Important information: As investment values can go down as well as up, you may not get back all the money you invest. If you're unsure about investing, please speak to an authorised financial adviser. Tax treatment depends on your individual circumstances and may be subject to change in the future.

Wouldn’t it be great to invest your money without investing your time?

That’s the ii Managed ISA. It’s all the tax-free benefits of our Stocks and Shares ISA, but with our experts choosing the investments for you.

We handle your portfolio, always ensuring we work towards your financial goals – and your future. You can start investing quickly and easily in a way that suits you.

Like the sound of a low, flat-fee ISA?

Add an ii ISA - including our Managed ISA - and enjoy £100 to £3,000 cashback when you add at least £20,000. See more details on this offer.

Offer ends 5 April 2026. Cashback is based on money and investments deposited/transferred into new ISA accounts. Available to customers who did not hold an ii ISA before 1 March 2026. Terms and exclusions apply.

Time is precious; you may not want to spend it researching investments. That’s where our Managed ISA steps in.

Feel confident knowing our team of experts will pick your investments and manage them for you.

Simplify your investments without the price tag. Get the convenience you need for our same low, flat fee.

All our price plans give you access to ii’s award-winning range of accounts; Personal Pension (including a Managed Portfolio), Stocks and Shares ISA (including a Managed ISA) and Trading Account.

If you’re on our Core plan you can invest up to £100,000 across all of your ii accounts. On Plus and Premium, there’s no limit to how much you can invest and you’ll enjoy a wider range of benefits and features.

| Invest up to | Monthly fee | Plan |

|---|---|---|

| £100,000 | £5.99 | Core |

| No limit | £14.99 | Plus |

As with any other investments, you'll pay an ongoing management charge for your Managed Portfolio. This is taken directly from the value of the fund and can range from 0.10% to 0.22% (costs may change over time), depending on your portfolio choice. See our factsheets for more information on these charges.

Your ISA is made for you.

Before opening your Managed ISA, you'll answer a few questions to match you to one of 10 investment portfolios. This is to find the one that best suits you and the level of risk you're comfortable with.

Once that's done, check you're happy and you're all set to open your ISA - then it's over to the experts.

Answer some questions about how much you want to invest and your appetite for risk.

If you aren’t sure what's right for you, we’ll help you through the process.

Once we know more about the type of investor you are, we can match you to your portfolio.

Then it's time to set it up and hand it over to us.

We’ll monitor your investments and adjust as needed to keep them in line with your goals.

Check in on it anytime, and if anything changes, you can easily switch to a different portfolio.

