Stockwatch: how far can this smoking rally go?

Some believe concerns about an economic slowdown are triggering a shift to defensive shares. Analyst Edmond Jackson gives his view on this FTSE 100 income play.

1st August 2025 12:23

by Edmond Jackson from interactive investor

Conventional wisdom says not to trust very high yields – especially those based on past projections – which more likely reflect a high-risk business facing change and a downgrading. Often, we must assume the market is telling us something.

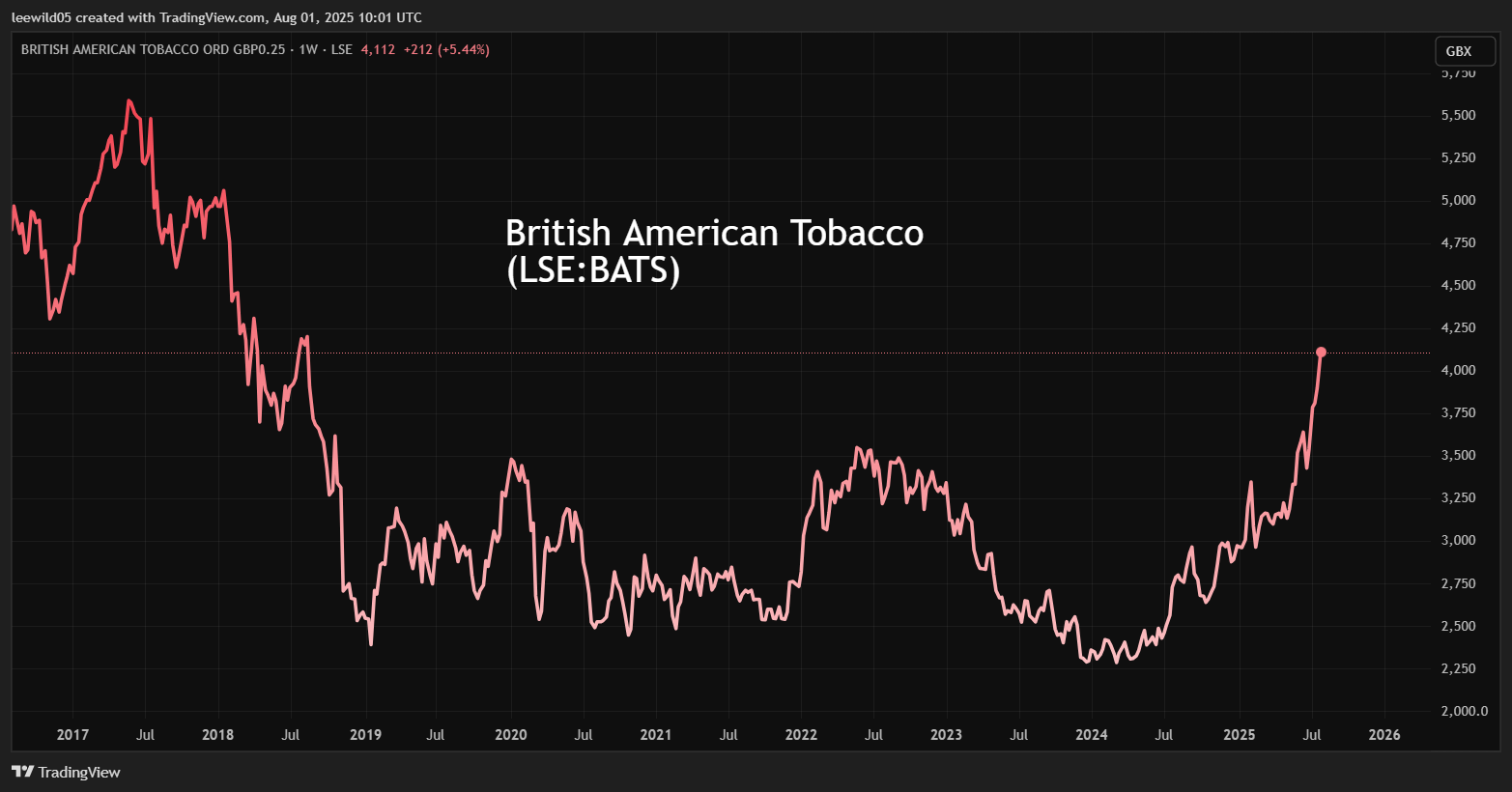

Yet British American Tobacco (LSE:BATS) has re-rated nearly 80% from various lows around 2,300p in early 2024 when it was possible to lock in a 10.7% yield. This implies the market was jaundiced and inefficient to have rated it so low, so might an ongoing strong rally from around 3,500p to over 4,000p last month, despite seemingly lacklustre interim results yesterday, have got similarly emotive?

