New forecast for oil prices and gold

With both key commodities at an interesting point, our chartist reruns the numbers.

22nd April 2020 08:45

by Alistair Strang from Trends and Targets

With both key commodities at an interesting point, our chartist reruns the numbers.

Brent Crude, Gold

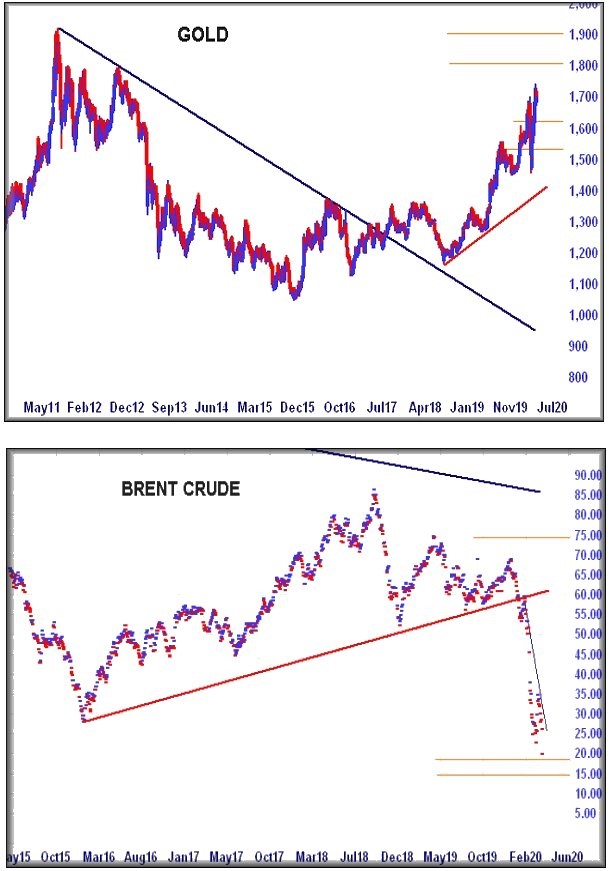

Gold isn't behaving properly. Our previous big picture analysis against the metal proved very successful but despite exceeding target levels, price movements are as reliable as UK Government Minister statements. We really do not trust gold at present.

If we step back and review the big picture, the metal only need bubble above $1,746 to next make an attempt at $1,804 with secondary, if exceeded, a longer-term top of $1,909.

Visually, with the secondary target matching the highs of 2011, the price is almost certain to experience a stutter if such a level appears.

However, similar to ministerial statements, something a bit dodgy is going on.

The price now needs only to melt below $1,657 and a downhill drip to an initial $1,627 looks very possible.

If broken, secondary is at $1,534 and if it appears, we shall expect a reasonable rebound.

We're not confident gold intends to conform to market pundits beliefs, rather we suspect it shall find an excuse to reverse yet again.

Brent Crude, as we feared, experienced a bit of a reality check, following the rather unsurprising experience of US Crude's May contracts discovering no-one wanted to actually take delivery of crude when storage tanks are already full.

The situation now is fairly blunt from Brent.

Thanks to the price reversing to $20.7, it conclusively broke (again) our $25 drop target.

The price needs to exceed $31 dollars to $31 to escape the trap it now finds itself in.

To be brutal, below $20.7 calculates with the potential of reversal to an initial $18.5 with secondary still at a bottom of $15.

There's a vague risk of $15 breaking, suggesting further weakness to $12.5 before a rebound but, realistically, if Brent makes it below the $15 mark, we cannot produce a big picture bottom above zero!

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.