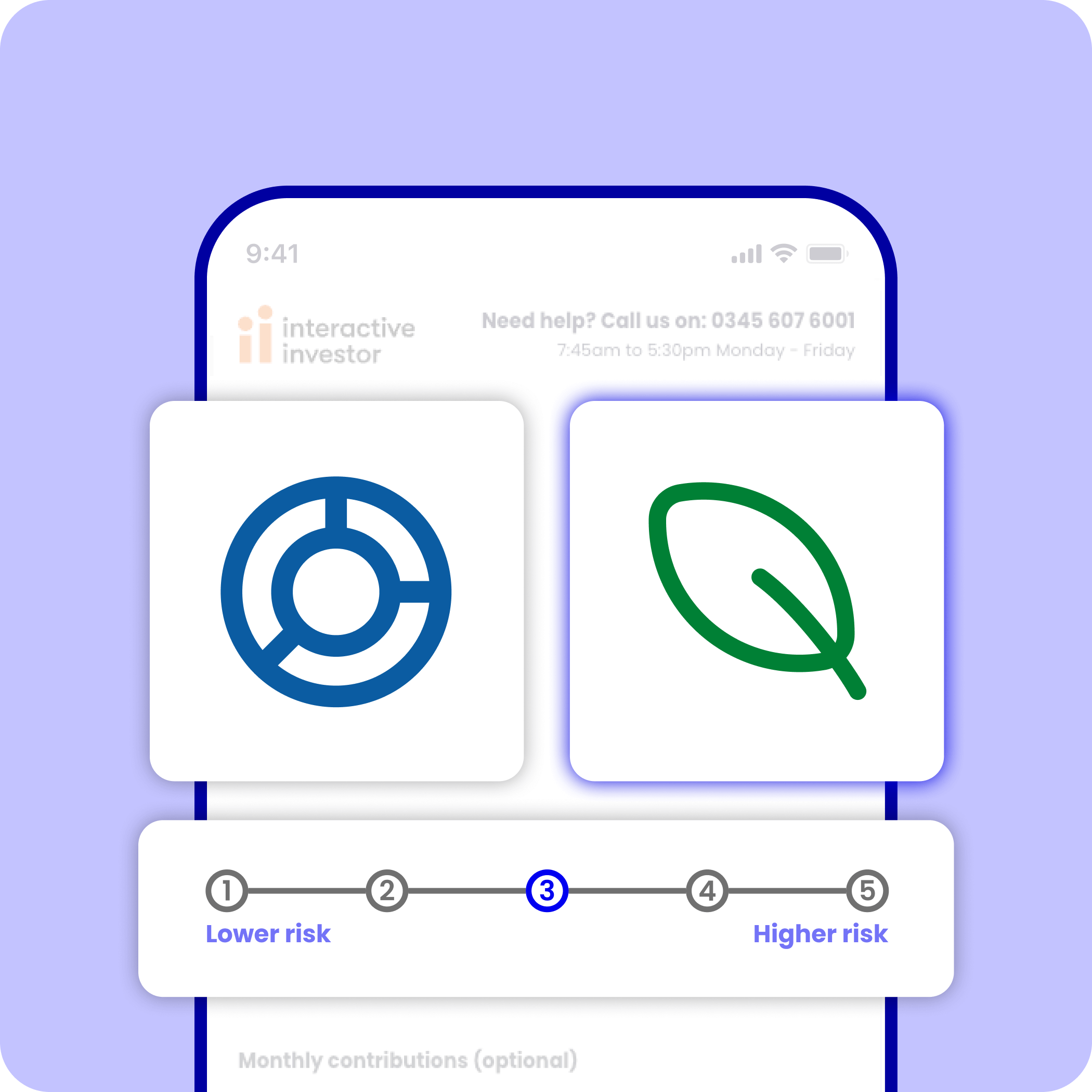

With 2 distinct styles and 5 levels of risk to choose from, you can find an investment portfolio that matches the type of investor you are. While there's no minimum investment period, all our portfolios are designed for long-term growth (at least 5 years).

Want to understand more about risk? Learn how you can strike the right balance.

Important information: interactive investor (ii) is an Aberdeen company. Aberdeen advise ii on the fund selection for the Managed ISA portfolios. The portfolios contain funds predominantly managed by Aberdeen but may also include funds managed by other third-party managers. Find out more about how ii and Aberdeen work together.

Please review the portfolio Factsheets for more details on the underlying funds and each portfolio's performance. More information about the recent performance of the portfolios can be found in our Quarterly Commentary. Remember, past performance isn't indictive of future returns.

Did you know that when you add a Managed ISA, you also get access to our Self-Managed ISA, at no extra cost? This means you can make your own investment decisions alongside your managed portfolio. One ISA, more ways to invest.

We know you want to make the most of your money. And you want a provider you can trust to help you do just that.

That’s why we’re proud of our multi-award-winning ISA, which was again named Boring Money’s Best Buy ISA in 2024.

In 2022, interactive investor (ii) became part of Aberdeen, a global wealth and investment group dedicated to helping people be better investors. And in 2024, the ii Managed ISA was launched with the support of Aberdeen.

The Managed ISA portfolios are designed for people who don't have time to manage their own investments or would simply prefer to leave it to the experts.

Aberdeen uses its wealth of investment expertise to advise ii on the strategic asset allocation and fund selection for the Managed ISA portfolios. This includes Aberdeen's in-house funds but may also include funds managed by other third-party managers. Each fund used in the portfolios, including Aberdeen-managed funds, charge a management fee. This charge is taken directly by the fund manager.

ii's Investment Committee oversees the relationship with Aberdeen and manages any conflicts of interests. This includes the risk that ii may favour the use of Aberdeen funds for the Managed

ISA portfolios rather than considering alternatives. The Committee act as the final decision maker on the portfolios, ensuring they offer value for money and continue to meet your needs.

For more details on the Managed ISA portfolios, including the fees, please view the portfolio factsheets.

A Self-managed ISA lets you pick your investments yourself. The Managed ISA is closely monitored by our experts, who take care of your portfolio on your behalf and make ongoing buy and sell decisions to keep you aligned to your chosen appetite for risk.

If you already have a self-managed Stocks and Shares ISA, then adding a Managed ISA is easy. The Managed ISA is an option available to you at no extra cost. Your monthly fee won't change unless your total account value increases and moves you up into a higher charges plan. Here's a reminder of our charges.

You can use both the managed and self-managed options separately from one another. This means you can keep your self-managed portfolio as it is and still open a Managed ISA alongside it to benefit from our expert guidance. Your Managed ISA sits within the same tax-efficient wrapper as your self-managed investments, and together they count towards your annual ISA subscription limit of £20,000.

Yes, you can transfer cash from your self-managed ISA to your Managed ISA.

Since the Managed ISA has its own range of portfolios, you cannot transfer investments into it. You have to sell any investments first before moving your money over.

