Top 10 investment trusts adopting a more cautious approach

Investment trust managers are reducing gearing levels, but the devil is in the detail, we're warned.

8th November 2019 15:54

by David Prosser from interactive investor

Investment trust managers are reducing gearing levels, but the devil is in the detail, we're warned.

After the disastrous suspension of Woodford Equity Income this spring, the board of Woodford Patient Capital (LSE:WPCT) felt compelled to act quickly to reassure shareholders. The closed-ended fund does not face the same liquidity issues as its sister vehicle, but the board was under pressure to prove its independence – and it had a good idea of how to do so. In June it announced it had ordered a substantial reduction in Patient Capital's gearing, from 17% in June to more or less zero within a year.

It is significant that Patient Capital's board chose to focus on gearing as the metric by which it would ease investor anxiety. Investment trusts' unique ability to take on borrowing has been a key driver of their consistent long-term outperformance of comparable open-ended funds; in rising markets, those borrowings have boosted returns. Equally, however, gearing worries some investors, who point out that it also exaggerates negative returns during more challenging periods for the markets. Overall, the fact they take on gearing is one reason why investment trusts tend to post higher levels of volatility.

In fact, Woodford Patient Capital is far from alone in plotting a path to lower gearing right now. Equity-focused investment trusts across the industry are quietly pursuing similar strategies; such funds do not face the same pressures as Patient Capital but they're positioning themselves in a similar way.

Bankers investment trust, for example, has just cashed in several top-performing US holdings, retaining the proceeds as cash to reduce its net gearing levels. Merchants investment trust revealed earlier this year that it had reorganised its borrowing, taking on more flexible forms of debt, partly so it would be able to take off gearing more easily at the discretion of the trust's board. Last autumn, JPMorgan American (LSE:JAM) said market conditions warranted it reducing gearing from 5% down to zero.

"Managers' approaches to gearing can vary significantly," explains Sam Murphy, an investment trust analyst at Numis Securities. "Some will vary gearing based on different factors such as equity market levels or valuations of the underlying market, while others run with structural gearing that will not change."

Widespread reductions in gearing levels

Still, there does appear to have been a shift. Data from Morningstar suggests almost 100 equity-focused investment trusts have reduced their gearing over the past year. They're led by North American Income (LSE:NAIT), Jupiter UK Growth (LSE:JUKG), BlackRock Throgmorton (LSE:THRG) and Aberdeen Emerging Markets (LSE:AEMC), all of which have made double-digit adjustments. The accompanying table (see below), showcases the top 10.

10 largest gearing cuts over the last 12 months

Source: Morningstar, as at 17 September 2019

It is important to be careful with such data. Gearing is calculated by comparing a trust's borrowing against the value of its assets. When a trust's portfolio rises in value, its gearing will therefore fall, all other things being equal; if the portfolio loses value, gearing will rise. Nonetheless, significant numbers of trusts do seem to have reduced gearing in recent times – or are minded to now do so.

What explains this move? Well, there's no getting away from the fact that the bull market of recent years has been unusually enduring. Developed market equities, led by the US, have now been rising for a decade – and while analysts calling the end of the bull run have been repeatedly confounded over the past 18 months, to characterise the current stage of the cycle as anything other than the tail-end requires a great deal of optimism.

Sooner or later, the travails of the global economy, facing headwinds such as the US-China trade dispute, Brexit and mounting tension in the Middle East, must be felt on global stock markets. Investors have benefited from the cheap money with which central banks have flooded the markets since the financial crisis, but there is precious little room for further monetary policy support.

For investment trusts, therefore, there is now an argument that reducing gearing makes tactical sense. As the risk of a market setback – or a fully-flung bear market – mounts up, so trimming back on gearing represents a way to take some risk off the table. "Funds with a more defensive mandate tend to favour lower gearing," says Numis's Sam Murphy.

It should be said that while Morningstar's data flags up 95 trusts where gearing fell over the 12 months to the middle of September, it also shows 59 trusts where gearing rose.

