How to invest for climate change: fund, trust and ETF tips

27th April 2022 09:00

by Hannah Smith from interactive investor

We ask experts to name the funds investors can use to combat climate change.

The world is “perilously close” to the tipping point of irreversible climate change, the head of the United Nations warned earlier this month. There’s no ignoring the climate emergency any longer, but solving it will require an enormous concerted effort. It will also require a lot of capital - $173 trillion of investment in the energy transition, to be precise, to achieve net-zero carbon emissions by 2050.

For investors, there are more options than ever if you want to get involved, with a record number of ‘climate aware’ funds coming to market. There were 186 such funds launched in the first three quarters of last year, taking the total to 636 globally, while assets in climate funds increased by 50% over that time to reach $275 billion, according to Morningstar.

The current situation in Ukraine could speed up the energy transition as global oil supplies are disrupted, suggests Dzmitry Lipski, head of funds research at interactive investor.

“The immediate impact of the war in Ukraine has shifted climate change from the investment agenda, at least, in the near term, however - the long-term impact of this war is likely to cause an acceleration in the green energy transition from fossil fuels, and an increase in the demand for renewable energy,” he says.

Investors looking to back climate-focused funds should be aware that they have had a difficult time so far this year because of their bias to small, fast-growing companies at a time when the growth investment styles has struggled, Lipski adds. Rising interest rates and inflation are making the market reconsider how much the future earnings of these companies are worth today. “Investors looking to take part in positive climate change should ensure their portfolios are well diversified and balanced without strong bias to any one style or market cap,” he suggests.

If you want to put your money to work tackling climate change, here are some of the top fund, trust and exchange-traded fund (ETF) picks, as chosen by expert investors.

- Top 20 most-bought sustainable funds, trusts and ETFs in ISAs

- How fund managers use their power to drive ESG change

- ii Top 10…ways to avoid greenwashing with funds

Funds

Amelia Overd, investment manager at Castlefield, a financial planning business and fund manager, tends to invest client money in sustainable funds that include climate change among other themes, to maintain diversification. On her buy list currently is Sarasin Responsible Global Equity, a thematic ESG fund, and Liontrust Sustainable Future Global Growth.

Overd suggests that, when choosing a climate-aware fund, investors should do their research on the provider as well as the portfolio. “It’s always worth looking at who’s creating a product – we get a lot of salespeople in offering low-carbon funds from big household-name investment banks that are themselves using their profits and investment book to fund arctic drilling, for instance,” Overd says.

She adds: “At the end of the day, you’re paying them fees, and those fees are going somewhere, so if it’s an organisation that’s committed to doing the right things for the planet and their employees, than that is still an impact of your investment.”

