Stockopedia: hunting for growth shares at fair prices

20th January 2021 14:46

by Ben Hobson from Stockopedia

Growth investing is so common that bargains are hard to find. Is the answer ‘growth at a reasonable price’?

When it comes to stock-market investment styles, growth investing has been the only game in town for much of the past 15 years. A long awaited ‘rotation’ back to ‘value’ still seems out of reach, leaving many investors navigating the tricky road of buying growth shares - but without paying too high a price.

Despite the challenges of the past year, growth stocks (especially among smaller companies) have been on a terrific run. Economic woes have dampened enthusiasm in places. But the market has been very much ‘risk on’ when it comes to rapid growth in sectors such as technology, pharmaceuticals, mining and industrials. In parts, this has pushed valuations way beyond what many investors - certainly value investors - would ever feel comfortably paying. So, what’s the answer?

- Invest with ii: Top UK Shares | Super 60 Investment Ideas | Open a Trading Account

One option is to consider ways of mashing growth and value into a strategy that looks for growth at a reasonable price. Here the focus is on looking for shares where earnings are growing (and forecast to grow further) and where prices are trending higher, but valuations are still palatable.

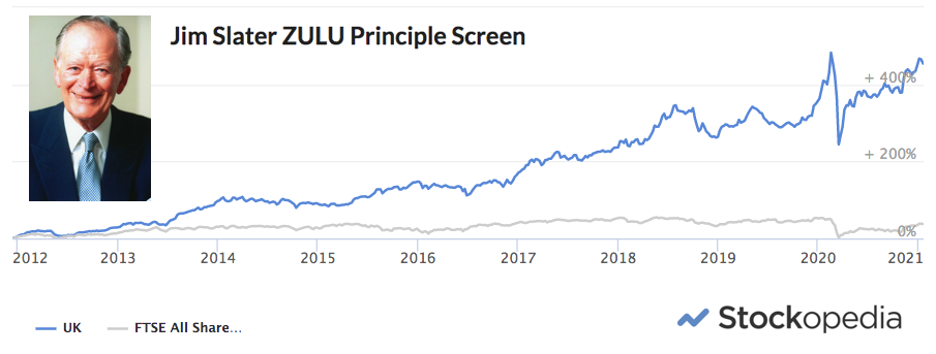

This kind of strategy has been a hallmark of successful growth investors ranging from Peter Lynch to the UK’s own Jim Slater (and indeed his son, Mark Slater). Encouragingly, a Stockopedia model of the Slater ‘Zulu’ strategy has rebounded well from the market disruption last year and is now seeing a rising number of shares qualifying for it.

Growth at a fair price

Slater’s strategy pursues small, profitable shares with robust cash flows, low debt and prices that are already rising. He was keen on firms with a competitive edge, offering new products or services that were steered by good management.

One of his most distinctive tools for picking shares is the price-earnings growth factor, or PEG. This compares the stock’s price-to-earnings ratio with the earnings forecast growth rate, as estimated by analysts. A PEG of less than 1 indicates that the stock may offer an attractive trade-off between price and growth.

- Mark Slater: three great growth shares I have been buying

- Mark Slater: why cheap UK market is a buy in 2021

Screening for Slater stocks

At Stockopedia, our tracking of the kind of rules used by Slater shows how reliable this kind of approach can be over time. This version of the Jim Slater screen looks for stocks with a PEG below 1, a price-to-earnings (PE) ratio below 20x, a return on capital employed greater than 10% and earnings that are expected to grow by at least 15%. Importantly, the shares also need to have positive relative strength against the market over the past year.

Here are some of the shares currently passing those rules:

Name | Mkt Cap £m | Forward P/E Ratio | PEG Slater | EPS Gwth % | Relative Price Strength 1y | Sector |

132.6 | 4.5 | 0.055 | 81.2 | +102 | Basic Materials | |

712 | 10.4 | 0.29 | 36.1 | +1.18 | Industrials | |

89.2 | 12.8 | 0.39 | 32.7 | +23.5 | Financials | |

472.4 | 10.8 | 0.39 | 27.4 | +136.9 | Basic Materials | |

436.1 | 17.0 | 0.44 | 38.2 | +3.02 | Industrials | |

270.6 | 13.8 | 0.46 | 30.1 | +17.0 | Financials | |

462.3 | 14.5 | 0.54 | 26.8 | +6.14 | Healthcare | |

489.6 | 17.7 | 0.56 | 31.4 | +111.9 | Industrials | |

73.4 | 16.8 | 0.87 | 19.4 | +13.7 | Technology | |

870.6 | 19.4 | 0.87 | 22.2 | +27.3 | Industrials |

Slater’s growth at a reasonable price approach is an interesting starting point for research because it picks up shares that appear cheap on valuation metrics like the PE ratio, but in many instances are on very solid trends. Names like Caledonia Mining, Pan African Resources and Volex have all seen their prices outpace the market by more than 100% over the past year.

It’s true to say that in an uncertain economic climate, small, growth-oriented companies are at risk of seeing their operations disrupted, so care is needed on the part of the investor. But for those with solid finances and the ability to withstand the conditions and continue to grow, potentially reasonable share prices could make them attractive.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.