Petrofac recovery continues

29th August 2018 14:27

by Graeme Evans from interactive investor

After a disastrous 2017, Petrofac is turning things around, repaying faithful investors and new money. Graeme Evans discusses latest results.

A year on since Petrofac Ltd disappointed shareholders by slashing its dividend, the mood surrounding the oilfield services firm feels markedly different.

Renewed oil price strength has clearly helped in terms of boosting activity, with an impressive US$3.3 billion of new orders recorded in the year to date. But today's half-year results also show the benefits of self-help measures through improving margins and significant progress in reducing capital intensity.

Petrofac says it is now "well positioned for the second half with good revenue visibility, a strong competitive position and healthy liquidity".

Compare this statement to a year ago when chief executive Ayman Asfari unveiled initiatives to shore up the balance sheet and reduce debt. This included rebasing the interim dividend from 22 cents a share to 12.70 cents.

Today's pay-out was kept at the same level as Petrofac continues to target dividend cover of between 2.0x and 3.0x business performance net profit. Even so, Petrofac is currently trading at an implied 4.4% yield.

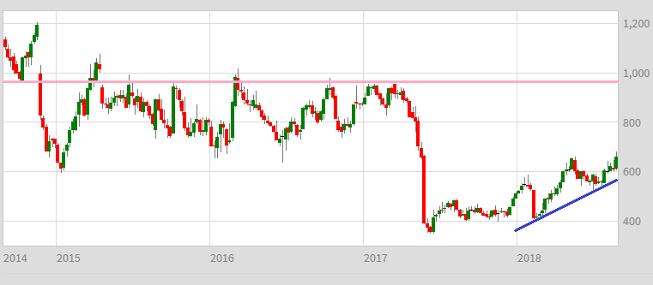

Shares had been trading at near to 1,500p in 2013, but then fell as low as 353p last summer after a slump in oil prices added to fears over the company’s rising debt pile. There has also been uncertainty caused by the ongoing inquiry by the Serious Fraud Office.

Since last August, the FTSE 250 stock has risen by more than 60% and was up a further 2% today after Petrofac announced an engineering contract worth a potential $600 million with Algerian state energy firm Sonatrach.

Half-year results also offered some comfort, particularly as net debt of $900 million was in line with the company's previous guidance and is expected to decline over the second half.

Source: interactive investor Past performance is not a guide to future performance

In addition, a 20% rise in underlying earnings to $190 million was better than hoped, helped by a return to profit in Integrated Energy Services. A number of disposals are due to complete in this division in the early part of 2019 as the company looks to focus on core operations.

Today, Goldman Sachs lifted its earnings per share guidance for 2018 by 3.6% in the wake of the update, but cut estimates for the subsequent two years given its more conservative view of the trading environment.

The broker has a 12-month price target of 674p, which is based on a valuation to earnings multiple of 6.8x.

Meanwhile, JP Morgan remains overweight on the stock and said that today’s results were another “indication of continuing solid operations”.

Our companies analyst Edmond Jackson noted the potential for Petrofac shares when they stood at 454p in mid-December, adding last month that they were still a "speculative buy".

However, he acknowledged that some investors were likely to continue to avoid the company until the SFO gave its verdict.

Jackson said that Petrofac was "a market leader of essential services with many strong client relations based on technical expertise; hence, it pays to accumulate a stock like this while sentiment is against it."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.