UK dividends tipped to top £100bn for first time in 2019

21st January 2019 12:51

by Tom Bailey from interactive investor

Dividend yields in 2018 hit their highest since 2009, but are expected to go even higher this year.

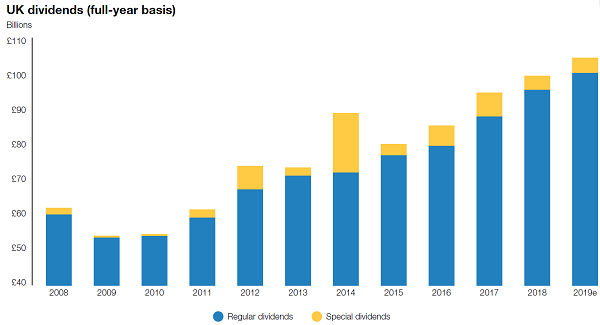

While UK shares suffered their worst year since the financial crisis in terms of price returns in 2018, companies paid a record amount in dividends, totalling almost £100 billion in headline terms, according to Link Asset Services' Dividend Monitor for the final quarter of last year.

The new record figure, £99.8 billion in 2018, was 5.1% higher in headline terms compared with 2017.

Underlying dividends (which, unlike headline figures, exclude one-off special dividend payments) also saw solid growth, with total payments standing at £95.9 billion, 8.7% higher than the year before.

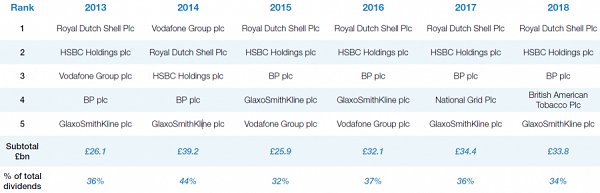

One of the biggest contributors of dividend payments in 2018 was British American Tobacco (LSE:BATS), paying out a total of £4.4 billion to shareholders.

Following its issuance of new shares and a large increase in payments per share in 2017, the company added an extra £0.9 billion contributing around one fifth of all UK dividend growth.

The year also saw banking dividends steadily increase. In the fourth quarter of 2018, Royal Bank of Scotland paid its first dividend in 10 years, while Standard Chartered (LSE:STAN) resumed income payments to shareholders after a three-year hiatus. At the same time, Lloyds Banking Group's (LSE:LLOY) shares finally managed to pay out more than they had done before the financial crisis.

The mining sector also saw strong dividend growth, with companies continuing to recover their dividend payment levels, following sharp cuts in 2016. The sector as a whole increased their collective payments by three-fifths in 2018. Glencore (LSE:GLEN) in particular stood out, tripling its dividend year-on-year.

Click here to see larger version of table.

Past performance is not a guide to future performance

The last quarter of the year was also unseasonably strong for dividend payments. This was partly the result of British American Tobacco switching to quarterly payments.

Underlying dividends overall for the quarter totalled £16.8 billion, 15.7% higher than the previous year.

The result of low prices combined with strong dividend payments also meant that UK shares were offering yields not seen since the worst days of the financial crisis.

How did the value of sterling impact dividend payments?

Sterling's fluctuations in 2018 had a mixed effect on dividend payments.

Around £2 in every £5 of UK dividends are paid in dollars, meaning that the GBP/USD exchange rate can have a significant impact on amounts paid in sterling.

At the start of the year, the pound advanced against the dollar, which depressed dividend payments. This started to reverse in the second half of the year (as sterling weakened compared with the dollar). Link Asset Management estimates that the "exchange-rate penalty" in 2018 totalled £1.3 billion.

How will dividend payments do in 2019?

For 2019, Link forecasts dividend growth of 4.2% in headline terms, which would equate to £104.1 billion in dividend payments from UK shares, which would be another new record. Moreover, it has pencilled a prediction of 5.3% in underlying growth.

Justin Cooper, chief executive of Link Market Services, says:

"Dividends are less volatile than profits, as companies tend to smooth the cycle, but they can still be expected to fall if the economy shrinks."

He adds: "if the world does sink into a recession in the next couple of years, or Brexit goes badly, the drop in dividends is likely to be in the 10% to 15% range.

"We still expect 2019 to break new dividend records, but our forecasts are not especially bullish - one or two companies face difficulties and the easy wins from the mining sector are behind us."

Past performance is not a guide to future performance

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.