Upgrades as Reckitt Benckiser margins swell

27th July 2015 14:25

by Harriet Mann from interactive investor

It's not often we welcome flu season, but high demand for Gaviscon, Nurofen and Strepsils during the first half was good news for consumer goods colossus . Its thinnest ever Durex condom and purchase of the K-Y lubricants maker last year excited profits, too, and management has raised full-year guidance as a result.

Ignoring foreign exchange fluctuations, first-half revenue jumped to £4.4 billion, up 5% on a like-for-like basis, driven by consumer health and hygiene. A 160 basis-point improvement in operating profit margin to 21.9% was substantially better than expected, and adjusted net income rose 7% at constant currency £720 million. Pre-tax profit hit £921 million, giving adjusted EPS of 99p.

Converting all its income into cash, the group achieved impressive free cash flow generation of £756 million, allowing it to declare a 50.3p dividend. This is in-line with its 50% pay-out ratio policy and is down from 60p last year, although this was before its disposal of from its pharmaceuticals business in December.

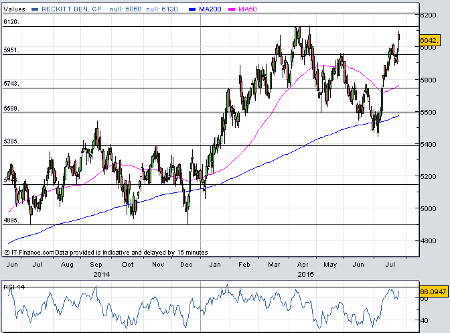

(click to enlarge)

Project Supercharge was launched in February to streamline the business, reduce costs and improve efficiencies. And it's performing ahead of expectations, with savings tipped to hit the upper end of the £100-£150 million target for the three-year programme.

"Given our strong HY performance, and accelerated delivery of Project Supercharge savings, we now expect to exceed the targets we set at the beginning of the year," says chief executive Rakesh Kapoor. "We are now targeting full year LFL net revenue growth of +4-5% and H2 moderate to 'nice' adjusted operating margin expansion, following the +160bps achieved in H1."

Reckitt shares continued their 15-year uptrend Monday, climbing as much as 3% to 6,095p to within a whisker of a new high. Of course, this kind of financial performance does do not come cheap, yet Reckitt shares have always traded on lofty multiples and they remain one of the most reliable blue chips around.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.