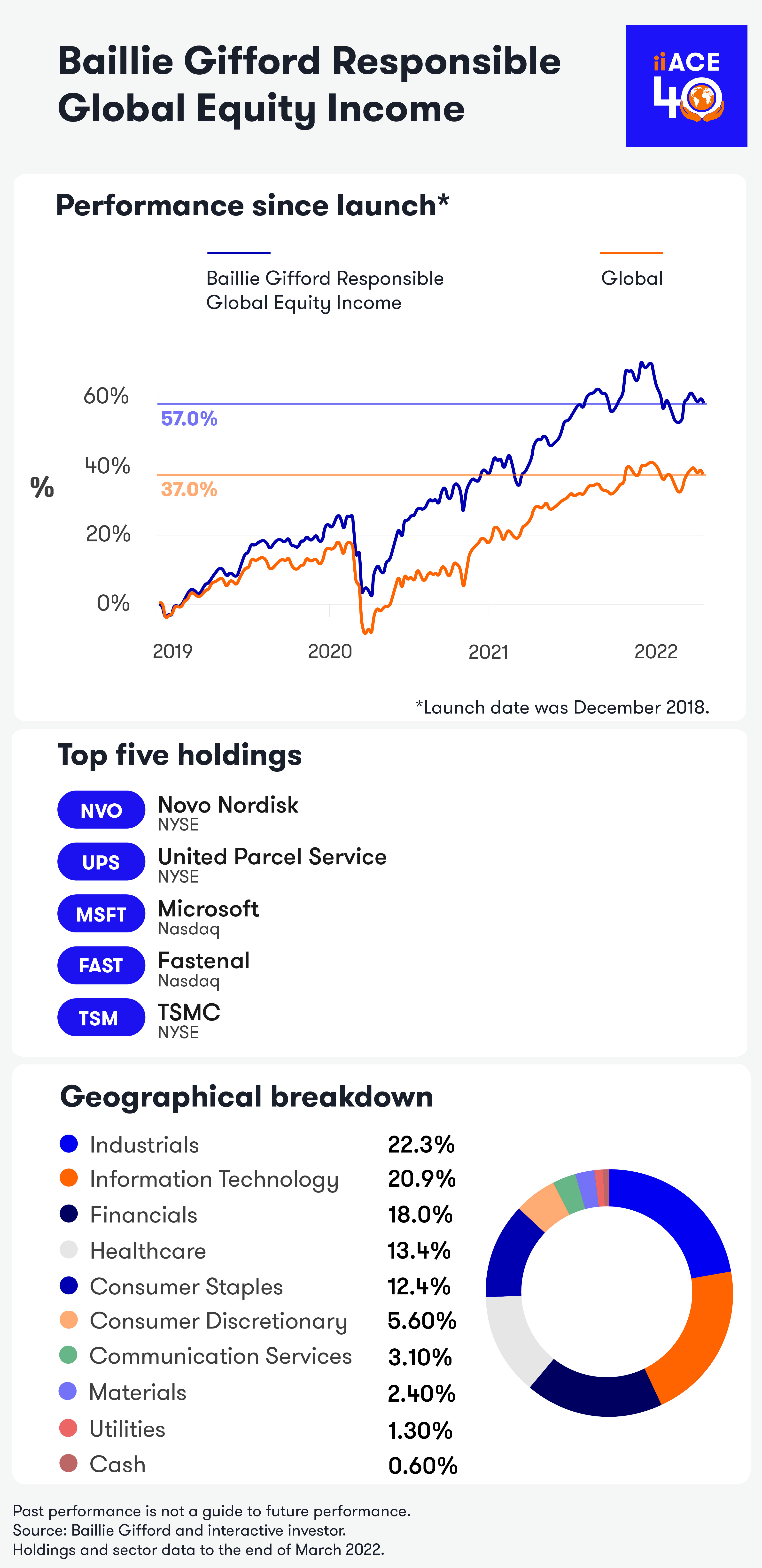

Another more generalist sustainable fund option chosen by Lipski is the Baillie Gifford Responsible Global Equity Income fund, which is a member of interactive investor’s ACE 40 list. Managers James Dow and Toby Ross exclude tobacco and alcohol stocks, among others, and follow the principles of the UN Global Compact, which covers human rights, labour, the environment and anti-corruption.

Among the fund’s top holdings are big names such as Novo Nordisk (NYSE:NVO), Procter & Gamble (NYSE:PG), Microsoft (NASDAQ:MSFT) and Nestle (SIX:NESN), and it is competitively priced with an ongoing charge of 0.53% and a 2% yield. “The fund is a compelling choice for those seeking a high and rising income from responsible equity investments,” he says.

For a more specifically climate-focused fund, Lipski highlights the Climate Assets Fund, a multi-asset fund managed by Claudia Quiroz of Quilter Cheviot since 2010. It invests in businesses trying to solve the world’s biggest problems, from climate change to resource scarcity and population shifts. With its asset allocation split of 65% equities, 15% bonds and 11% alternatives, it could be suitable for investors wanting a more balanced portfolio with lower volatility, suggests Lipski.

Last November, interactive investor interviewed Quiroz as part of our ‘Insider’ video series – see below.

- Two UK climate change shares I am backing

- Proof from a pro that green investing does not sacrifice returns

For a more single-themed fund, VT Gravis Clean Energy Income offers stable long-term dividend income, low volatility, capital protection and growth, with a 3.6% yield, says Lipski. Offering exposure to the wind, solar and hydro power sectors, more than half the portfolio is invested in the UK, and top holdings include Greencoat UK Wind, Renewables Infrastructure Group, and Clearway Energy.

