Share Sleuth: this share trebled, but now it’s time to sell

Richard Beddard doesn’t review the performance of portfolio constituents at the turn of the year, but explains that selling this stock to boost his cash pile was staring him in the face.

10th January 2024 10:24

by Richard Beddard from interactive investor

Even though I allow myself one trade a month, I did not plan to trade prior to this monthly update because of Christmas, and illness. Neither are conducive to good decisions.

For all the right reasons, Christmas is a frenetic time of year in my household. Work becomes downtime, which is why the articles you may have read from me over the holiday period were reflective; pulling together my thoughts on good and bad annual reports, and documenting the changes to my Decision Engine.

- Invest with ii: Open an ISA | ISA Investment Ideas | ISA Offers & Cashback

Couple the welcome distractions of Christmas with the unwelcome distraction of sinusitis, and my mind was not in the best state to trade. The good thing about owning shares for the long-term is you do not have to, if you do not feel up to it.

Trades staring me in the face

But when I sat down to reflect on the portfolio as 2024 opened, there were two simple trades staring at me in the face.

Share Sleuth did not have enough cash to add a new holding, or add to an existing one. That would have required about £4,750, which is Share Sleuth’s minimum trade size (2.5% of the portfolio’s total value). But the portfolio had a little less than £1,800 in reserve.

My attention turned to holdings I could reduce or liquidate.

Sitting in 39th position out of 40 in the Decision Engine table was Tristel (LSE:TSTL). Judges Scientific (LSE:JDG) was in 40th place.

Tristel makes a unique hospital disinfectant, and Judges Scientific buys and operates businesses that make scientific instruments. I scored Tristel in November 2022, and will be re-scoring it soon. I scored Judges Scientific in May 2023.

Both are good businesses. I have sometimes imagined holding them forever.

Their relatively low scores of 5 out of 10 have little to do with their quality, and much to do with their share prices. Judges Scientific trades at 43 times normalised profit, and Tristel trades at 40 times normalised profit.

- 37 growth stocks to own in 2024

- Wild’s Winter Portfolios 2023-24: a 23% profit in two months

- Richard Beddard: a new share for a new year

On Wednesday 3 January, I ejected the portfolio’s last remaining shares in Judges Scientific at a price of £92.00, realising just over £3,100 net of £10 in lieu of broker fees. That money, plus the portfolio’s cash and any dividends paid in January should be enough to fund an addition in the coming month, if I make one.

Removing Judges Scientific from the portfolio is a decision I might not have made a few years ago. I have vowed many times before to concentrate Share Sleuth on my best ideas, but that has conflicted with a bull-headed desire to hold good companies for decades. Rather than selling good, put perhaps overpriced, shares I have hung on to rump-sized holdings lest I forget about them.

I am not going to forget about Judges Scientific, though. Removing a share from my Share Sleuth does not mean I remove it from the list of shares I score annually in the Decision Engine. Should Judges Scientific rise back up the rankings, most likely because the shares fall in price, I will be in the market for them.

Judges Scientific was a great addition to the portfolio. SharePad, the software I use to keep track of Share Sleuth, tells me it made a 231% return on the two investments I made in March 2018 and January 2019 and subsequently reduced to zero in four trades. That is 23% annualised.

Past performance is not a guide to future performance.

Tristel remains in the firing line too. According to my scoring process, Tristel and Judges Scientific are my 39th and 40th best ideas and holding on to them does not make much sense.

The removal of Judges Scientific reduces the number of Share Sleuth holdings to 27.

The Share Sleuth super-conglomerate

Unlike many investors, I do not review the performance of portfolio constituents at the turn of the year.

One reason is the temptation to talk about movements in the share price. Annual movements in share price are not relevant to holdings intended to be held for 10 years or more.

Another is that I review each business annually, when it publishes its annual report. There is no need to do it twice.

There is also no need to keep readers informed of Share Sleuth’s performance in an annual update, because I write this portfolio commentary every month. It ends with a chart and table showing the performance of the current constituents.

Instead, at the turn of the year I judge the portfolio as if it were a single business, a practice I learned from Terry Smith, manager of the Fundsmith Equity fund.

These are Share Sleuth’s weighted average statistics. Its profitability, financial strength, and market valuation consolidated as though it were a single conglomerate. The averages are weighted according to the value of the portfolio’s holding in each share:

Debt to Capital (%) | -18 |

Return on Capital (%) | 31 |

Cash Conversion (%) | 72 |

Earnings Yield (%) | 6 |

These statistics make me feel good. They are better than I can remember after completing the same exercise in previous years. They mean the Share Sleuth super-conglomerate has more cash than debt, it is highly profitable even in cash terms and even if all the profit were returned as dividends and not invested in growth, it would yield 6%.

