Global economic outlook: dialling down restrictiveness

We expect interest rate cuts as cooling inflation gives central banks room to breathe. But what are the things that could go wrong with this forecast?

4th July 2024 12:56

by Global Macro Research from Aberdeen

Global monetary policy easing should broaden later this year if, as we expect, sequential inflation moderates again.

The slowdown in US growth looks consistent with a ‘soft landing’, although both a ‘no landing’ and a severe slowdown are still risks. Improving growth in Europe means some convergence with the US.

There are plenty of structural headwinds to Chinese growth, but policy easing should help meet the country’s growth target this year.

A Trump victory in the US presidential election in November would likely represent an inflationary shock to the global economy.

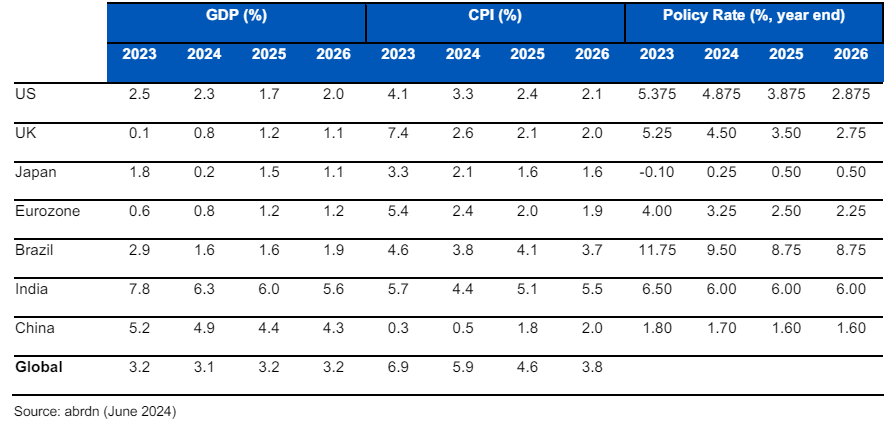

Global forecast summary

Source: abrdn (June 2024)

Inflation to moderate, but…

We think the re-emergence of inflation pressures during the first half of this year in the US and elsewhere, should soon give way to a resumption of moderating inflation on a month-on-month and quarter-on-quarter basis.

Core-services inflation has proved particularly sticky. But leading indicators, such as US rents, suggest shelter inflation there should ease. A cooling labour market is likely to help slow wage growth. Falling used-car prices suggest goods disinflation will resume. Meanwhile, the latest decline in oil prices will also help.

…plenty of risks

We expect interest rate cuts as cooling inflation gives central banks room to breathe. But what are the things that could go wrong with this forecast?

That said, the sharp drop in US inflation in the second half of last year means that base effects will turn increasingly unfavourable as the year progresses. So, even if sequential inflation moderates again, year-over-year progress may not look so good.

Indeed, history provides plenty of reasons to worry about the ‘last mile’ in an inflation fight. The effects from higher-inflation expectations could mean inflation linked to labour-intensive services remains sticky.

Moreover, geopolitics might re-ignite inflation pressures in a way central banks can’t look through. In the long run, more supply-side shocks, including from international politics and climate change, may increase inflation volatility.

US growth to moderate

However, the recent slowdown of growth in US activity should help inflation pressures to moderate.

What’s more, restrictive monetary policy, fading support from diminishing household savings, moderating investment in non-residential buildings, and less support from government spending, are all reasons why growth will continue to cool.

Recent survey data highlight the risk that this slowdown morphs into an outright contraction. But for now, with employment growth still solid and our recession-risk indicators low, we think this slowdown looks consistent with a ‘soft landing’ – as inflation is brought back on target without economic damage.

Good news in Europe…

Meanwhile, growth has recovered in the Eurozone and UK amid positive real-income growth and improving sentiment. We forecast an extended period of around-trend growth in these economies, implying a degree of convergence with the US.

Headline inflation in these economies is heading back to target, although better growth has also contributed to stickier underlying inflation.

We are not yet changing our UK growth forecasts in the likelihood of a new Labourgovernment next month, partly because there are public-spending and political constraints on supply-side reforms. But if the Labour Party does achieve planning liberalisation and a closer relationship with the European Union, this could boost potential growth.

Expect lower rates

We expect the global monetary-policy easing cycle to gradually broaden. Having started its cutting cycle in June, the European Central Bank should lower rates twice more this year. We think the Bank of England will start cutting in August for a total of three times in 2024. We are also forecasting Federal Reserve(Fed) cuts in September and December.

In each case, rate cuts will still leave policy at restrictive levels, and there’s a risk further cuts will be delayed and fewer in number. It won’t be difficult for inflation or growth data to delay easing. But a return to rate hikes is less likely. For next year, we are forecasting a roughly once-per-quarter pace of rate cuts in the US, Eurozone, and UK.

The level of r*– or ‘equilibrium’ rates – will help determine where interest rates settle in the long run. Demographics, inequality, and the relative cost of capital are still weighing on r*. But artificial intelligence and investment in the energy transition could push it higher. Either way, the extra yield that bonds need to pay to attract investors may need to rise amid large deficits and more volatile inflation.

The Bank of Japan is an exception to global easing. Strong wage growth and pressure on the yen mean the central bank is likely to hike rates further. But with Japan’s exit from its ‘lost’ decades of deflation still a work in progress, monetary tightening will be modest.

China’s challenges

The Chinese real estate sector remains deeply troubled. Alongside subdued consumer confidence and little prospect of consumers spending a large savings pool, there are headwinds to growth. Indeed, demographics and capital misallocation mean that trend growth may slow towards 4% by the end of the decade.

However, ongoing policy easing, including recent measures to put the property sector on firmer foundations, is helping to improve activity growth. The gross domestic product growth target of around 5% is likely to be achieved this year, and inflation has escaped negative territory. But concerns about ‘de-risking', and the need to reserve some dry powder in case of a trade war with the US, rule out more substantial stimulus.

Other EMs and risks…

We expect aggregate emerging market (EM) growth to continue gaining some momentum later in 2024, amid resilient services and a pickup in manufacturing and trade.

Headline inflation has returned to target in EMs, although sticky core-services inflation is likely to remain a challenge, including in emerging Europe and Mexico. We expect Asia-Pacific central banks to continue waiting for the start of Fed-rate cuts before easing because of possible currency pressures. Better growth and sticky services inflation may slow the pace of rate cuts elsewhere. But we expect the EM easing cycle to broaden out over time.

The US election in November is a key risk to the global outlook. A second term for President Joe Biden, which is what we’re basing our forecasts on at this stage, would represent broad policy continuity. However, the mix of tariff, fiscal, regulatory and immigration policies that Donald Trump may pursue if he wins could cause uncertainty and result in strong inflationary pressures.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.