Value opportunity emerges in green energy

17th August 2018 11:34

by Dzmitry Lipski from interactive investor

There are many stocks in the alternative or clean energy sector trading at a discount to the broader market, a real value opportunity is emerging. Dzmitry Lipski looks at some key options.

Renewable energy sources are predicted to be the fastest-growing energy source and are set to take over from fossil fuels in the future.

Global energy demand continues to rise, driven by rapid growth in emerging economies along with advances in the technology behind renewable energy production, all contributing to reduction in production costs of renewables.

According to REN21, the global renewable energy policy network, renewable energy sources make up nearly 20% of global energy consumption and are expected to grow to over 60% of market share by 2030. By contrast, fossil fuels are expected to drop from 70% today to 20% over the same period.

China, Europe and the United States accounted for nearly 75% of the global investment in renewable power, with Germany setting an example - its renewable energy sector accounts for more than 30% of total energy consumption.

Over the longer term, the alternative energy sector should continue to benefit from further declines in the cost of alternative assets as technology improves, alongside higher prices for traditional energy sources, and climate and environmental events.

With many stocks in the alternative or clean energy sector trading at a discount to the broader market, and with energy prices set to recover from low levels seen in recent years, a real value opportunity is emerging.

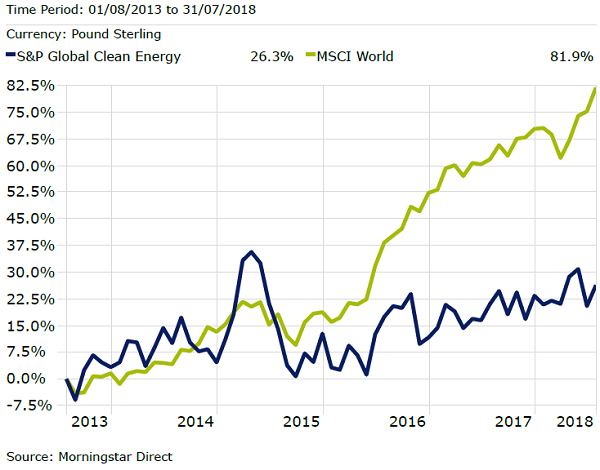

Past performance is not a guide to future performance

Investors looking to take advantage of longer term investment opportunities in fast growing renewable energy sector, could consider the following options.

For active exposure: RobecoSAM Smart Energy fund focuses purely on renewable energy stocks.

Impax Environmental Markets fund provides more broader exposure not only to renewable energy, but also to water treatment and waste technology.

For passive exposure: iShares Global Clean Energy ETF offers exposure to the largest 30 companies involved in renewable energy.

| Fund/Index | YTD | 1 Year | 3 Years | 5 Years |

|---|---|---|---|---|

| Robeco SAM Smart Energy | 3.17 | 14.85 | 17.98 | 10.64 |

| Impax Environmental Mkts | 3.24 | 7.64 | 17.05 | 11.86 |

| iShares Global Clean Energy | 2.42 | 4.04 | 3.84 | 5.35 |

| S&P Global Clean Energy | 2.38 | 4.33 | 3.48 | 4.78 |

| MSCI World | 6.81 | 12.44 | 15.44 | 12.71 |

Source: Morningstar Direct as at 30th June 2018. Total returns in GBP

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.