I expect the super-conglomerate to carry on investing and grow, of course, and consequently for Share Sleuth’s returns to be greater (over the long term).

Share Sleuth performance

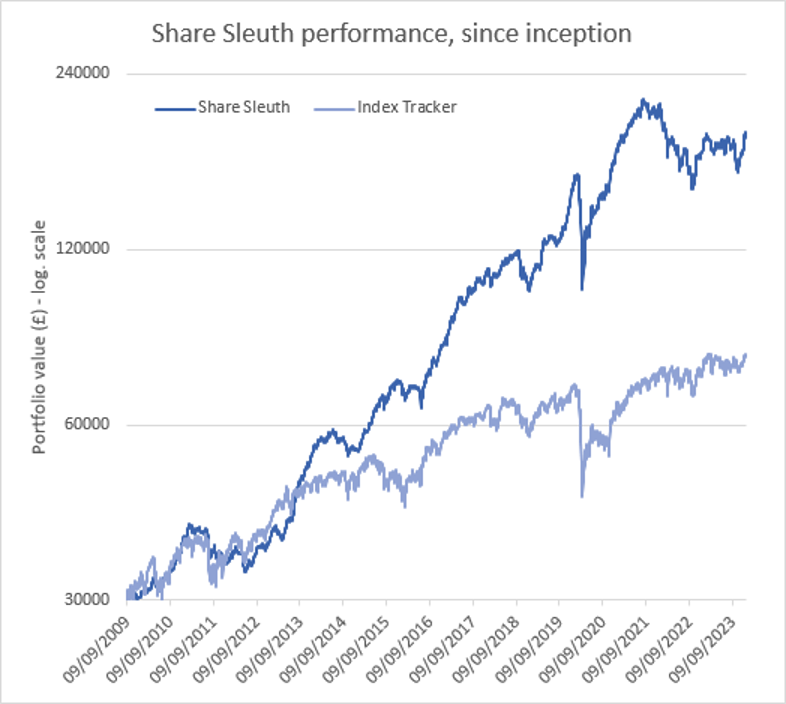

At the close on Friday 5 January, Share Sleuth was worth £186,894, 523% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £78,469, an increase of 162%.

Past performance is not a guide to future performance.

After the removal of Judges Scientific and dividends paid during the month from Bunzl (LSE:BNZL), Garmin Ltd (NYSE:GRMN), Renishaw (LSE:RSW) and Tristel, Share Sleuth’s cash pile is £4,912.

The minimum trade size, 2.5% of the portfolio’s value, is almost exactly the same!

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 4,912 | ||||

Shares | 181,982 | ||||

Since 9 September 2009 | 30,000 | 186,894 | 523 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 2,922 | -28 |

BMY | Bloomsbury | 1,681 | 5,915 | 7,875 | 33 |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 3,959 | -12 |

BNZL | Bunzl | 201 | 4,714 | 6,358 | 35 |

CHH | Churchill China | 1,058 | 12,223 | 14,548 | 19 |

CHRT | Cohort | 1,600 | 3,747 | 8,832 | 136 |

CLBS | Celebrus | 1,528 | 3,509 | 3,285 | -6 |

DWHT | Dewhurst | 532 | 1,754 | 3,990 | 128 |

FOUR | 4Imprint | 190 | 3,688 | 8,512 | 131 |

GAW | Games Workshop | 100 | 4,571 | 9,430 | 106 |

GDWN | Goodwin | 266 | 6,646 | 15,455 | 133 |

GRMN | Garmin | 53 | 4,413 | 5,125 | 16 |

HWDN | Howden Joinery | 2,020 | 12,718 | 15,465 | 22 |

JET2 | Jet2 | 456 | 250 | 5,691 | 2,176 |

LTHM | James Latham | 750 | 9,235 | 8,813 | -5 |

PRV | Porvair | 906 | 4,999 | 5,780 | 16 |

PZC | PZ Cussons | 1,870 | 3,878 | 2,824 | -27 |

QTX | Quartix | 3,285 | 7,296 | 4,763 | -35 |

RSW | Renishaw | 234 | 6,227 | 7,956 | 28 |

RWS | RWS | 2,790 | 9,199 | 6,902 | -25 |

SOLI | Solid State | 356 | 1,028 | 5,002 | 387 |

TET | Treatt | 763 | 1,082 | 3,823 | 253 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,600 | 244 |

TSTL | Tristel | 750 | 268 | 3,375 | 1,158 |

TUNE | Focusrite | 1,050 | 9,123 | 6,248 | -32 |

VCT | Victrex | 292 | 6,432 | 4,377 | -32 |

XPP | XP Power | 240 | 4,589 | 3,072 | -33 |

Notes

3 Jan 2024: Removed Judges Scientific

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £175,618 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £78,469 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, Close on Friday 5 January 2024.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all the shares in the Share Sleuth portfolio.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.