Fund managers turn bearish and fear a recession is around the corner

One in three fund managers believe a recession is 'likely' in the next 12 months.

19th August 2019 11:48

by Tom Bailey from interactive investor

One in three fund managers believe a recession is 'likely' in the next 12 months.

It was a rocky week for global equities, with both main US exchanges closing down around 3% on Wednesday (16 August). These large swings came primarily on the back of escalating trade war rhetoric from the US and China, as well as growing concern of a slowdown in economic growth both globally and in the US.

Meanwhile, on Wednesday, 10-year US bond yields fell below the rate on two-year bonds for the first time since 2007. Lower yields for long-term bonds suggest expectations that the US central bank, the Federal Reserve, will continue cutting interest rates, again an implicit acceptance that the US economy is facing a slowdown.

While markets have (at the time of writing at midday on 16 August) stabilised, there is now a clear growing bearishness for both the outlook for the economy and equity prices.

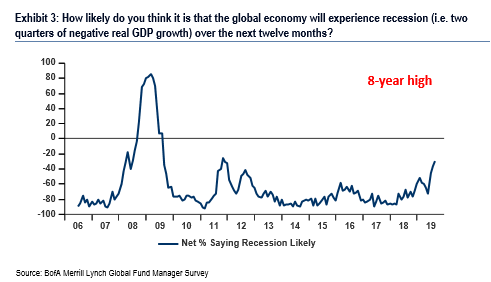

This was well reflected in Bank of America Merrill Lynch's monthly Global Fund Manager Survey, with just over one in three fund managers (34%) saying they believe a recession is "likely" in the next 12 months. This figure represents the highest number predicting an imminent recession since October 2011.

Moreover, the survey found that a net 43% of investors expected more interest rate cuts from the Federal Reserve in the short term. Meanwhile, only 9% expected higher rates over the next year. This, the survey notes, is the most "bullish" fund managers have been on rate cuts since November 2008, a month after the peak of the financial crisis.

With Federal Reserve rate cuts usually being deployed to counter economic weakness, an expectation of cuts in the short term is usually an implicit expectation that the economy is likely to start slowing.

Expectations of further rate cuts among fund managers can also be seen in fund managers identifying "long US treasuries" as the "most crowded trade." Being long US treasuries is what you would expect from an investor anticipating rate cuts and, by extension, economic weakness.

Added to that, only 5% of those surveyed now expect value stocks to underperform growth. As the survey notes:

"[this is] the lowest level since the Global Financial Crisis, reflecting extremely bearish inflation and growth expectations".

Finally, a third of those investors said they had taken out protection against a sharp fall in equity markets in the next three months. While 51% said they had not, it was still the highest net score since the survey began asking the question in 2008.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.