Goldman’s got a better way to bet on China

China’s new Five-Year Plan is already playing favourites, and Goldman thinks it’s tipping the market’s next big winners.

28th November 2025 08:24

by Stéphane Renevier from Finimize

- China’s Five-Year Plans have a habit of singling out the sectors that end up delivering the fastest earnings growth

- Goldman’s new 50-stock Five-Year Plan portfolio captures the sectors that are in the spotlight this time around. And – what do you know – they’re already outperforming

- You can use Goldman’s list as a targeted tilt toward policy-backed assets – but be aware that some of these trades might already be crowded.

China just released the proposal for its next Five-Year Plan – and it might already be tipping its future winners.

The proposal – which lays out the country’s priorities through 2030 – won’t be final until March. But Goldman Sachs has parsed the early draft, tracked which sectors got the most love, and scored how strongly each one’s being backed.

And here’s the kicker: when Goldman applied the same method across 25 years of past plans, they found that the most policy-favoured sectors consistently delivered the fastest earnings growth.

In other words, China’s next big outperformers may be sitting in plain sight.

Here’s what Goldman discovered

Most investors shrug off government roadmaps. But China’s Five-Year Plans tend to be reliable. The economy’s hit about 90% of the numerical targets laid out in the past five plans – a level of policy follow-through that makes them unusually useful as investing signals.

Goldman’s analysts did something cool: they broke each plan and every annual Government Work Report into thousands of policy sentences, mapped those sentences to industries using curated Chinese-language keyword dictionaries, and used a finance-focused AI model to score how supportive each sentence was. That produced 25 years of sector-level policy favourability scores.

