The Week Ahead: AB Foods, JD Sports, Wm Morrison

A handful of FTSE 100 stocks prepare to report results, accompanied by many popular smaller-cap names.

6th September 2019 11:33

by Richard Hunter from interactive investor

A handful of FTSE 100 stocks prepare to report results, accompanied by many popular smaller-cap names.

Monday 9 September

Associated British Foods (LSE:ABF) is a conglomerate, which offers protection if one part of the business hits a rough patch, but can also prevent the exciting parts of the company achieving the valuation they deserve.

In AB's case, there is little excitement these days and, with its post-financial crisis boom over, the shares are stuck in a volatile downwards trend. Much of the focus has shifted from sugar and food to the budget clothes chain Primark which generates about 60% of group profit. Margins are better here, but retail is a tough industry right now and there are few winners.

While Primark remains a popular brand and is generating like-for-like sales growth in the US, that is not sufficient to offset issues elsewhere in the business. AB shares also trade at a premium to the sector with only a modest dividend yield. That said, market consensus of the shares is currently a ‘buy'.

Trading Statements

Blackbird, Diaceutics, Medica Group, MD Medical, Filta Group, Abcam, Associated British Foods

AGM/EGM

Totally, First Property, appScatter Group, Anglo African Oil & Gas

Tuesday 10 September

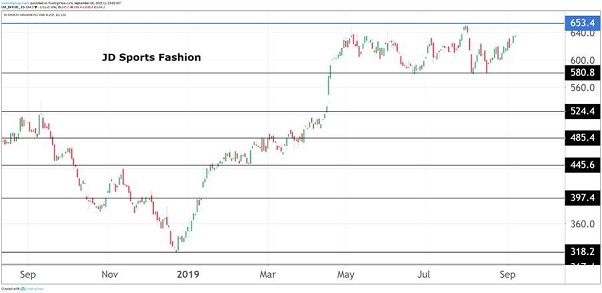

Appetite for JD Sports Fashion (LSE:JD.) shares remains undiminished, resulting in JD's promotion to the FTSE 100 index in June of this year, which means that expectations will be high for the half-year numbers on Tuesday.

This follows a six-month price performance where the shares have added 30% - indeed, further back the share price performance has been stellar – up 92% over the last two years, 136% over the last three and 670% over the last five.

Source: TradingView Past performance is not a guide to future performance

The company recently announced further international expansion, with 18 new stores added across Europe and a net five new stores in the Asia Pacific region. This in turn could contribute to the trebling of revenues from just three years ago.

In the meantime, the company continues to benefit from the appetite of millennials and Generation Z customers for athleisure, as well as that ever-growing international footprint.

Despite its status as a growth stock (meaning it pays next to nothing in dividends as it reinvests in the business), the market consensus of the shares is still a resolute 'buy'.

Trading Statements

Hilton Food, Harworth Group, JD Sports Fashion, IP Group, Integrated Diagnostics, Vectura, Trinity Exploration, Team17, The Simplybiz Group, Urban Exposure, Nucleus Financial, Petropavlovsk, 888, Gulf Keystone Petroleum, Cairn Energy, Concurrent Technologies, Boku, Ashtead, Good Energy Group, Xaar, EKF Diagnostics, TP Group, Litigation Capital Management

AGM/EGM

Mirada, Hipgnosis Songs Fund

Wednesday 11 September

Trading Statements

Advanced Medical Solutions, Gulf Marine Services, Anpario, Avesco, Futura Medical, DP Eurasia, ECSC Group, Galliford Try

AGM/EGM

Staffline, Tricorn, IG Design, SDCL Energy Efficiency Income Trust

Thursday 12 September

Investors will be looking for some overdue good news from Morrison's (LSE:MRW) half-year update, since the shares have fallen 29% over the last year and 18% in the past six months alone.

Quite apart from the pressure of competition, particularly from the German discounters Aldi and Lidl in Morrison's space, the company still lags in comparison to its larger rivals in the increasingly important channels of online and convenience stores.

In addition, the supermarket was indirectly hit by the collapse of the Asda/Sainsbury's merger, where it had been hoped that Morrisons would be a buyer of some of the additional stores which would have become available.

More positively, recent like-for-like sales growth has been largely driven by wholesale, which is a core part of the company's strategy. Meanwhile, the update at Christmas showed a fourth consecutive period of growth in the festive season, suggesting that Morrisons can up its game when required at the right time, while the current dividend yield of 4.7% is attractive.

Even so, the current market consensus of the shares as a ‘hold’ is indicative of the fact that investors currently believe there to be better value elsewhere in the sector.

Trading statements

Greencoat Renewables, Cairn Homes, Morrison (Wm) Supermarkets, Safestore, Silence Therapeutics, Brooks Macdonald, Haynes Publishing

AGM/EGM

XPS Pensions Group, Trident Resources, Scancell Holdings, Atlantis Japan Growth Fund, Better Capital

Friday 13 September

Trading statements

JD Wetherspoon

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.