Look East for fastest dividend growth

18th September 2018 12:27

by Tom Bailey from interactive investor

Once seen as a no-go zone for income investors, companies in the Far East are becoming increasingly generous to shareholders, writes Tom Bailey.

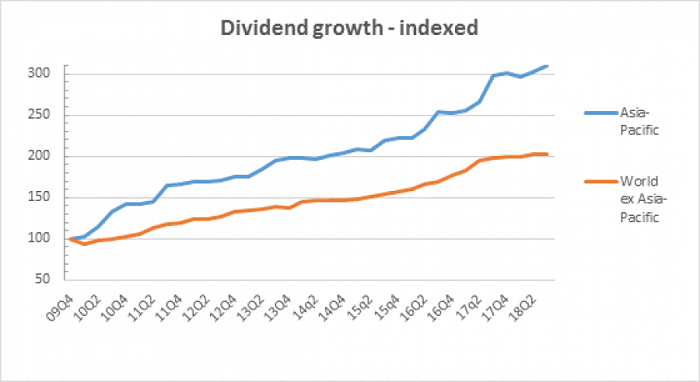

Dividends from the Asia Pacific region have grown at twice the rate of the rest of the world, according to the new Henderson Far East Income Index.

Dividends from Asia Pacific excluding Japan soared by a total of 15.9% in the 12 months to the end of July 2018, reaching a record-breaking £222.6 billion. This was more than twice the 5.5% dividend growth estimated for the rest of the world.

Historically, the region has not been an area of particular interest for income investors. However, as the most recent figures attest, that is now changing.

In the past, firms in the region have been more inclined to reinvest for future growth rather than allocate capital to rewarding shareholders.

Source: interactive investor Past performance is not a guide to future performance

However, as economic growth in the countries slows to more sustainable levels and businesses mature, so corporate investment is likely to head the same way, meaning more cash allocated to dividend payments.

As Mike Kerley, manager of Henderson Far East Income investment trust, notes:

"The Asia Pacific region is much more than just a crucible of investment and growth, enticing investors interested in making capital gains. As economies have developed and companies have matured, it’s now a huge income-generating machine, too."

At the same time, governments in the region have attempted to improve corporate governance, encouraging better shareholder treatment and improving remuneration.

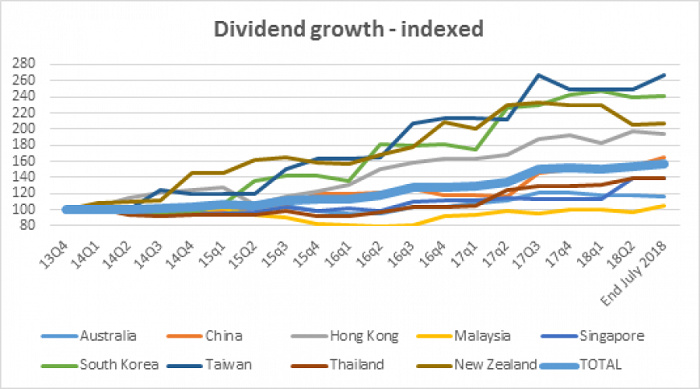

As the data from Janus Henderson shows, dividends paid from companies in the Asia Pacific region accounted for £1 in every six of payouts worldwide, compared to one in nine in 2009.

By contrast, the UK, a historically generous place for income investors, saw its share of dividend payments drop from £1 in every 10 to one in every 12.

"This development, in conjunction with ageing Asian populations increasingly looking to receive an income from their savings, is resulting in a more entrenched culture of dividend-paying and this is providing opportunity for UK savers, too," says Kerley.

Source: interactive investor Past performance is not a guide to future performance

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.