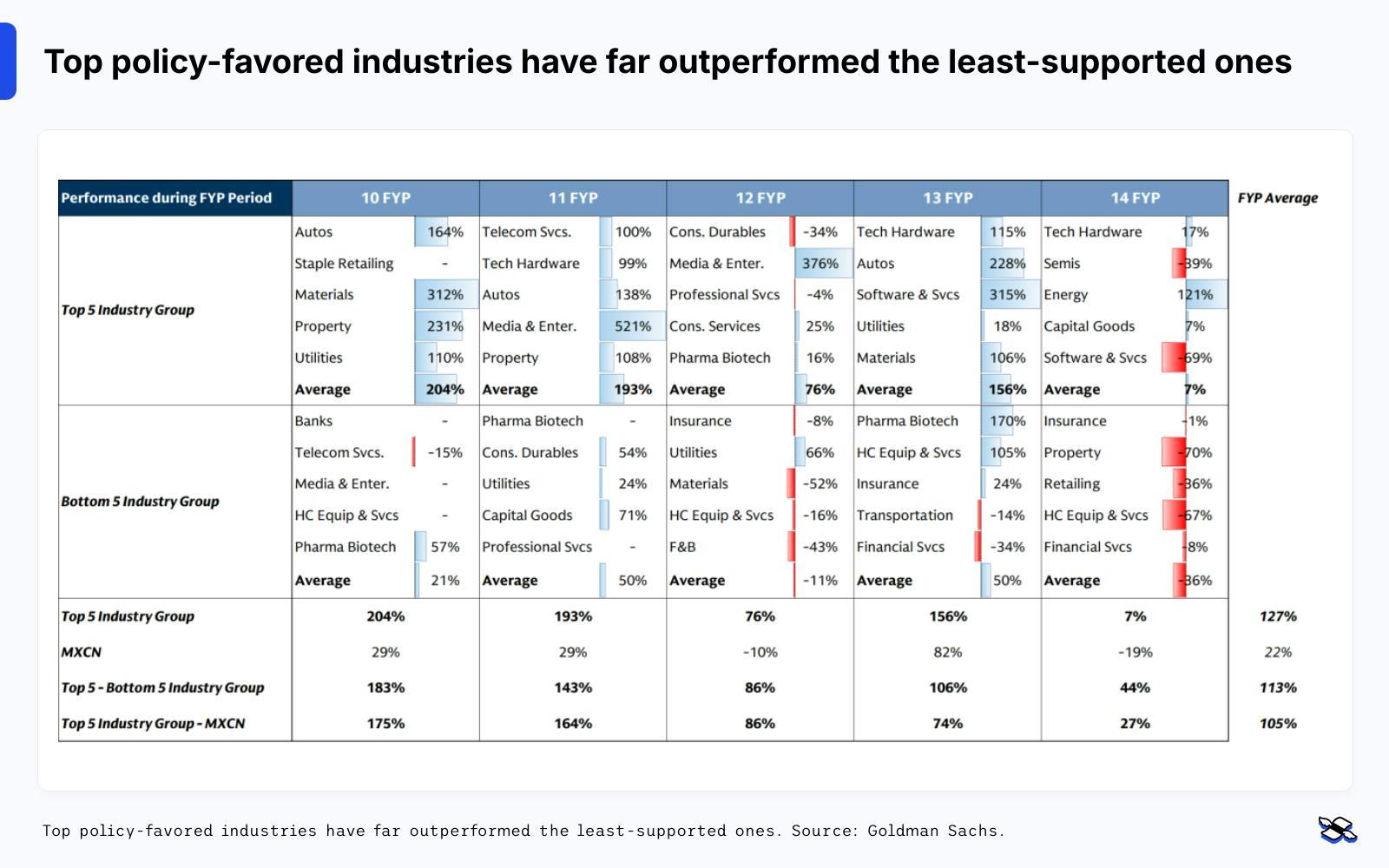

Then, they ran a simple backtest: for every cycle, go long the five sectors with the strongest policy support and short the five with the weakest. The result was remarkably consistent: the long–short spread averaged about 114% across each Five-Year Plan. That’s an extra 13% per year versus the broader index.

And importantly, the performance wasn’t driven by hype or stock multiple expansion. It came from fundamentals. See, the sectors with the highest policy support delivered around 14% annual earnings per share (EPS) growth, while the lowest-support sectors delivered closer to 1%. In other words, when Chinese authorities give an industry priority, that industry tends to get the capital, regulatory support, and investment needed to grow earnings materially faster. It’s not a flawless predictor – and it doesn’t remove China’s market volatility – but across two decades of data, the pattern is very hard to deny.

Top policy-favoured industries have far outperformed the least-supported ones. Source: Goldman Sachs.

Where Goldman sees the opportunity this time

The upcoming 15th Five-Year Plan proposal puts three themes front and center: modernisation, security, and science and tech. Those are the most frequently mentioned concepts in the document, according to Goldman’s text analysis.