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

With market indices exploring fresh highs despite some inevitable impact of the US trade tariffs globally as cyclical companies cite a second-quarter downturn, BAT seems part of an “everything rally”. But should investors ride it or trim gains?

Somewhat understandably, Microsoft Corp (NASDAQ:MSFT) has topped a $4 trillion (£3 trillion) valuation after a major earnings beat driven by cloud infrastructure and AI, but are big caps in other sectors getting swept up by US tech behemoths?

Source: TradingView. Past performance is not a guide to future performance.

Continuing a mixed and complex story

I last commented on BAT in February with a “hold” stance at 3,090p after the 2024 annual results, when a 9% drop in the shares demonstrated how sentiment was jittery. There was a slight miss on revenue expectations and (as ever though) BAT’s financial statements were a complex read. The industry context was described as quite flat for traditional combustibles, partly due to cost and also social restrictions. And in terms of new products, various governments were doing their best to limit youth addiction to vaping.

- The stock paying half of all FTSE 100 dividend income in August

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The shares have recovered to mid-2018 levels following half-year figures that included exchange rate headwinds: revenue improved by 1.8% at constant exchange rates – not exactly matching inflation – otherwise it was down 2.2%. A return to growth in the US for the first time since 2022 has helped. New categories edge up 2.4%, hardly a growth drive but “a phased roll-out of innovations is expected to drive higher performance by new categories in the second half”.

At the product level,Velonicotine pouches are a success story in BAT’s new products category. Management grew its smokeless brands by 1.4 million to 30.5 million, accounting for 18.2% of group revenue. My sense from BAT updates some years ago, however, is that new products growth of 7% is quite pedestrian (from a relatively small base also) versus expectations.

Reported operating profit leapt 19.1%, helped by an improved margin of 42.0% albeit a weak comparator given first-half 2024 was hit by one-off impairment charges. Adjusting also for a Canadian provision, operating profit rose just 1.9% at constant exchange rates, but on a flat 43.2% margin. Essentials are therefore sluggish versus a forward price/earnings (PE) ratio above 11x (based on consensus), the question being whether a prospective dividend yield just over 6% is appropriate compensation for the holding risks.

Smoking shares remain a sentiment tussle between fear that new products cannot adequately substitute long-term decline in tobacco if health regulations tighten, and greed. This has generated cheap ratings, while right-wing governments (on the ascendency?) are pro individual freedoms and businesses making money.

Strong margins maintained but cash generation lapses

Bulls tend to champion how, despite industry risks, BAT enjoys fat margins and strong cash generation, and a lack of near-term growth appeal matters less because BAT and other smoking shares will always get bought at an attractive price for yield.

In which case, is a circa 6% yield now fair pricing in respect of margin and cash flow, specifically? The table shows historically very strong operating margins in the high 30% area, but which declined from 2022 at the reported level; and indeed, terrific free cash-flow generation despite investment in new products, has been well ahead of earnings.

British American Tobacco - financial summary

Year-end 31 Dec

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 13,104 | 14,130 | 19,564 | 24,492 | 25,877 | 25,776 | 25,684 | 27,655 | 27,283 | 25,867 |

| Operating margin (%) | 34.0 | 32.2 | 151 | 38.2 | 34.8 | 38.1 | 39.8 | 38.1 | -57.3 | 10.6 |

| Operating profit (£m) | 4,453 | 4,554 | 29,547 | 9,358 | 9016 | 9,820 | 10,234 | 10,523 | -15,625 | 2,736 |

| Net profit (£m) | 4,290 | 4,648 | 37,485 | 6,032 | 5,704 | 6,400 | 6,801 | 6,666 | -14,367 | 3,068 |

| Reported earnings/share (p) | 230 | 249 | 1,360 | 260 | 247 | 273 | 289 | 294 | -645 | 138 |

| Normalised earnings/share (p) | 234 | 239 | 251 | 284 | 316 | 328 | 317 | 326 | 377 | 68.9 |

| Operating cashflow/share (p) | 253 | 247 | 261 | 449 | 393 | 426 | 423 | 442 | 497 | 455 |

