FTSE 100: Should we take today's rally seriously?

With markets volatile, our analyst reads the tea leaves for clues as to future direction.

22nd November 2019 08:54

by Alistair Strang from Trends and Targets

With markets still volatile, especially in the UK, our analyst reads the tea leaves for clues as to future direction.

FTSE for FRIDAY (FTSE:UKX)

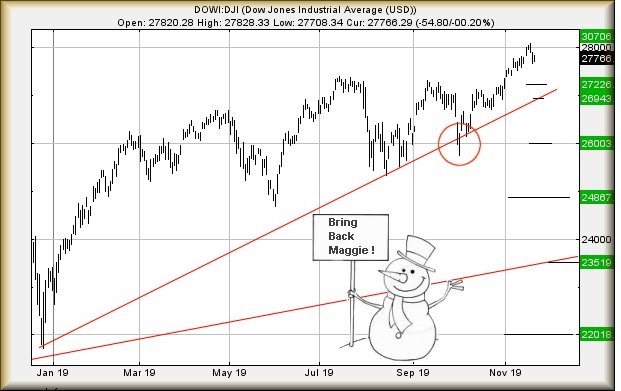

Whether it's US vs China, the UK's woes, or whatever, markets are not doing particularly well at present with early signs of the DOW coming "off the boil".

We're quite far from pressing any sort of panic button but should the US primary index manage below 27,600, it shall be regarded as entering a cycle down to 27,250 points and hopefully some sort of rebound.

If broken, our secondary calculates at 26,950, a point where it almost must bounce. The US market requires exceed 27,900 to escape this immediate prophecy of doom.

Any reason for the US to find itself below 26,950 will prove pretty alarming, thanks to the risk of a further 1,000 point freefall!

Source: Trends and Targets Past performance is not a guide to future performance

Article written late on Thursday 21st November:

The FTSE 100, closing Thursday at 7,231, risks some immediate trouble if it wanders below 7,180 points.

Such a trigger risks kickstarting a mantra threatening a visit to 7,164 points initially. If broken, secondary is at 7,083 points and hopefully some sort of real bounce.

To get out of trouble, the UK market requires to better 7,294 points as this should prove capable of 7,320 points.

If bettered, secondary is at 7,356 along with a strong chance of some hesitation. As always, we've a major however...

On Tuesday, the UK market did something we really dislike. Between 10:45 and 2:30pm on the 19th, the market painted a very slow, very deliberate, downtrend. It was almost like some "grown up" had decided 'This is the new trend and any rise cannot be taken seriously unless the index betters this downtrend!' As a result, we're pretty far from confident about any long position scenario.***

At present, this unpleasant stain is at 7,311 points. If past experience proves reliable, the market shall now struggle to exceed this strange blue line until such point a material change in circumstances emerge.

As a result, we strongly suspect the current reversal cycle intends 7,083 points. We've shown the start of this deliberate trend on a chart inset, to try and explain why the main chart has a blue downtrend simply hanging in the air.

This sort of contrived trend generally highlights, quite firmly, a coming period of reversals.

***This movement was on the FTSE. Curiously, FTSE Futures did not display quite as vivid price movements and suggest Futures only require exceed 7265 presently to better this strange trend. We're inclined to pay more attention to the FTSE itself as it was "real".

Have a good weekend.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.