Where the FTSE 100 will end 2016

30th December 2016 10:05

by Alistair Strang from Trends and Targets

Written Thursday, 29 December - 10:46pm

FTSE for Friday

It's not often we get to produce a FTSE for the week and follow the next day with an outlook for the end of the week. Next week is liable to be little different, due again to New Year holidays and, thankfully, in Scotland we take two days off at the start of the year.

The FTSE has remained extremely boring and we're starting to suspect our ridiculous prediction of the market closing for the year at 7,158 may prove correct.

Movements on the index during Thursday now suggest anything above 7,120 should launch growth to 7,137 next with secondary obviously 7,158.

Unfortunately, given the range of index moves on a daily basis this week, we'll be surprised to witness the market experience a 38-point day to 7,158.

Who knows?

If what passes for a collapse is coming, the index needs below 7,090 to raise an eyebrow as weakness toward 7,075 looks possible with secondary at 7,030. We rather suspect it's not going to happen given the underlying force upward.

We've a thing about opening spiked downward powering upward rises and, given the FTSE was spiked down at the open on Thursday, a rise should follow. Hopefully, "they" don't pay us back by spiking the market up to 7,137 at the open today, Friday 30th.

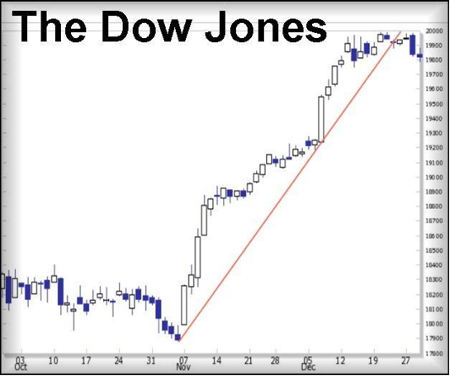

The Dow Jones

The US market has spent Christmas week doing the opposite of the FTSE, but certainly has embraced the concept of pathetically small movements.

We've been expecting it to bounce from 19,785 if the intention has been to park the market during the holiday season. Perhaps the low of 19,789 on Thursday will be deemed sufficiently close to bottom, with the result the last Friday of 2016 can be hoped to provide an upward day.

Anything now above 19,845 points is supposed to be capable of 19,880 next with secondary, if bettered, at a less likely 19,972 points. We use the term "less likely" due to the bandwidth of daily moves this week.

Despite the 150-point droop on Wednesday, we're not confident proposing a balancing 150-point rise during the half session which will be Friday.

Of course, there's always the danger 19,785 will be broken. If this happens, reversal to a new bottom at 19,712 looks possible.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.