| Capital expenditure/share (p) | 32.3 | 36.1 | 47.7 | 41.1 | 35.6 | 32.9 | 32.4 | 28.9 | 27.0 | 27.3 |

| Free cashflow/share (p) | 221 | 211 | 213 | 408 | 357 | 394 | 391 | 413 | 470 | 428 |

| Dividend/share (p) | 154 | 169 | 100 | 195 | 203 | 210 | 216 | 218 | 231 | 236 |

| Covered by earnings (x) | 1.5 | 1.5 | 13.6 | 1.3 | 1.2 | 1.3 | 1.3 | 1.4 | -2.8 | 0.6 |

| Return on total capital (%) | 19.8 | 16.3 | 23.6 | 7.2 | 7.4 | 8.0 | 8.4 | 7.8 | -15.2 | 2.7 |

| Net Debt (£m) | 15,003 | 17,276 | 45,649 | 44,259 | 42,243 | 40,088 | 35,933 | 38,590 | 33,897 | 31,440 |

| Net assets per share (p) | 263 | 439 | 2,649 | 2,853 | 2,786 | 2,732 | 2,924 | 3,371 | 2,350 | 2,247 |

Source: historic company REFS and company accounts

But in the first half of 2025, various cash flow measures have actually weakened. While cash flow is typically weighted to the second half, cash generated from operations is down 32.3% to £1,483 million on an adjusted basis, and free cash flow pre-dividend down 42.1% to £1,234 million which compares with half the cost of this year’s £2,634 million dividend.

Dividends have already been declared in respect of 2025 - 240.24p per share to be paid in four quarterly instalments of 60.06p (last May, this August, in November, and February 2026). They are underwritten by £4,404 million of balance sheet cash as of 30 June and there is no let-up in share buybacks currently, as if management is confident in its expectation to generate around £50 billion free cash flow before dividends between 2024 and 2030 inclusive. To date, £9.1 billion has been generated.

Explanations proffered for this first-half drop in cash generation are two-fold – a £700 million equivalent timing of US tax payments, plus a £368 million litigation settlement. These strike me as part of the financing side of cash flow rather than operations, but if that is all causing the drop then fair enough.

Deleveraging properly must continue

Sustainability of intrinsic operational cash flow is required to continue grinding down debt to reduce interest costs - the 30 June balance sheet had £35,208 million of debt, down 12.3% on £40,158 million the year before. On a net basis this lately represented 65.3% gearing and means credit rating agencies ascribe “stable” at grade BBB, implicitly with scope to improve.

- Insider: a £100k bet on FTSE 250 stock at 18-month low

- Shares for the future: why I’ve downgraded a former top stock

While manageable and the interim net interest charge taking a modest 19.1% of operating profit, BAT’s lack of meaningful growth dynamic means it must narrow every restraint it has on modest growth.

A £1.1 billion share buyback programme appears on course to reduce issued share capital by around 1.2%, hence such enhancement to earnings per share (EPS) and dividend per share (DPS).

After release of the interims there has been modest upgrading of 2025 net profit expectations, from £7,470 million to £7,486 million, and in respect of 2026 from £7,790 million to £7,834 million. This probably helped drive the shares higher mid-Thursday, and BAT is up another 0.6% Friday morning to 4,064p versus the FTSE 100 index 0.6% easier after US weakness.

On a technical basis – the balance of overall trade in a share – BAT therefore remains a momentum trade and the last disclosed short position above 0.5% of the issued share capital was in September 2024.

Are fears of economic slowdown triggering shift to defensive shares?

In terms of BAT’s story and financial progress/prospects, I see the shares now as fairly valued, but clearly they have momentum.

This is odd in the sense of coinciding with a revival of big-cap US tech shares, but perhaps the old “growth vs value” sense of the market shifting between such characteristics is becoming outdated. BAT’s latest momentum certainly has improved with cyclicals cautioning about the second quarter.

Calling these shares right now therefore seems as much about macro prospects and market trends as the underlying business. I would prefer to see better progress from BAT’s new products as substituting combustibles, and am cautious that the stock market’s momentum may be getting exposed relative to corporate earnings we see from later this year more generally.

Within a “hold” stance overall on BAT, I therefore do not suggest committing fresh money and, according to your risk tolerance, if overweight the shares then consider locking in some gains. Holders can, however, take encouragement that BAT has regained status among international investors as an income share.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.