TalkTalk 'reset' already delivering results

17th July 2018 12:53

by Graeme Evans from interactive investor

Turnaround plans have fed through to some impressive first-quarter numbers at TalkTalk. Graeme Evans gauges market reaction here.

Having hit the "reset" button last year, TalkTalk Telecom chief executive Tristia Harrison gave investors the loudest signal yet that her turnaround plans are capable of delivering meaningful growth.

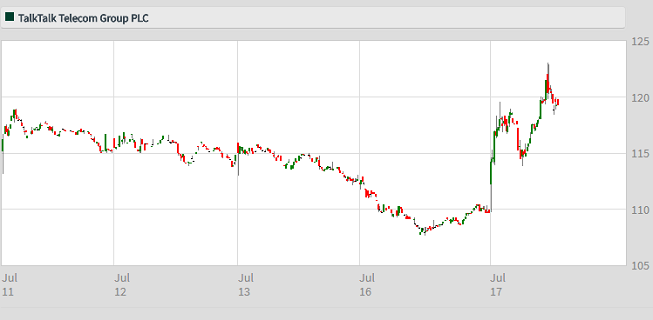

Today's update, showing the company added a net 80,000 broadband customers in the first quarter of the financial year, triggered a rise of more than 9% for the company's beleaguered share price.

It's still early days, of course, but Harrison says that TalkTalk is benefiting from being a much "simpler, lower-cost business" that is now capable of achieving at least 150,000 net adds in the current financial year.

On Friday, our own Edmond Jackson noted that the company had the scope to surprise on the upside and suggested that existing shareholders would do well to remain patient for the benefits of the new strategy.

What's more, speculation is swirling about the potential for a buyout of the business after Toscafund raised its stake to 16% from 11% at the start of June. That excited traders because the hedge fund has a history of working with Charles Dunstone, TalkTalk's chairman.

Last week, the stock was upgraded by Cazenove to a 'neutral' stance on the basis the company has reached the end of its downgrades cycle, with the operational narrative now mostly encouraging.

Source: interactive investor Past performance is not a guide to future performance

Following today's update, Barclays left its estimates and 130p price target unchanged. It says TalkTalk trades on a projected 2019 price earnings multiple of 15.8x, with a 2.3% dividend yield.

In the opposite corner, Credit Suisse recently reaffirmed its 'underperform' rating and cut its price target to 90p from 140p.

Shares in this one-time high-yielder hit a record low of 95p as recently as February when the company announced it would be cutting its dividend. Having previously yielded 6% or more, TalkTalk slashed the payout from 10.29p to 4p and expects a figure of just 2.5p in relation to the current financial year.

A return to "a more normalised dividend policy" will only be possible once earnings growth returns and leverage is back near 2x net debt/headline EBITDA.

The current earnings performance has been dented by the cost of growing the customer base, having just added more than two million subscribers to the company's fixed low price plans. There’s also been the impact of spending on the infrastructure needed to deliver much higher broadband speeds.

Certainly, the investment in price looks to be paying off after the final quarter of the last financial year delivered TalkTalk's highest ever net customer adds figure of 109,000.

This has been followed by today's addition of another 80,000 customers to the broadband base compared with just 20,000 for the same period a year ago. Barclays had expected a figure closer to 50,000.

It means that TalkTalk's full-year guidance is unchanged as it looks to benefit from having a significantly larger base from which to drive revenues and earnings. The company says this should lead to underlying earnings growth of 15% and improving free cash flow in the current year.

But with BT Group, Sky and Vodafone increasing competition in the home broadband market, TalkTalk management will still have their work cut out to keep the share price moving in the right direction.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.