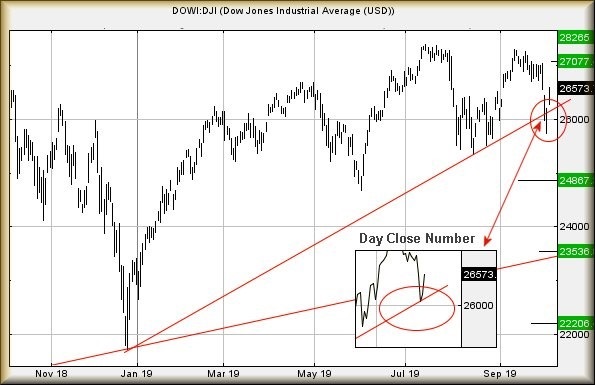

The chart below has a little circle though the Dow Jones uptrend for 2019. We've also shown the movement as an inset as we fear it's liable to prove important.

This sort of thing we refer to as a warning sign, a clear signal an important trend can be broken. Often, when this sort of thing occurs, any movement below the trend is usually sharp, fast, and painful.

At present, the implication is we should use 26,078 as final straw.

Essentially, weakness on the Dow below this level is liable to provoke sharp reversal down to an initial 24,867 points.

If broken, secondary is a longer-term 23,536 points. Generally, these circled trend breaks imply reversal should occur due to some sort of negative news and worse, if our initial target is achieved, ultimately there's a heck of an argument favouring "bottom" at 22,206 points eventually.

In terms of the important question, "If I go short, where's the stop?", the answer is pretty straightforward; as tight as possible. The drop, if it happens, will tend not form part of a trading cycle.

What's surprising about this scenario is the suggestion the market could be poised to reverse all movement during 2019 and ponder if Mr Trump is planning to Tweet something outrageous in the weeks ahead.

Who knows, maybe he shall announce his undying love from the UK's Mr Johnson, just before executing a ban on all trade with the UK...

All kidding aside, there is 'something' about the Dow's movement in recent months which, if it were a share price, would leave us uncomfortable.

To get out of trouble, the Dow needs only to exceed 26,630 to give the first hint we're being panic merchants. As it closed last week at 26,573, it's not a big ask.

Above 26,630 is supposed to trigger movement up to an initial 27,076 points.

If exceeded, our secondary is at an amazing looking 28,285 points and the territory of new all-time highs.

The first major challenge, of course, shall be the question as to whether sufficient strength exists to achieve the 27,076 level. If it does, the circled break below red shall be consigned to history as a false alarm.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.