No-deal Brexit could wipe 25% off UK share prices

23rd January 2019 10:00

by Tom Bailey from interactive investor

UK shares look cheap, but one doomsayer thinks prices could fall further, depending on the Brexit outcome.

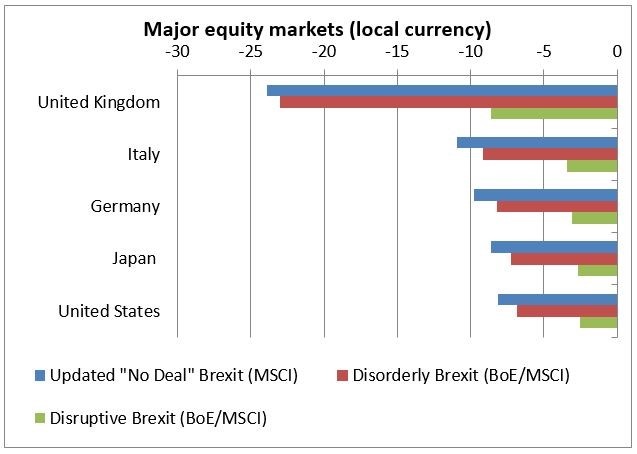

MSCI, the global provider of stock market indices, has gloomily predicted that if Brexit takes the form of a no-deal, UK shares could fall as much as 25%.

As part of its stress test analysis MSCI took into account the Bank of England's Brexit study, which assumes an 8% GDP contraction and 25% devaluation of the pound against the US dollar in a no-deal scenario.

From this, MSCI "propagated these shocks to financial market risk factors," concluding that UK shares would fall by almost 25%.

In its analysis, MSCI points out that since the referendum, UK equities have lagged global shares, meaning that markets have at least in part priced in Brexit risk. But it adds "the real impact – if there is 'no-deal' – has yet to materialise."

Meanwhile, according to MSCI, a disruptive Brexit was forecast to have a relatively more benign impact on markets, with prices falling by just under 10%.

The pessimistic stance is a sign of caution for investors that 'cheap' UK shares could become even cheaper and remain out of form, depending on the outcome of Brexit.

In terms of valuations UK equities, in particular the large cap names in the FTSE 100 index, look attractive, and it has been argued present a "once in a decade buying opportunity." This is based on the median price-to-earnings ratio for the FTSE 100 being in the cheapest 10% of readings since 1996, creating a potential buying opportunity.

Source: interactive investor

At the same time, the UK market is not the only one expected to take a hit. Italian and German stocks, it is predicted, would see declines of around 10%, while Japan and the US would also see falls just under that figure.

However, a no-deal Brexit is not a foregone conclusion. While the recent defeat of May's deal in the House of Commons seemingly makes such a prospect more likely, the response to the defeat was a slight sterling rally, pinned on forex markets no longer expecting a 'hard Brexit' (of which no-deal is one variety).

"Investors should continue to watch closely while preparing themselves for the worst," warns MSCI.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.