Top 10 most-popular investment trusts: November 2021

There have been two new entries to our top 10 investment trust league table.

1st December 2021 10:57

by Tom Bailey from interactive investor

There have been two new entries to our top 10 investment trust league table.

November saw two new investment trusts enter the top 10 most-bought rankings.

Shooting into second place was Allianz Technology Trust (LSE:ATT). The trust, as the name suggests, has a focus on technology. Its top 10 holdings has a number of the big tech giants, but the overall portfolio has a bias towards mid-caps. Of the famous tech names, Microsoft (NASDAQ:MSFT), Tesla (NASDAQ:TSLA) and Alphabet (NASDAQ:GOOGL) are among the biggest positions.

Over the past year, it has returned investors almost 27%, while over three years it has returned almost 170%. Run by Walter Price, the trust has over the past couple of years been a favourite of investors. However, for much of 2021 it found itself outside the top 10 most-bought list.

- Research: Top Investment Trusts |Sustainable Funds List | Top UK Shares

The other new entry was Alliance Trust (LSE:ATST), in seventh position. Earlier in November, the trust announced it would raise its dividend by 32.5% as part of a broader move to start returning a higher amount of income to shareholders in future. Since April 2017, Alliance Trust has adopted a multi-manager approach, overseen by Willis Towers Watson.

- New space investment trust returns 25% over first quarter

- Pros and cons of investment trusts and ETFs for thematic investing

- What are the cheapest ETFs to track global markets at the end of 2021?

Scottish Mortgage (LSE:SMT), however, remained investors’ favourite trust. The global trust has been a permanent feature of the most-bought list, rarely losing its number one spot. With three-year performance of 207%, the appeal of this trust to investors is easy to understand. On a one-year basis, performance has also been strong, with returns standing at 36.7%.