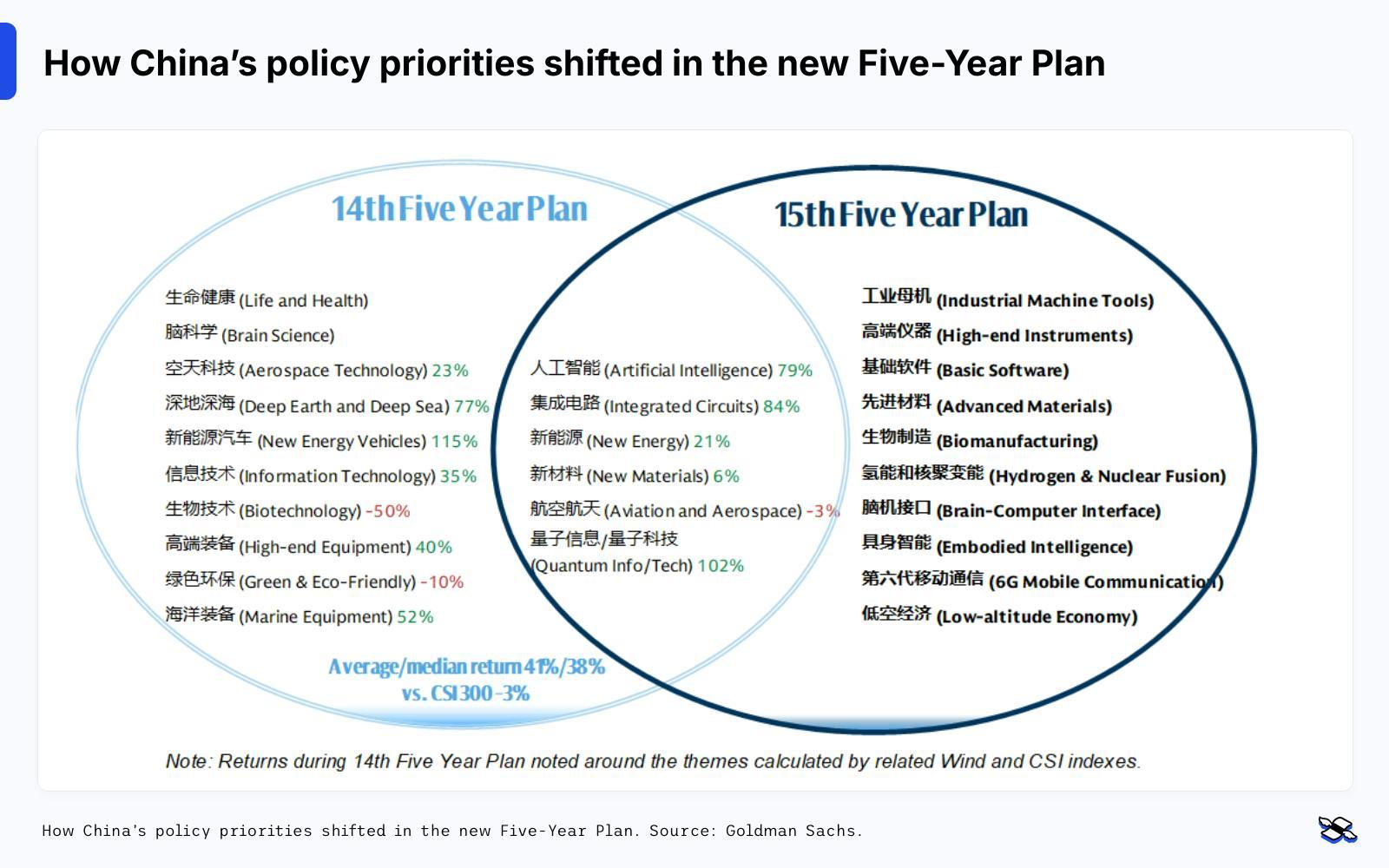

The proposal also introduces several notable shifts: domestic consumption is elevated into the top tier of national priorities for the first time in any Five-Year Plan; protection of private enterprises is given more emphasis; “opening up” is pushed higher in the policy order; and the old “houses are for living, not speculation” line is removed. Plus, several emerging technologies – including 6G, biomanufacturing, hydrogen and nuclear fusion, and embodied intelligence – all show up for the first time.

Goldman’s model flags 35 industries aligned with these priorities, representing about $13 trillion (£9.8 trillion) in market value – roughly two-thirds of China’s listed companies. The strongest clusters fall into areas where China wants to be more competitive: chips and advanced hardware, high-end manufacturing and automation, new materials and scientific instruments, software and the digital platforms, and national security-linked frontier tech.

How China’s policy priorities shifted in the new Five-Year Plan. Source: Goldman Sachs.

These themes match the country’s next-stage growth logic: upgrade industry, localise sensitive technologies, and lean more heavily on consumer demand at home. The earnings outlook reflects it: consensus expects these 35 industries to grow profits by around 20% annually from 2025 throughout 2027, versus roughly 15% for the broader market.

And Goldman’s pros didn’t stop at sector themes. To make the signal usable for stock-pickers, they built the GS 15th FYP Portfolio – a 50-stock well-diversified basket pulled from the most policy-aligned industries. It leans into mid-cap names with solid liquidity, higher capital spending (capex) and research and development intensity, stronger profitability, and growth that actually supports the valuation. In plain English: Goldman thinks this is a smarter way to play China than just buying your basic, broad passive ETF.

A lot of these stocks already seem to have a head start. The basket is up about 68% over the past year, beating MSCI China by 33 percentage points. It trades on around 26x forward earnings, but consensus expects roughly 30% EPS growth from 2025 to 2027 – double what analysts see for the broader index. That leaves the portfolio on a forward price-to-earnings-to-growth ratio of around 1x, similar to the benchmark despite far stronger growth. And with a three-year beta of about 0.7 versus MSCI China, it’s delivered faster returns with less market sensitivity.

Here’s the full list of stocks:

Goldman’s 50-stock basket for playing the 15th Five-Year Plan idea (part 1). Source: Goldman Sachs.

Goldman’s 50-stock basket for playing the 15th Five-Year Plan idea (part 2). Source: Goldman Sachs.

How you can benefit (and what to watch out for)

The simplest way to use this is as a tilt, not a high-conviction, core bet. It’s about edging towards where policy’s pointing – the sectors the government is backing with urgency. Adding exposure to semiconductors, high-end manufacturing, automation, materials, biomanufacturing, the digital economy, and selective consumption puts you closer to the parts of the market that have historically turned policy support into actual earnings growth. Scaling back exposure to property, old-economy industrials, and some financials helps you avoid areas that the proposal is deprioritising and that carry long-running, deep-seated challenges.

Still, nothing’s a sure thing. Backtests always look cleaner than reality, and some of the earnings strength Goldman expects may already be reflected in today’s prices – especially after this year’s sharp rally across mid-cap policy winners.

And while China’s policy signals are powerful, they’re not permanent: priorities can shift quickly, and markets tend to front-run well-telegraphed themes. That means there’s still room for momentum as investors try to get ahead of the full Plan in March, but it also raises the risk of buying into a crowded narrative. Call it an odds-tilt, not a guaranteed trade – but in markets, stacking a few reliable edges is often how you win.

Stéphane Renevier is an analyst at finimize.

ii and finimize are both part of Aberdeen.

finimize is a newsletter, app and community providing investing insights for individual investors.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.