Stockopedia: the 10 quality and momentum shares leading the market

The case for looking beyond momentum investing in bullish markets.

16th September 2020 15:09

by Ben Hobson from Stockopedia

Ben Hobson lays out the case for looking beyond momentum investing in bullish markets.

10 quality and momentum shares that are leading the market

When it comes to stock market truisms, the idea of ‘buying low and selling high’ sums up what many would recognise as value investing. It means buying cheap and waiting for a recovery.

But over the past 50 years, another path to investment profits has earned itself a growing reputation. This is momentum investing.

It is the art and science of buying stocks when they’re rising and then selling at even higher prices. Momentum investing has had a strong run over more than a decade... and it’s also played a role in driving the best-performing shares through the 2020 Covid-19 crisis.

Invest with ii: Top UK Shares | Super 60 Investment Ideas | Open a Trading Account

Buying shares on the up

Back in the 1970s and 80s, a man named Richard Driehaus was one of the best-known money managers in America, and he later became known as a father of momentum investing.

He was once quoted as saying: “I would much rather invest in a stock that’s increasing in price and take the risk that it may begin to decline than invest in a stock that’s already in a decline and try to guess when it will turn around.”

- Why analysts’ earnings upgrades can help you spot stocks on the up

- The psychological errors that can wreck your best trades

This kind of view was at odds with traditional value investing, and in recent decades financial researchers have paid a lot of attention to it. Momentum has become a real discipline, with its own drivers and behavioural triggers. But the researchers also found a few flaws.

With value investing, everyone generally agrees that it needs patience and sometimes doesn’t work at all.

By contrast, a typical momentum strategy would buy the fastest rising stocks and hold them for between six and 12 months before the effect reverses. But the ever-present risk is that momentum can crash suddenly. It can get battered when markets turn south, which is exactly what we saw in the financial crisis.

Mixing up momentum

To try and neutralise this crash risk, some of the best financial thinkers have mixed momentum with other factors to smooth out the returns. One example is US fund manager James O’Shaughnessy, who played a major role in showing how momentum and value can achieve outperformance.

- 10 stocks scoring well against this financial health checklist

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Others have suggested combining momentum and quality - and it is here that we’ve seen some of the best returns in recent years and through 2020. High quality, strongly profitable, conservatively-financed firms with momentum behind them have proved to be resilient right across the market-cap range.

