Impressive BP still home for income seekers

31st July 2018 11:06

by Richard Hunter from interactive investor

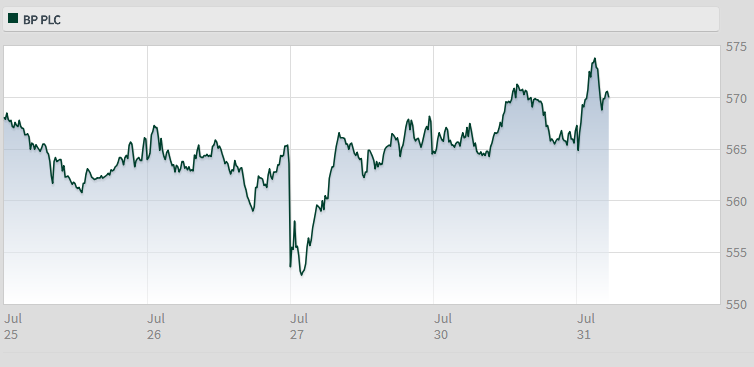

Following a great run through spring, BP shares have tracked sideways as oil prices stabilise, but what do latest results say? Richard Hunter, head of markets at interactive investor, shares his thoughts.

Recent results across the oil sector globally may have been accompanied by a tinge of disappointment, but BP has firmly avoided any such gloom.

The numbers have clearly been boosted by an oil price which is comfortably in excess of BP's breakeven level of somewhere around $50 per barrel. However, this is only part of the story.

• The week ahead: Lloyds Bank, BP, Rolls-Royce, Next

• Chart of the week: Time to take profits at BP?

• Royal Dutch Shell confirms massive share buyback

The company has sailed through several storms over the last decade, not least of which was the Gulf of Mexico spillage which continues to drag, albeit at much lower payment levels. The business has been streamlined, non-core assets sold and strategic purchases made, such as the recent acquisition of US shale assets from BHP Billiton.

Operationally, there was a strong input across the board, with particularly noticeable contributions from Upstream and Rosneft. Meanwhile, and not surprisingly, key metrics look impressive and the increase to the dividend - adding to an already punchy 5.3% yield - is a sign of confidence in prospects, whilst the share price is further supported by the share buyback programme.

Source: interactive investor Past performance is not a guide to future performance

Less positively, the net debt figure remains substantial, even though there has been a slight reduction in the period, whilst the latest Gulf of Mexico repayments of $700 million show that the issue is not yet completely off the table. Meanwhile, the BHP shale assets acquisition may be dilutive in the short term, although the longer-term benefits are clear.

Overall, however, these are a set of numbers which rightly flatter the oil behemoth. Progress is being made in practically all areas of the business and the company has delivered despite heightened expectations.

The shares have been on something of a run, having risen 27.5% over the last year as compared to a 4.5% hike for the wider FTSE 100, and are up 13% in the last six months alone. The market consensus of the shares as a 'strong buy' seems to have been vindicated.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.