The UK shares that do best in February

This month is one of the best times to own shares, but we name the stocks that do better than others.

4th February 2019 13:54

by Stephen Eckett from ii contributor

This month is one of the best times to own shares, but we name the stocks that do better than others.

Since 1970, the average return from the FTSE All Share index in February has been 1.5%. The month has seen positive returns in 63% of years.

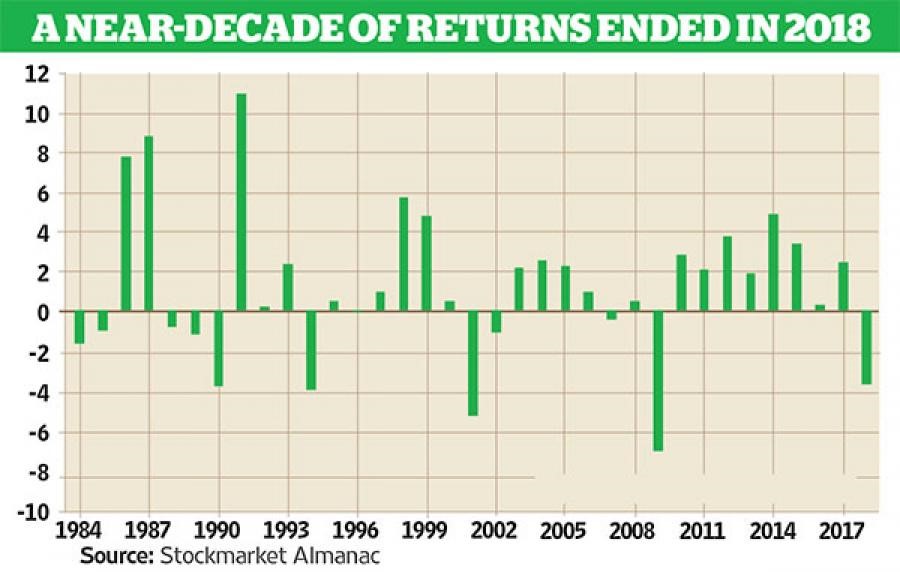

The chart below shows how strong the market has been in February in recent years. Since 2009, it was up every February – until last year, when the index fell by 3.8%.

February tends to have a run of positive returns for about eight years, before suffering a significant fall. In fact, since 1994 the market has only seen significant negative returns in four years. There is no obvious reason for this, although one possible explanation is that shares have been weak in January recently and bounced back in February.

In an average February, shares rise strongly on the first trading day, trade flat for a couple of weeks, gain strongly in the middle of the month and drift off slightly towards the end of the month.

February is one of the two best months – the other being January – for mid-cap stocks relative to large-caps. Since 2000, on average, the FTSE 250 index has outperformed the FTSE 100 index by 1.6 percentage points in February. The large-cap index has outperformed mid-caps in February in only four years.

On the international front, February is one of the four months in the year when the FTSE 100 index has historically outperformed the S&P 500 index. Since 1999, the UK index has underperformed the US index in February in just four years.

It's a busy month for analysts, as there are more FTSE 100 results announced during the month than any other, with 36 companies announcing their prelims (plus 55 FTSE 250 companies). It also tends to be a strong month for gold and silver.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.