Moreover, although the Association of Investment Companies' figures show that average gearing levels across the whole sector (excluding venture capital trusts) have fallen during the past 12 months, the change has not been dramatic. Today, the typical trust has gearing of 7.2%, whereas a year ago the average stood at 7.8%.

Still, current gearing levels do look very modest against longer-term historical comparisons: a decade ago, for example, average gearing was above 16%. Some investment companies certainly have made tactical decisions to lower gearing over the past 12 months amid deteriorating market sentiment, and the longer-term trend tells an even more compelling story – investment trusts now have a sustained record of reducing risk.

This strikes a chord with Alan Brierley, an investment trust analyst at Investec, who argues that gearing should be considered strategically rather than as a tool with which to second-guess short-term market movements.

"My view on gearing is that it is a differentiating feature of investment companies," Brierley argues. "Accordingly, I would generally expect all companies to use strategic low-cost gearing to enhance long-term returns. I don't believe in tactical gearing as I doubt that any manager can consistently add value by doing this – I would rather they focus on stock selection."

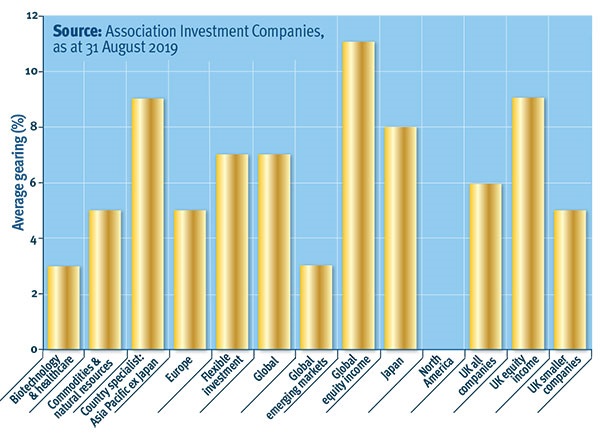

Gearing levels by trust sector

Markets ahead of fundamentals

Clearly, this isn't a universally held opinion. At Bankers (LSE:BNKR), for example, chairman Sue Inglis told investors over the summer that "currently, the company is not geared as it is considered that markets are running ahead of fundamentals". At Merchants, fund manager Simon Gergel said in July that further market appreciation could prompt a move to reduced borrowing. "If markets go up, the board could take some of the gearing off," he explained.

Equally, for at least some of the funds maintaining relatively high levels of gearing (see table below), their position on borrowing reflects a more optimistic view of market prospects. Scottish Mortgage investment trust (LSE:SMT), for example, last year confounded sceptics concerned by its high exposure to technology stocks by extending its gearing. In the end, investors in such trusts have to take a view on whether such optimism is justifiable, just as they must judge whether funds reducing gearing are calling the market correctly.

In practice, most investment trust managers retain the right to at least consider engaging in tactical gearing activity - moving borrowing higher or lower - while also putting longer-term structural gearing in place. Majedie investment trust is a good example, having reorganised its borrowings at the end of last year, cutting back on short-term debt on the basis of its market views while still maintaining a relatively high level of gearing overall.

One complicating factor, moreover, is the remarkably low cost of borrowing that continues to prevail. For many investment companies, this has been too good an opportunity to ignore, says Murphy. "An undoubtable trend has been the issue of long-term debt to take advantage of low interest rates," he says. "Trusts have been able to finance investments at ever-decreasing rates."

Examples include BMO Global Smaller Companies (LSE:BGSC), which recently issued £35 million of long-term fixed-rate debt costing only 2.26% a year, and JPMorgan Claverhouse (LSE:JCH), which issued £30 million of 25-year debt at 3.22%.

In such an environment, many investment companies may be taking the view that asset allocation and stock selection are better ways to implement their current take on markets.