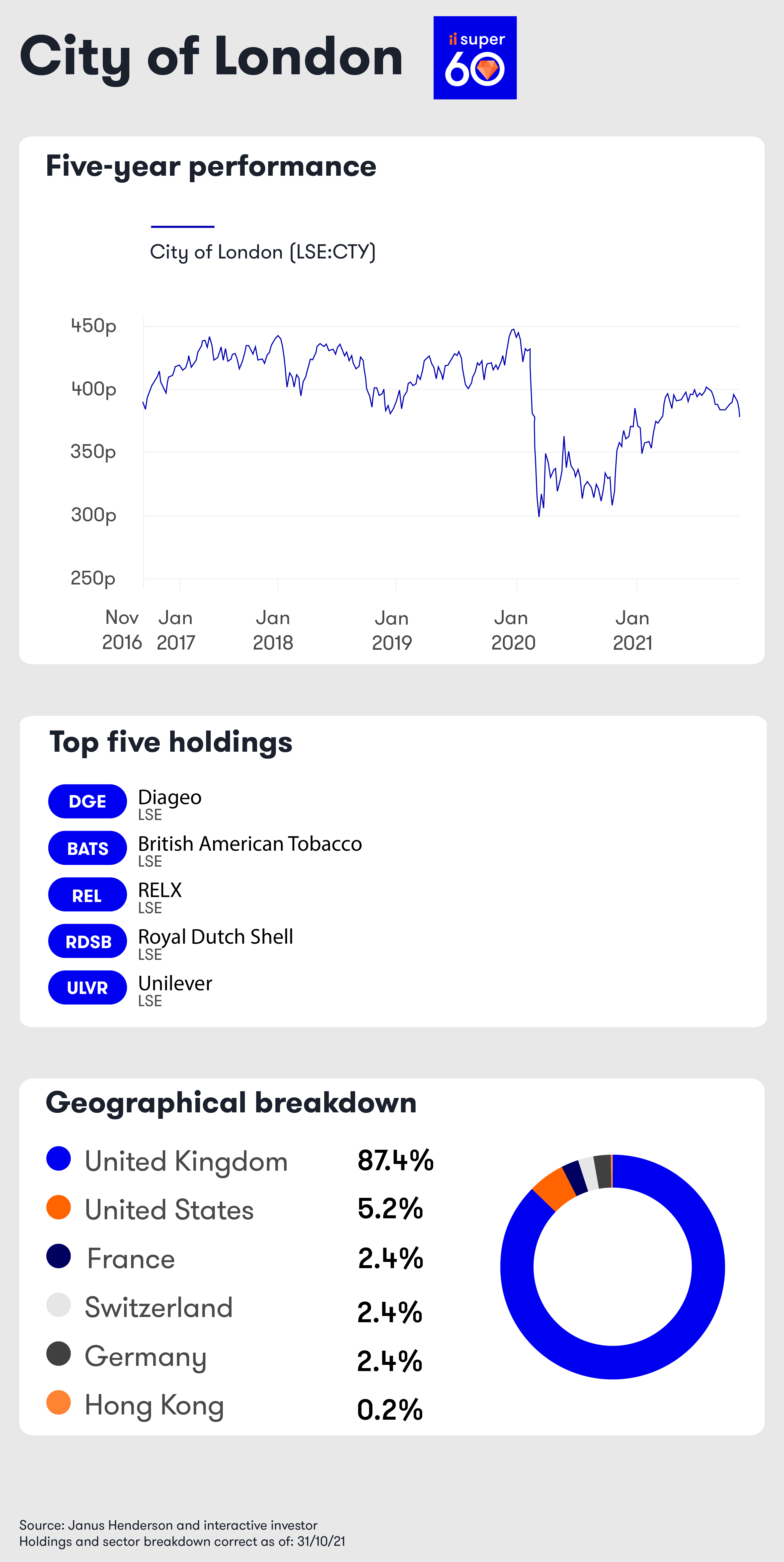

City of London (LSE:CTY) is in third place. The trust has long been an investor favourite owing to its consistent dividend payment increases, having increased dividends for 55 consecutive years. However, over the short term it has struggled with performance, returning just 11% over three years. For a more detailed look at the trust, see the mini factsheet below.

In fourth place was HarbourVest Global Priv Equity (LSE:HVPE), reflecting a growing interest in private equity among investors. The trust entered the rankings in October.

The trust is a private equity-focused fund-of-funds. Its strategy is designed to give investors “part-ownership of a diversified portfolio of underlying private companies, spanning investment stages from early venture to large-cap buyouts”.

Over the past year, it has demonstrated strong performance, returning investors 52.3%. Over the past three years, the trust has returned 94.8%.

Edinburgh Worldwide (LSE:EWI) kept a place in the rankings in November, albeit down by six places, from third to ninth. In October, the trust re-entered the rankings having lost its place in August. Due to recent short-term performance lagging rivals, the trust had previously fell to an uncharacteristic discount, which has since closed.

- Check out our award-winning stocks and shares ISA

- Subscribe to the ii YouTube channel for interviews with popular investors

Once again Smithson Investment Trust (LSE:SSON) has made an appearance on the list, up one place to fifth. Since its launch in 2018, it has been highly popular with investors.

Capital Gearing (LSE:CGT) fell one spot to sixth. The trust invests in a defensive manner. Its continued inclusion in the top 10 can be read as investors being in a less “risk off” mood. Capital Gearing has returned 13.6% over the past year.

Pacific Horizon (LSE:PHI) rose by one place. The Asia-Pacific focused trust has provided investors with a return of almost 200% over the past three years. Over the long term, returns are even better. Recent data from the Association of Investment Companies (AIC) showed that £1,000 put into the trust on 9/11 in 2001 would have been worth £27,080 after two decades.

Completing the top 10 is Monks (LSE:MNKS) which is viewed by many as a less aggressive version of Scottish Mortgage. Over one-year and three-year time periods it has returned 9.5% and 79.9%.

The two trusts no longer in the top 10 are Evy Hambro’s BlackRock World Mining Trust (LSE:BRWM) and Personal Assets (LSE:PNL).

Top 10 most-popular investment trusts: November 2021

| Rank | Trust | Sector | Rank change from October | One year-performance to 30 November | Three-year performance to 30 November 2021 (%) |

| 1 | Scottish Mortgage | Global | no change | 36.7 | 207 |

| 2 | Allianz Technology | Technology & Media | new entry | 26.6 | 168.9 |

| 3 | City of London | UK Equity Income | down 1 | 13.1 | 11 |

| 4 | HarbourVest Global Private Equity | Private Equity | no change | 52.2 | 94.8 |

| 5 | Smithson Investment Trust | Global Smaller Companies | up 1 | 21.1 | 86.7 |

| 6 | Capital Gearing | Flexible Investment | down 1 | 13.6 | 28.9 |

| 7 | Alliance Trust | Global | new entry | 16.3 | 47.2 |

| 8 | Pacific Horizon | Asia Pacific | up 1 | 26.5 | 198.1 |

| 9 | Edinburgh Worldwide | Global Smaller Companies | down 6 | -3.5 | 92.7 |

| 10 | Monks | Global | down 2 | 9.5 | 79.9 |

Source: interactive investor. Note: the top 10 is based on the number of “buys” during the month of November.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.