The funds soaring in a difficult month

Saltydog picks out some of the winning sectors in a challenging period.

2nd December 2025 12:32

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

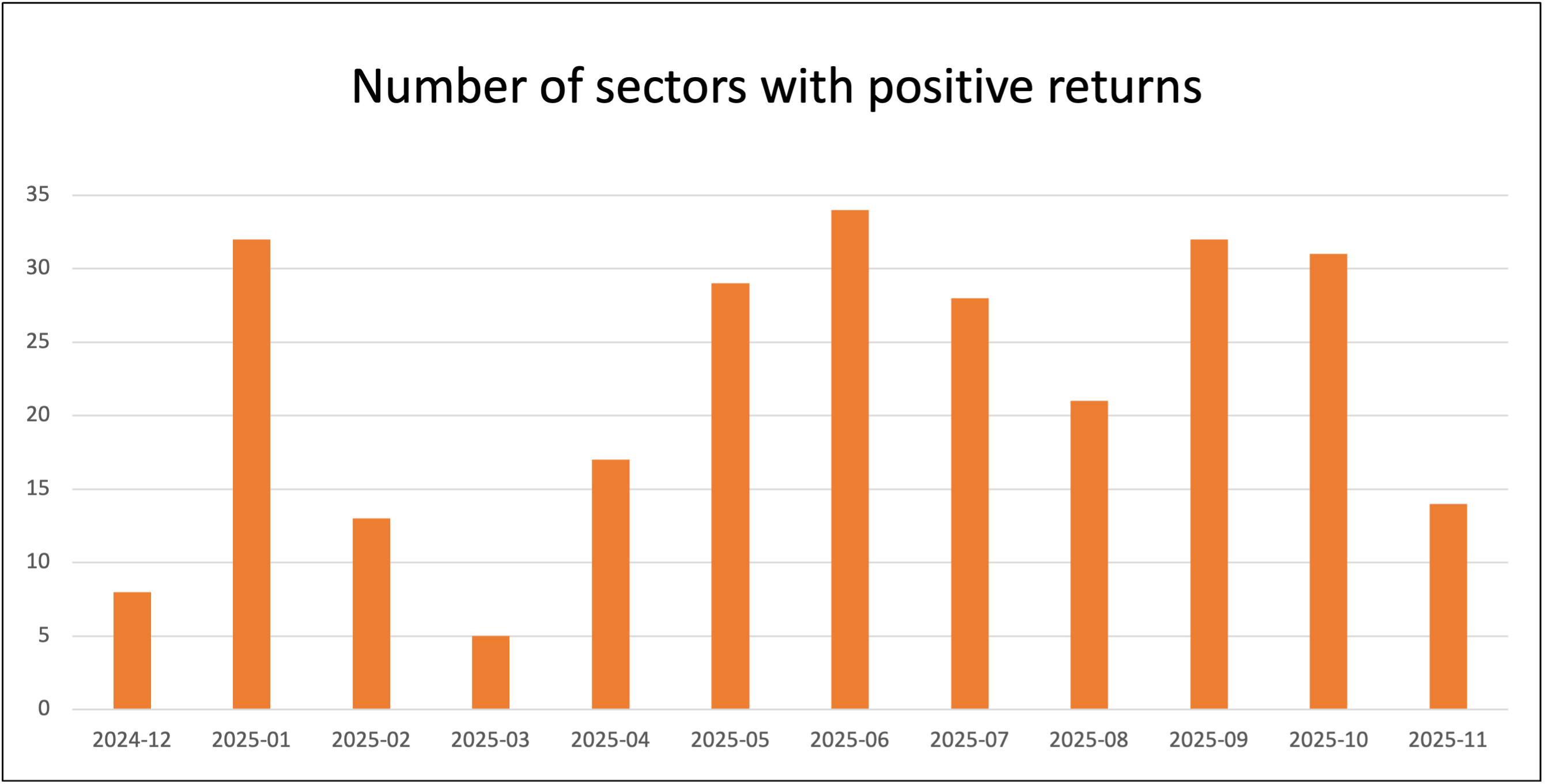

In the final week of November, global stock markets rallied and more than 90% of the funds that we monitor made gains. However, the month as a whole was still the weakest we have seen since the tariff wars in the spring.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

Our initial analysis shows that only 14 of the 34 sectors we track made gains in November. The Healthcare sector led the way with a one-month return of 7.3%, followed by Latin America, which rose by 4.3%. A further 10 sectors avoided losses, but each went up by less than 1% over the month.

The worst-performing sector was Technology and Technology Innovation. Even after rising by 3.2% in the final week, it still finished the month down 5.8%.

Past performance is not a guide to future performance.

As we have seen several times this year, the best-performing funds did not come from one of the regularly reported Investment Association (IA) sectors.

The Specialist sector is a catch-all category for funds that don’t naturally sit within the more tightly defined sectors.

This means that it is home to funds investing in a wide range of assets with wildly varying fund objectives and strategies.

As a consequence of this, the IA doesn’t provide performance data for the sector as a whole.

Within the Specialist sector are the gold funds. Unlike some exchange-traded funds (ETFs), they do not invest directly in bullion.

Instead, they invest in companies involved in the mining and processing of gold and other precious metals. They have been the best-performing funds of 2025, with year-to-date returns of more than 100%.

After strong double-digit growth in August and September, they had a relatively quiet October but have bounced back and were the best-performing funds in November.

The price of gold has risen significantly over the past couple of years for several reasons. Geopolitical and economic uncertainty has played a major role.

Conflicts in Ukraine and the Middle East, ongoing trade disputes, tensions between the US and China, and concerns about government debt have all encouraged investors to look to gold as a store of value.

- Gold: buy the dip, or mind the drop?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Top 10 most-popular investment funds: November

Interest rate cuts, and expectations of further falls, have also made non-yielding assets such as gold more attractive when compared to cash and bonds. When the opportunity cost of holding gold falls, demand and prices tend to rise.

Another important factor has been sustained central bank buying.

Several emerging market countries have been accumulating gold at near-record levels as part of a move to diversify reserves and reduce reliance on the US dollar. The sanctions imposed on Russia in 2022 raised questions about the security of foreign-held assets, making gold a more appealing alternative.

Finally, a more volatile US dollar and rising concerns about large US fiscal deficits have reinforced the view that gold remains a valuable hedge in an uncertain world.

Gold funds have benefited even more than the metal itself because company profits and share prices often rise by a greater percentage than the underlying gold price.

Saltydog’s top 10 funds in November 2025

Fund | Investment Association sector | Monthly return |

Specialist | 14.5 | |

Specialist | 14.1 | |

Specialist | 13.8 | |

Specialist | 11.8 | |

Specialist | 9.0 | |

Specialist | 9.0 | |

Commodities & Natural Resources | 8.9 | |

Healthcare | 7.9 | |

Healthcare | 7.1 | |

Healthcare | 7.1 |

Source: Morningstar. Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.