Tertius Bonnin, assistant portfolio manager at EQ Investors, a financial planning firm, highlights a concentrated 40-stock portfolio of climate-related stocks from M&G: the M&G Global Sustain Paris Aligned fund. “This is a core global equity fund and the manager thinks of himself as quite defensive in nature. He’s looking for high-quality companies with repeated cashflows, enduring profitability and strong climate management,” says Bonnin.

Another fund backing the energy transition is the Aviva Climate Transition Global Equity fund. Bonnin points out: “The team uses a science-based framework and talks to companies that may be dirty emitters and get them to sign up these science-based targets so these companies can start on their own journey to be cleaner in future.”

Another of his top picks is the Ninety One Global Environment fund, a £1.8 billion fund run as a concentrated portfolio of just 25 stocks. All the products and services of the companies it holds relate to the decarbonisation theme. “It has a very high pedigree investment team, a long-term track record, and there is a compelling investment case there,” he adds.

Trusts

In the investment trust space, Impax Environmental Markets (LSE:IEM) and JLEN Environmental Assets (LSE:JLEN) are well-established and well-respected names – Impax, for instance, has been running since 2002.

More focused renewable energy trusts liked by fund selectors include Greencoat UK Wind (LSE:UKW), NextEnergy Solar (LSE:NESF) and Foresight Solar (LSE:FSFL).

Trusts like these “can play a really interesting part in a wider portfolio,” says Overd. “Renewable infrastructure has a lot of interesting investment characteristics that might be a differentiator and can be a bit of diversifier, although we have to remember that it’s still equity at the end of the day. As a house, we are increasing our exposure to infrastructure more generally in the current investment climate.”

EQ Investors like the Harmony Energy Income Trust (LSE:HEIT), which they backed at its IPO in November. “These guys do energy storage, they trade in and out of the grid at peak and trough times of energy demand to try to create a profit from that,” Bonnin explains. “Energy storage has been really important to balance out the obvious downside of renewables which is the variability in generation.”

Exchange-traded funds (ETFs)

Notably, there are many more passive funds focusing on climate change and clean energy than there were just a couple of years ago. Critics have argued that these funds “undermine” the fight against global warming by routinely engaging in greenwashing, so investors should always look under the bonnet to see what these funds actually hold.

“They are a starting point,” says Overd. “There are probably people with quite specific investment aims in terms of fees and it might be the case that moving some of their money to a low-carbon [passive] strategy might be the first step in incorporating broader sustainability goals into a traditional investment portfolio.”

iShares Global Clean Energy ETF (LSE:INRG) is one of the more established products in the space, launched in 2007, but now there are other specifically climate-focused newcomers to choose from.

EQ Investors is very much focused on active management but, acknowledging pressure on fees, it is looking for best of breed passive funds for more price sensitive investors. Bonnin flags the HANetf iClima Global Decarbonisation Enablers ETF (LSE:CLMA), which has decarbonisation as one of a number of themes, helping to reduce its volatility and concentration risk.

What is ESG investing?

ESG stands for “environmental, social and governance”. Funds with this label have been growing in popularity as investors push for their money to do good and avoid harmful companies.

There are three main types of EGS funds.

- Avoids: funds that exclude specific companies, sectors or business practices, such as tobacco

- Considers: strict ESG criteria, such as pollution levels, are taken into account

- Embraces: these focus on companies that deliver positive social and/or environmental outcomes, such as renewable energy.

To help investors navigate confusing technical jargon, interactive investor launched the ii ethical long list in 2019, which contains more than 140 socially responsible and environmental funds, investment trusts and ETFs available on our platform. The ethical investment list is a collaboration with SRI Services.

We also launched the ACE 40, a rated list of best-in-class ethical funds for retail investors wanting to better align their investments with their personal values. All ACE 40 investments are categorised into one of three broad ethical investment ‘styles’ to help investors find a fund that meets their values. The three categories are Avoids, Considers and Embraces and you can find out more about them here.

There is also the ii Ethical Growth portfolio, which is designed to give investors an idea about how they can build their own diversified ethical portfolio.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.