Most highly geared UK equity-focused trusts

| Investment rust | Gearing (%) |

|---|---|

| UK All Companies | |

| Henderson Opportunities (LSE:HOT) | 14 |

| JPMorgan Mid Cap (LSE:JMF) | 9 |

| Mercantile (LSE:MRC) | 9 |

| Jupiter UK Growth | 7 |

| UK Equity Income | |

| Chelverton UK Dividend Trust (LSE:SDV) | 65 |

| Value And Income (LSE:VIN) | 39 |

| British & American (LSE:BAF) | 39 |

| Merchants Trust (LSE:MRCH) | 24 |

| Perpetual Income & Growth (LSE:PLI) | 20 |

| JPMorgan Claverhouse (LSE:JCH) | 19 |

| Shires Income (LSE:SHRS) | 19 |

| Lowland (LSE:LWI) | 15 |

| Law Debenture Corporation (LSE:LWDB) | 15 |

| Schroder Income Growth (LSE:SCF) | 15 |

| City of London (LSE:CTY) | 13 |

| Aberdeen Standard Equity Income Trust (LSE:ASEI) | 12 |

| Temple Bar (LSE:TMPL) | 11 |

| UK Smaller Companies | |

| Aberforth Split Level Income (LSE:ASIT) | 32 |

| BlackRock Throgmorton Trust (LSE:THRG) | 22 |

| Aberdeen Smaller Companies Income (LSE:ASCI) | 19 |

| Marwyn Value Investors (LSE:MVI) | 16 |

| Chelverton Growth Trust (LSE:CGW) | 13 |

| JPMorgan US Smaller Companies (LSE:JUSC) | 11 |

| Global | |

| Witan (LSE:WTAN) | 10 |

| Brunner (LSE:BUT) | 8 |

| F&C Investment Trust (LSE:FCIT) | 8 |

| Scottish Mortgage (LSE:SMT) | 8 |

| AVI Global Trust (LSE:BTEM) | 8 |

Source: Association of Investment Companies, as at 31 August 2019

Asset allocation

Managers' ability in this regard may be constrained by their investment mandates, but it is notable that in the flexible investment trust sector, several funds have pared right back on equity exposure. Personal Assets (LSE:PNL), RIT Capital Partners (LSE:RCP), Aberdeen Diversified Income & Growth (LSE:ADIG), Henderson Alternative Strategies Trust (LSE:HAST) and Capital Gearing (LSE:CGT) all now hold less than a third of assets in equities, points out Iain Scouller, an investment trust analyst at Stifel.

"Several of these trusts have been in existence for many years and have experienced various up and down markets," Scouller points out. The fact that their managers currently prefer asset classes such as bonds, gold, hedge funds and real estate to equities may be just as strong a signal of scepticism about market prospects as reduced gearing.

Gearing, in other words, should not be regarded as an absolutist indicator of investment trust manager sentiment. In recent years, we've seen a steady decrease in average gearing levels across the sector, coinciding with what most analysts believe are the final years of the bull run. But many managers simply don't believe gearing is the right tool for market positioning. And given that the ability to take on gearing is a unique selling point for the industry, managers are reluctant to give it up, especially when borrowing costs are so low.

What is gearing?

Investment trusts are allowed to gear, or borrow to invest. This can improve their performance, but it means they tend to be more volatile than their open-ended peers. Gearing in a rising market magnifies gains for each shareholder; but if the market falls, investors in a geared trust will suffer greater losses per share.

Simply put, if the manager borrows X to invest and the trust grows, the manager has to repay X plus interest but retains the investment growth as part of the trust's net asset value. So, if you have £1,000 invested (let's assume a constant share price for now) and the manager gears by 10%, then there is effectively £1,100 working for you.

Now, if that doubles in value to £2,200, the manager pays back the £100 plus, let's say, 1% interest. That leaves you - the investor - with £2,099. If the manager had not geared, you would only have £2,000.

Conversely, if the same investment halves in value to £550, the manager still has to pay back £101. This magnifies the losses, leaving you with only £449 instead of the £500 you would have without gearing.

Many trusts are ungeared or only modestly geared, as our table of gearing by sector (above) shows. Out of the mainstream investment trust sectors, global equity income trusts have the highest average gearing figure, at 11%. But for more specialists sectors such as property, gearing levels are much higher. BMO Commercial Property Trust (LSE:BCPT), for example, has a gearing figure of 21% as at 23 September, according to the Association of Investment Companies.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.