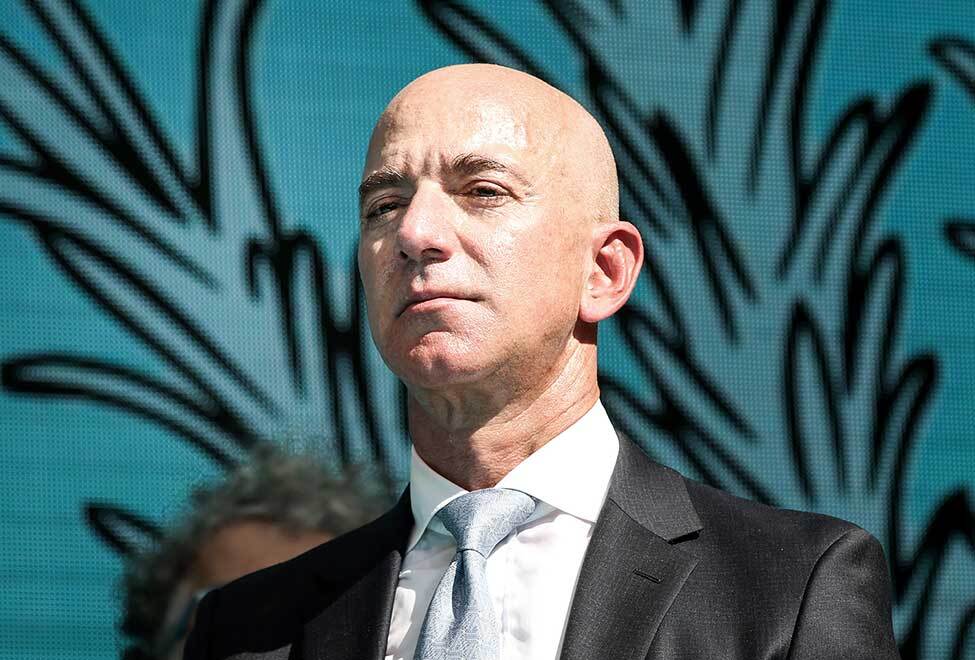

Where should Amazon’s Jeff Bezos invest his climate change billions?

Amazon founder Jeff Bezos has set aside $10 billion to combat climate change. Steve Freedman suggests wh…

22nd April 2020 17:26

Amazon founder Jeff Bezos has set aside $10 billion to combat climate change. Steve Freedman suggests where he should put the Earth Fund money to have the greatest possible impact.

If you had $10 billion (£8.1 billion) to invest to combat climate change and protect our planet, where would you put that money? That is the conundrum facing Amazon chief executive officer Jeff Bezos, who has set aside precisely that amount in his new philanthropic “Earth Fund”.

From the futuristic (such as drones that generate wind power) to the prosaic (water pressure monitors that anticipate pipe leaks), there is a growing range of viable environmental technologies that he could channel that money to.

Drawing on our own two-decade experience in thematic impact investment, we highlight three areas that are particularly well-placed to benefit from Bezos’s billions.

1. Wood of the future

We need more research into advanced wood-based materials for construction. Traditional building materials, such as cement and steel, are very energy intensive to manufacture. In contrast, wood-based building materials may not only require less energy to produce, but, more importantly, can also act as carbon storage for the duration of their existence.

There is, therefore, a tremendous opportunity in materials science to find new ways to use advanced wood-based materials in urban construction to replace steel and cement on a growing scale. The engineered wood market is forecast to grow at a compound annual growth rate of 25%, according to Allied Market Research. Because it is at an early stage of development, it would benefit from both more funding for fundamental and applied research.

2. Clean batteries

The clean energy industry has not been lacking in investment, but one area that has lagged is the storage of that energy. In the US alone, it is estimated that 120 gigawatts of energy storage will be needed by 2050 – five times more than is currently available. Research also needs to focus on improving the environmental footprint of batteries (in particular lithium-ion) and on making them more recyclable. Additionally, while advances have been made in terms of fairly short-term storage, the integration of renewable energy at scale into the power grid requires robust solutions for longer-term storage, spanning several months to create a buffer against seasonal variations in energy production and consumption. Hydrogen-storage, if it can be perfected, could be a viable solution to store surplus renewable energy.

3. Green plastic

Plastic has an image problem. It is hard to recycle, does not easily decompose and can be fatal to wildlife on both land and sea. Rather than abandoning it altogether, we need to make it greener.

That means developing viable bio-based biodegradable plastics to replace the current fossil fuel-based plastics. These either release CO2 into the atmosphere if incinerated after use, or pollute ecosystems if left to decompose. Today’s bioplastics are an improvement, as they reduce reliance on fossil fuels. But many are synthesized to be chemically equivalent to conventional plastics, which means they will have the same adverse environmental impact at the end of their lifecycle. Hence the need to develop biodegradable bioplastics with a focus on finding just the right speed of biodegradation for each specific application. By 2027, the value of the global biodegradable plastics markets is forecast to reach $12.4 billion – a four-fold increase in a decade.

Aside from developing new technology, we need to better understand the world around us and our impact on it. To this end, research into ecosystem services – the benefits that we get from the natural environment and healthy ecosystems – would be extremely helpful.

By identifying a commonly accepted suite of ecosystem services and placing a value on them, we can better focus conservation efforts and stimulate investment into green infrastructure. A lack of understanding of what needs to be preserved, how, and why has made it difficult to coordinate such initiatives.

Steve Freedman is senior product specialist at Pictet Asset Management.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.