Why 2019 could be a bonanza for income seekers

17th December 2018 10:37

by Tom Bailey from interactive investor

The FTSE 100 was more unpopular than most global stockmarkets in 2018, but ever cloud has a silver lining. Tom Bailey explains the benefits.

In a year that saw stockmarkets around the world turn into a sea of red, the FTSE 100 was exceptional only in being more unpopular than most.

Its unpopularity can be gauged by its price – it is now down 10% year to date. At the same time, fund managers asked in the Bank of America Merrill Lynch survey have constantly rated UK equities as their least favourite asset class over the course of 2018.

A number of fears weighed heavily on the blue-chip index, Brexit uncertainty and fears of a potential Labour government led by Jeremy Corbyn being the cited more often. Neither seems unlikely to ease up anytime soon.

While the FTSE 100 price is down over 10%, real returns (including dividend payments) are slightly better, albeit still negative, at a loss of 6.8%. The point here is that the index is still made up of generous dividend payers, which presents an opportunity for investors.

The weakness of share prices, combined with the index set to pay out a record high of £93.7 billion in dividends, means that the FTSE 100 is now expected to have an attractive yield in 2019.

Richard Hunter, head of markets at interactive investor, says the FTSE 100's current and anticipated yield [4.9% for 2019] is "a clear invitation to income-seeking investors who are being paid to wait for any recovery".

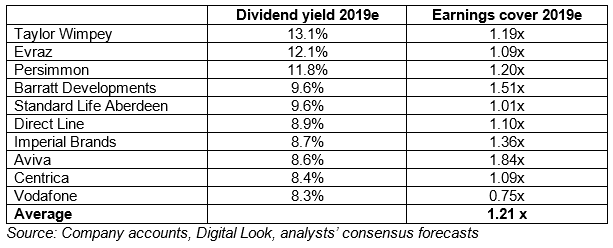

Investors, however, should be cautious. As the table above shows, the expected dividend cover for the index's highest yielding shares is only 1.21 times.

That's well below the ideal level of 2 times, leaving the companies in the index vulnerable to and external shock and downturn in revenue.

For the whole index, dividend cover is slightly better, expected to be 1.79x.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.