Imperial Brands CEO is out: who's next for the chop?

A raft of FTSE 100 chiefs and big hitters have left or been kicked out recently. No one is safe.

3rd October 2019 14:15

by Graeme Evans from interactive investor

A raft of FTSE 100 chiefs and big hitters have left or been kicked out recently. No one is safe.

A week of upheaval in the boardrooms of Britain's biggest companies continued today, with Imperial Brands (LSE:IMB) the latest company to deliver a change at the top.

Alison Cooper, whose two decades with Imperial include nine years as CEO, will leave the tobacco company next year. She's far from the only high-profile exit announced this week, with Tesco (LSE:TSCO) boss Dave Lewis, Standard Life Aberdeen (LSE:SLA)'s Martin Gilbert and the CEO of Sainsbury's (LSE:SBRY) division Argos among those heading for pastures new.

Cooper's exit means some of her FTSE 100 Index counterparts may be sitting a little less comfortably today, particularly as current trading conditions and growing shareholder activism appear to have made hiring and firing non-execs increasingly twitchy.

Iain Conn at Centrica (LSE:CNA) is set to go next year, while Gavin Patterson has been replaced at BT (LSE:BT.A), John Flint has gone at HSBC (LSE:HSBA) and Veronique Laury is out at B&Q owner Kingfisher (LSE:KGF). It leaves investors wondering who might be next.

Sainsbury's CEO Mike Coupe is likely to be top of many people's list after the Asda takeover debacle. He continues to receive the backing of the supermarket's chairman Martin Scicluna, with his position looking a little more secure now that the leading candidate to replace him — John Rogers — has swapped the top job at Argos for the finance director's position at WPP (LSE:WPP).

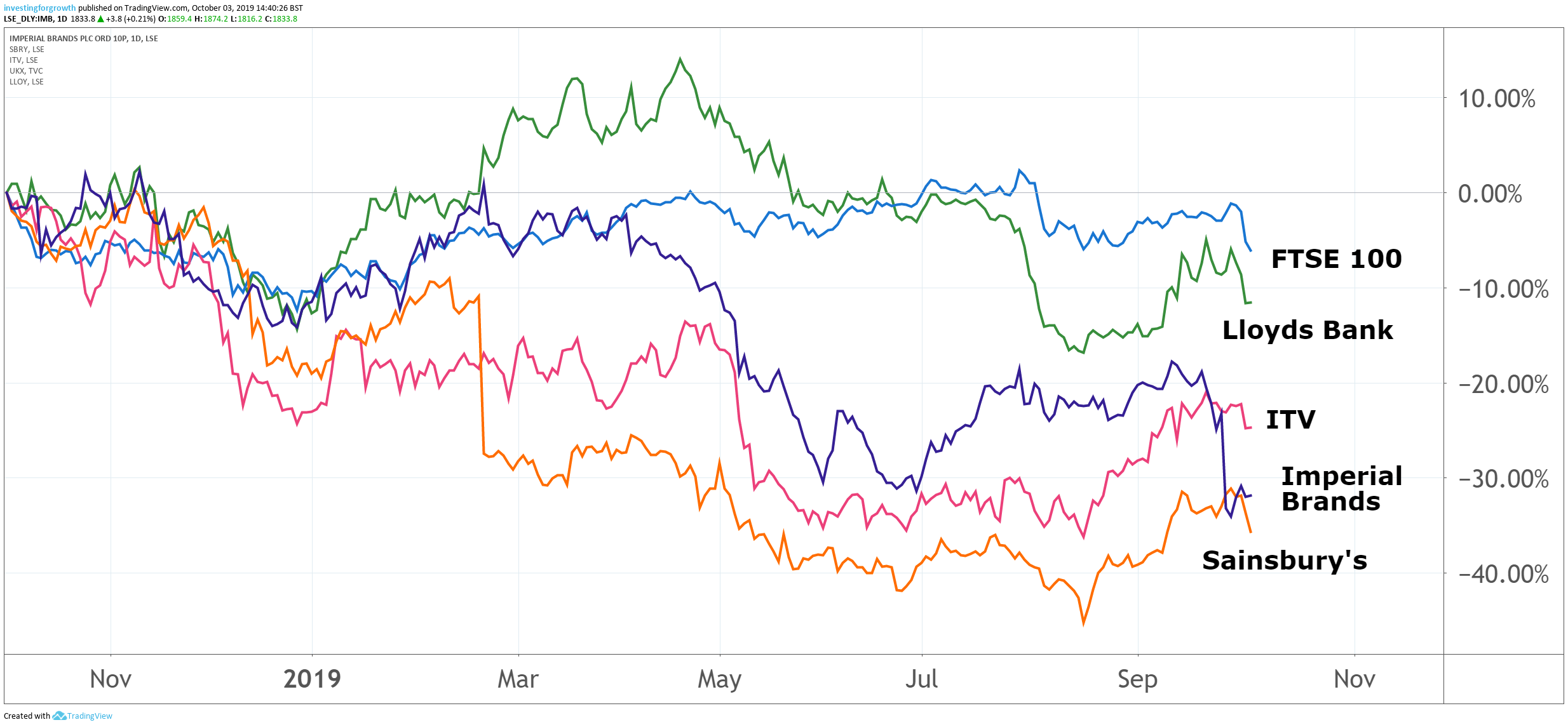

Many investors, however, are likely to believe a change is needed after seeing the share price tumble to a 30-year low. Other CEOs on thin ice include Dame Carolyn McCall, who took the helm at ITV (LSE:ITV) in early 2018 but has presided over a 29% decline in the share price.

And what about Antonio Horta-Osorio, whose progress in reviving Lloyds Banking Group (LSE:LLOY)since becoming chief executive in 2011 hasn't been reflected in the share price? Pearson CEO John Fallon is also under pressure after a profits warning last week — issued on the same day as Imperial Brands warned that its growth had been slower than expected.

While no reason was given by Imperial for Cooper's departure, it's clear that she's paid the price for last week's warning and a share price that's trading at its lowest level since 2011. Perhaps tellingly, there was no statement from Cooper with today's announcement.

Shareholders still have reason to be thankful for £10 billion of dividends over her nine-year tenure, but the outlook concerning future riches is much less certain as Imperial faces challenges expanding into next generation products. The company recently replaced its decade-long 10% annual dividend growth policy with progressive pay-outs.

Embarrassingly for Imperial and Cooper, rival British American Tobacco (LSE:BATS) reiterated its guidance on group revenues only two weeks previously. BAT had replaced CEO Nicandro Durante with Jack Bowles in April. With Cooper going, it means Imperial must now find a CEO as well as a replacement for chairman Mark Williamson, who has already announced plans to step down.

Cooper is one of just five women running FTSE 100 companies, with the others being ITV's McCall, Emma Walmsley at GlaxoSmithKline (LSE:GSK), Liv Garfield at Severn Trent (LSE:SVT) and Alison Brittain at Whitbread (LSE:WTB). The number will become six next month when Alison Rose replaces Ross McEwan at the helm of Royal Bank of Scotland (LSE:RBS).

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.