FTSE for Friday: is it about to go horribly wrong for FTSE 100?

1st July 2022 07:59

by Alistair Strang from Trends and Targets

After a painful Thursday, independent analyst Alistair Strang checks the charts to get an idea of what Friday might have in store for the main UK index. He also has an update on the Ripple cryptocurrency.

Last night, I watched something strange happening. A moth was fluttering around, utterly directionless, like the FTSE, when suddenly it dropped and flew directly to some yellow flowers growing in the garden. The moth, illuminated by garden floodlights, behaved in exactly the same fashion as a bee, fluttering from bloom to bloom.

This, obviously, has everything to do with the FTSE as the unexpected can happen at any time…

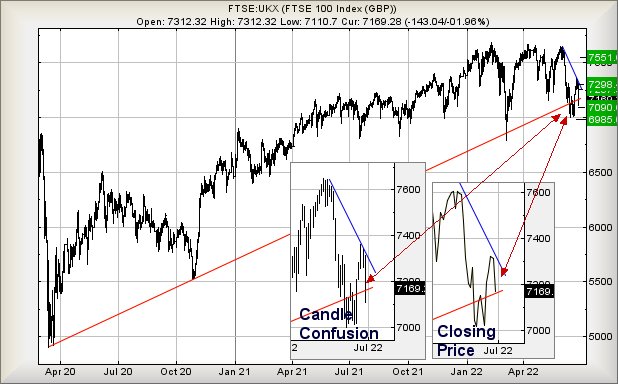

The chart inset below is quite fascinating from our perspective. Despite the FTSE experiencing a truly awful Thursday, it emulated the moth by deciding to visit the uptrend which it had broken during the day. But curiously, almost as if it were intended, the FTSE did not close the session below the uptrend.

As a result, our immediate inclination is not to anticipate July starting with a 1st of the month massacre.

Past performance is not a guide to future performance.

Instead, above 7,193 points looks capable of triggering surprise recovery to an initial 7,257 points with secondary, if exceeded, calculating at 7,298 points. At risk of being a 'tease’, there’s a curious phenomena shaping up which also suggests above 7,298 risks provoking a further recovery cycle to 7,551 points sometime in the future.

If everything intends to go horribly wrong, below 7,110 has the potential to inflict some real trouble, calculating with the risk of reversal to 7,090 points with secondary, if broken at 6,985 points.

Ripple

As the daily massacre of crypto currency appears to be continuing, our chum who once enjoyed a substantial belief in Ripple has raised an eyebrow, asking for an update. Last time we glanced at Ripple, we finished with a throwaway comment giving criteria for reversal to 0.40. Currently, it’s around 0.32 which is pretty close to his original entry level.

Strangely, a few days ago, Ripple hit a logical bottom level and, while it hasn’t exactly bounced with conviction, there is slight hope the 0.28 level may prove to be a floor level. Since reversing to such a point, the price has certainly gyrated just above the floor but has neither recovered nor broken the floor. Maybe it’s a ‘fingers crossed’ moment as we’re seeing similar behaviour with bitcoin and Ethereum.

Of course, there’s always the risk the cryptocurrency market is awaiting a magical point, when it will decided everyone is convinced bottom is “in”, enacting a gotcha drop immediately thereafter. Certainly, with bitcoin, sufficient argument remains threatening a final plunge to the 10,000 dollar level.

But we’re a little sceptical, ‘cos it’s all getting a little too obvious.

Past performance is not a guide to future performance.

In the event Ripple does manage below 0.28 (or close a session below 0.308), further reversal to 0.208 looks possible with secondary, if broken, at 0.151 and hopefully an ultimate bottom, due to us being unable to calculate below such a point.

However, if our suspicion proves correct regarding the 0.28 level, Ripple need only exceed 0.37 to light the first spark of hope. This should apparently trigger movement to an initial 0.561 with secondary, if beaten, a more useful 0.735.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.