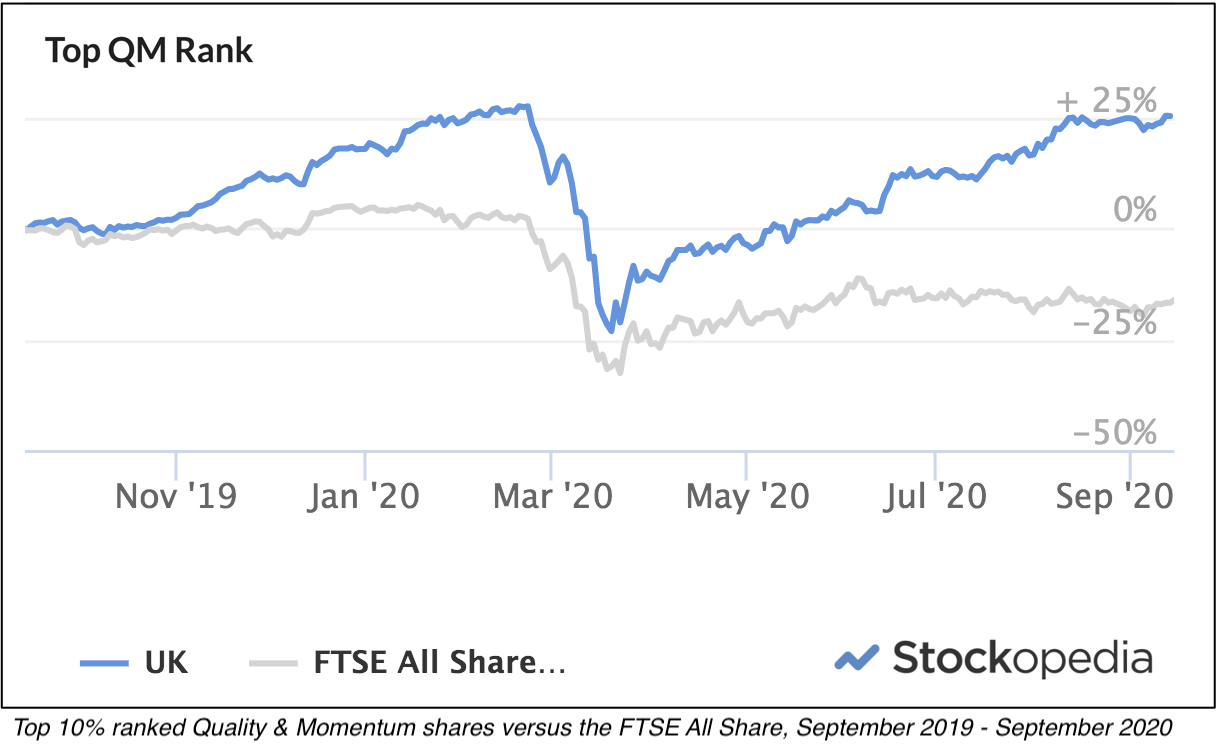

This chart shows the performance of the top 10% of highest quality and momentum stocks (based on Stockopedia’s own assessments and rankings) over the past year. The strategy did come off with the market in the spring, but it has since recovered all that lost ground and left the market way behind.

Screening for quality and momentum (QM)

So what would an investor be looking for with this strategy? For a start, company quality tends to show up in high profitability and strong industry-leading margins.

These kinds of firms are stable, growing and often have accelerating sales and earnings. They also have strong and improving financial histories with no signs of accountancy or bankruptcy risk.

Meanwhile, positive momentum trends show up in share prices and earnings growth. You can find the clues in stocks that are trading close to their 52-week high prices and rising fastest in the market.

Here are some of the stocks that current lead the highest combined quality and momentum rankings:

| Name | Mkt Cap | Quality Momentum Rank | PE Ratio | Relative Strength | Industry Group |

|---|---|---|---|---|---|

| % 1y | |||||

| Luceco (LSE:LUCE) | 326.4 | 100 | 19.9 | 147 | Machinery, Equipment |

| Computacenter (LSE:CCC) | 2,629.80 | 99 | 21.6 | 113 | Software & IT |

| Spirent Communications (LSE:SPT) | 1,712.90 | 99 | 26.1 | 69.6 | Communications |

| CMC Markets (LSE:CMCX) | 944 | 99 | 9.7 | 283 | Investment Banking |

| Plus 500 (LSE:PLUS) | 1,559.50 | 99 | 8.3 | 134 | Software & IT |

| Spectra Systems (LSE:SPSY) | 74.3 | 99 | 22.1 | 80.8 | Professional Services |

| Team17 (LSE:TM17) | 946.6 | 99 | 47.2 | 197 | Software & IT |

| Sylvania Platinum (LSE:SLP) | 173.9 | 99 | 4.5 | 86.8 | Metals & Mining |

| UP Global Sourcing (LSE:UPGS) | 85 | 98 | 13.2 | 63 | Household Goods |

| Ergomed (LSE:ERGO) | 333.6 | 98 | 31.2 | 170 | Biotechnology |

To give you a flavour, high QM right now shows up in more speculative smaller stocks like Spectra Systems (LSE:SPSY) and UP Global Sourcing (LSE:UPGS), right through to the larger-cap IT systems group Computacenter (LSE:CCC), games developer Team17 (LSE:TM17), and financial trading platforms like CMC Markets (LSE:CMCX) and Plus500 (LSE:PLUS).

In summary, good quality and momentum can be pointers to some of the best stocks on the strongest uptrends.

This has been a successful strategy in the bullish conditions of recent years. Care is always needed with strong momentum, but this combination of factors can be a clue to finding shares that can compound investment returns over many years.

In good times, these types of shares can become expensive to buy. But in volatile markets, there may be chances to buy them at cheaper prices.

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.