FTSE for Friday: why I'm nervous about market prospects

6th May 2022 07:33

by Alistair Strang from Trends and Targets

There's plenty of bad news around at the moment, and the Nasdaq tech index plunged again overnight. Independent analyst Alistair Strang gives his view on prospects for our own FTSE 100 ahead of new US jobs data.

There was a time when we looked forward to producing our Friday outlook for the FTSE 100. There was always a reasonable chance the volatile UK leading indicator would do something useful but, unfortunately, since the Russia drop, things are proving pretty fake, the market essentially pretending to move while effectively remaining enmeshed in place.

Visually, we need to zoom out and glance at market behaviour since the start of 2020 to appreciate how horrific the situation really is.

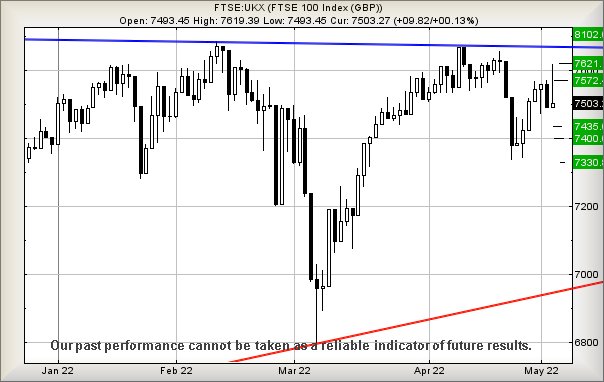

The big blue line on the chart below can be called a glass ceiling or, more accurately, a horizontal trend. It’s effectively broadcasting a harsh reality that the UK index has a solid border crossing at 7,690 points, which creates a reasonable expectation that growth cannot be regarded as real until such time the FTSE actually exceeds this trend.

- Why reading charts can help you become a better investor

- Why oil prices will keep rising and the stocks to benefit

- ii view: Shell profit breaks records as oil boom continues

- Warren Buffett: stocks I’m buying and AGM comments

What proved a bit of a surprise was we had expected the FTSE to follow a similar model to markets elsewhere in the world. From the US to Asia, once a market exceeded its personal pre-pandemic high, that market started to go up.

By the time the FTSE managed to better 7,550 points, the model was pretty firmly established and we’d expected London to dutifully follow the pack.

For a few sessions, it appeared this was indeed going to be the case, then along came the Russia issue, with the FTSE behaving badly at every excuse thereafter. To be fair, neither the USA nor Europe appear to be covering themselves in glory while Ukraine remains an issue. Perhaps the UK is even performing better than our neighbours.

Except, of course, for the issue at 7,690 points.

From a fairly Big Picture perspective, above 7,690 remains with the “almost certain” prospect of a FTSE lift to the 8,100 point level. If the FTSE were regarded as a share, we’d probably describe the prospect as a “no brainer” category of trade, throwing in a gentle caveat of a reality reminder - the FTSE is not a share!

Source: Trends and Targets. Past performance is not a guide to future performance

FTSE for Friday

As for near-term movements for Friday, we’re a little nervous about immediate market prospects, suspecting some imminent reversals risk proving possible.

It’s worth remembering it’s a US Payrolls Friday, often an excuse to display some flamboyant movements and, therefore, extreme caution is recommended with any positions open just prior to 1.30pm.

For the FTSE 100, we’re nervous at any excuse to drive the index below 7,477 points, as this now risks imminent reversal to an initial 7,435 points with secondary, if broken, at 7,400 and hopefully a bounce.

- Insider: better times ahead for these two well-known shares?

- Shares for the future: my five best shares for long-term investment

Below 7,400 risks spoiling the party (sorry Boris) as a further 70 point reversal to 7,330 becomes possible. If triggered, the tightest stop loss appears to be hideously wide at 7,557 points.

Source: Trends and Targets. Past performance is not a guide to future performance

The alternate scenario comes, should the FTSE somehow manage to stagger above 7,557 points. Initially, we’re looking for recovery to a useless 7,572 points with secondary, if exceeded, calculating at 7,621 points.

Have a good weekend. Hopefully the Miami Grand Prix proves worth watching.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.