Post-election surge in UK house prices as optimism returns to the market

House prices rose at the fastest January rate on record

20th January 2020 10:55

by Stephen Little from interactive investor

House prices rose at the fastest January rate on record

UK house prices went up by 2.6% in January, with the market boosted by a post-election bounce, according to property website Rightmove.

House prices went up by £6,785, making it the largest monthly price rise recorded at this time of year.

Nearly 65,000 properties were put on the market between 8 December and 11 January.

On an annual basis prices rose by 2.7%, taking the average asking price up to £306,810.

There has also been a jump in demand since the election on 12 December.

Between 13 December to 15 January, enquiries to estate agents were up 15% compared to the same period a year ago. The number of sales agreed rose 7.4% over the same period.

Miles Shipside, Rightmove director and housing market analyst, says: “These statistics seem to indicate that many buyers and sellers feel that the election result gives a window of stability. The housing market dislikes uncertainty, and the unsettled political outlook over the last three and a half years since the EU referendum caused some potential home-movers to hesitate.

“While there may well be more twists and turns to come in the Brexit saga, there is now an opportunity for sellers to get their property on the market for a spring move unaffected by Brexit deadlines. For those who can afford to move and have been putting it off, now would appear to be a good time to get a view from a local estate agent on their property’s value, and a mortgage quote for the great fixed-rate deals that are currently available.”

The lack of housing supply means first-time buyers face record house prices in order to get on the property ladder.

Newly-marketed properties with two bedrooms or fewer now have a national average asking price of £193,103.

Shipside adds: “First-time-buyer activity has remained strong, buoyed by cheap interest rates and the high costs of renting. The downside of this high demand is upwards price pressure, with the average price of typical first-time-buyer property hitting a new record high. However, the annual rate of increase remains fairly modest at 1.6%, less than the rate of growth in average earnings, so affordability has actually improved a little for first-time buyers.”

Regional trends

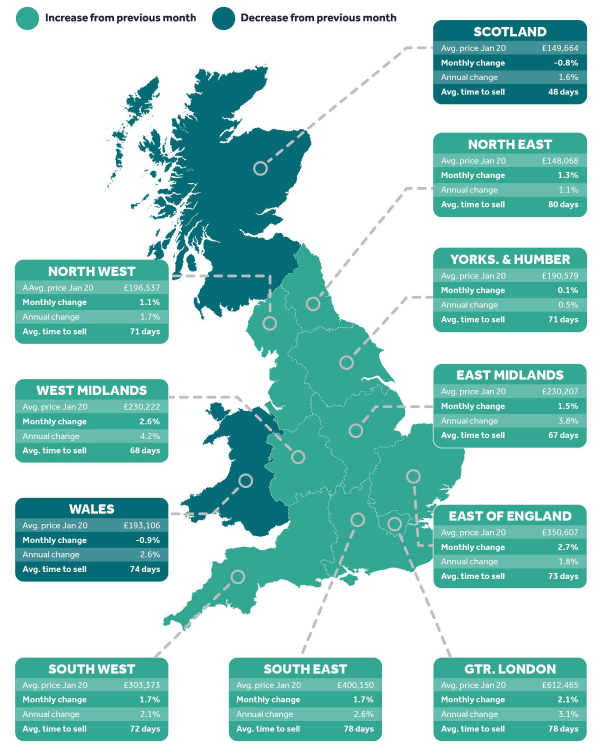

Most regions saw monthly prices grow, with only Scotland and Wales experiencing a decline.

The East of England saw the biggest monthly price rise at 2.7%, followed by the West Midlands at 2.6%.

The average price of property in London went up by 1.7%, while the South East also experienced solid growth at 1.7%.

Prices dropped in Scotland by 1.6% and in Wales by 0.9%.

Mark Manning, managing director of Yorkshire-based estate agent Manning Stainton, says: “There is more confidence now and the market is springing into life. Regionally, we have solid foundations, so our market is in a really good position and we’re expecting our sales agreed figures to be very good.

“We didn’t really see much buyer urgency throughout 2019 and we desperately needed new listings, but then in December just gone, we sold more properties than in any other December since 2004, which was huge. We’ve now seen a 15% increase in home-owners looking to sell and things are picking up.”

UK house prices in Janaury

Source: Rightmove 2020

This article was originally published in our sister magazine Moneywise, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.