FTSE 100: a long-term target, and the worst-case scenario

This seasoned chartist takes a step back to look at the big picture and some interesting targets.

22nd June 2020 08:50

by Alistair Strang from Trends and Targets

This seasoned chartist takes a step back to look at the big picture and some interesting targets.

What if the FTSE 100 index were looked at with optimism, rather than the usual misery it deserves?

Of course, we’d be remiss if we ignored the glaringly obvious.

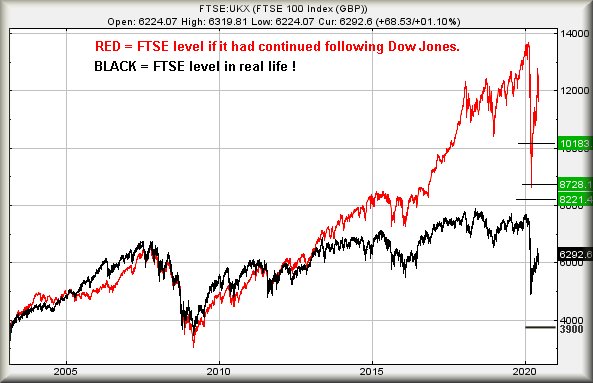

The red line on the chart below highlights where the FTSE would be, had it continued to copy Dow Jones movements, but in 2013 everything changed. Wall Street continued heading upward with incredible strength. The FTSE didn’t.

Had the UK market continued to follow the US market, the FTSE would have nearly reached 14,000 points before Covid-19 hit. In reality, the FTSE managed 7,500 points before the collapse.

In the period since the Covid-19 drop, the Nasdaq and S&P have exceeded their pre-drop levels. The Dow Jones has not, and neither has the FTSE. The Dow has certainly been trying its best to recover, but we’ve a couple of alarm bells ringing due to some recent dance steps.

However, should the FTSE manage to exceed 6,750 points, it enters a cycle where we are supposed to plan for recovery to 8,221 points initially with secondary, if bettered, at 8,728 points.

Such movement will take the index into a region where 10,180 presents itself as a major point of long-term interest. These figures are based entirely on FTSE movements since 2013, utterly ignoring how Wall Street behaves. It’s clear the last seven years has seen the two indices execute a pretty solid divorce.

We’ve a pretty solid suspicion the UK market closing a session above 6,750 shall prove improbable, resulting in the situation where there’s an attraction coming from a bottom of 3,900 points or so, just requiring negative sentiment to force a drop.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of interactive investor.

All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.