FTSE 100's future could depend on today's events

12th October 2018 10:18

by Rebecca O'Keeffe from interactive investor

UK blue-chips have tumbled this month, but have they fallen far enough, or has the blood-letting just begun? Rebecca O'Keeffe, head of investment at interactive investor, talks volatility and catalysts.

Investors are breathing a sigh of relief Friday, with European indices clawing back some of their recent losses.

However, the verdict is still out about current valuations and while some investors are viewing this as a buying opportunity, many others are maintaining a more cautious stance and waiting for clear signs that this was a temporary pull-back rather than the start of a more pronounced correction.

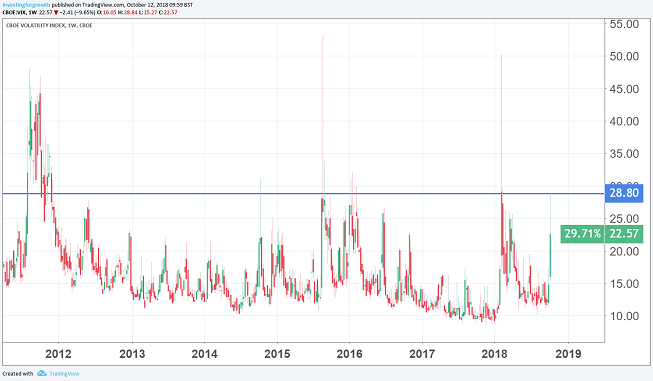

One major plus point for investors who are viewing the market as oversold and a good time to buy is the VIX index.

Previous sell-offs have fizzled out when the major volatility index reached the high twenties, and yesterday’s high saw the VIX reach 28.84, before falling back (see chart below).

Over the past few years, this level of volatility has typically proved to be a market turning point, the one exception being early-2016.

Source: TradingView Past performance is not a guide to future performance

Trade wars, rising interest rates and slowing growth have been front and centre in terms of big macro reasons for the rout, but the reality is that investors need to be asking whether valuations can be justified by company profits or have markets got ahead of themselves?

The start of the US earnings season sees JP Morgan, Wells Fargo and Citibank all reporting today, and good results could provide the catalyst that sees markets recover their recent losses, while disappointing numbers are likely to jeopardise any positive sentiment.

Source: TradingView (four-hour chart) (*) Past performance is not a guide to future performance

*Horizontal lines on charts represent previous technical support and resistance. Diagonal blue line of first chart is FTSE 100 uptrend since 2016 low.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.