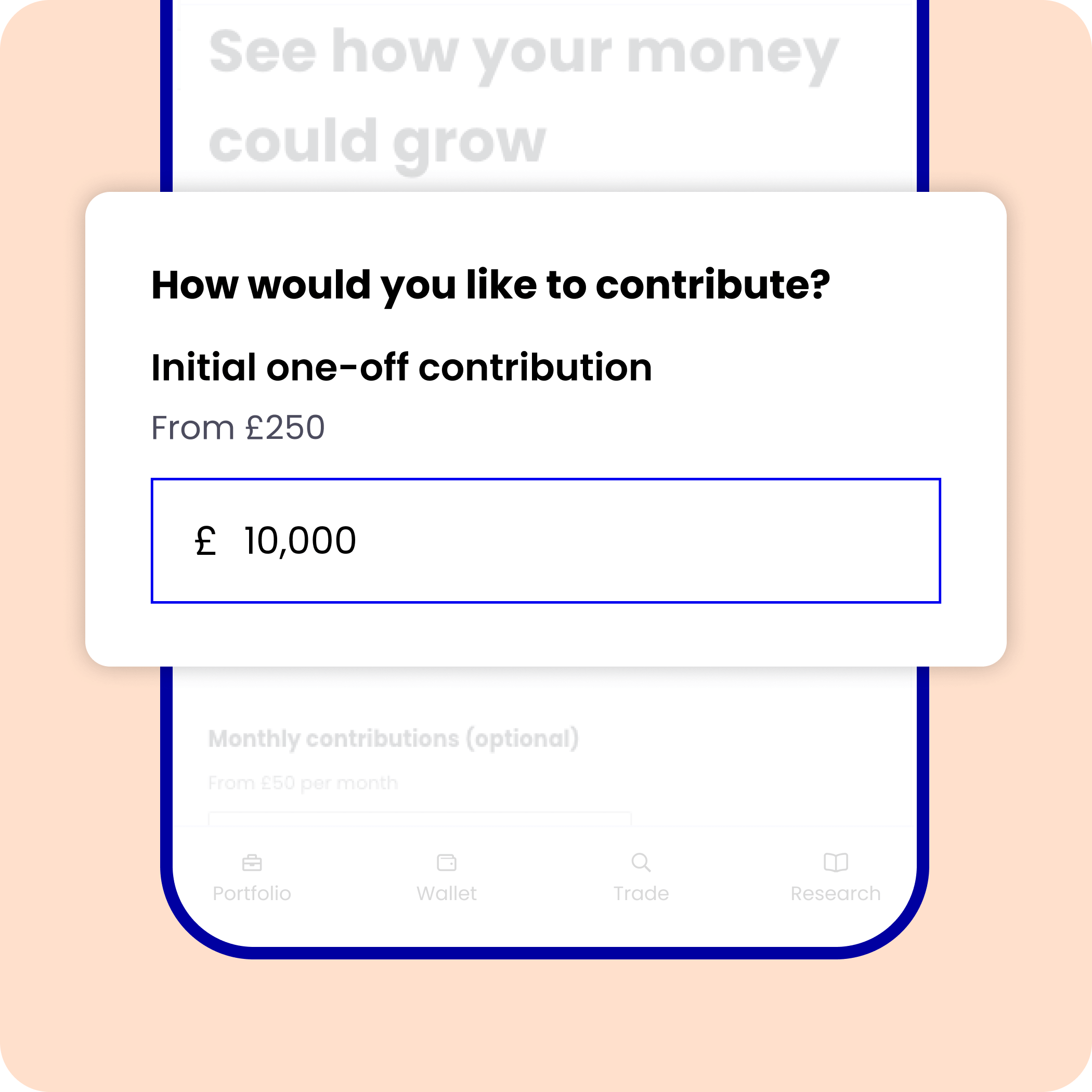

The minimum investment amount is either a £250 lump sum or a £50 regular payment.

If you're starting with a lump sum, you can do this when you set up an account via debit card. If you're starting with a regular payment, you will be prompted to set up a direct debit on account opening.

You can also make one-off payments of at least £50 at any time. Any amount above £50 will be automatically invested into your chosen portfolio.

You can withdraw money from your Managed ISA at any time, with no penalties or exit fees. Withdrawals from your Managed ISA can take up to 12 working days to appear in your self-managed ISA, depending on ongoing transactions in your Managed Portfolio.

Any money you withdraw from your ISA, whether managed or self-managed, cannot be replaced without using up part of your annual ISA allowance. While your allowance remains unchanged, any contributions will count towards it.

When you open a Managed ISA, we’ll ask you a few questions to understand your goals. This involves discovering your risk appetite, and whether you prefer an index investment style or sustainable investment style.

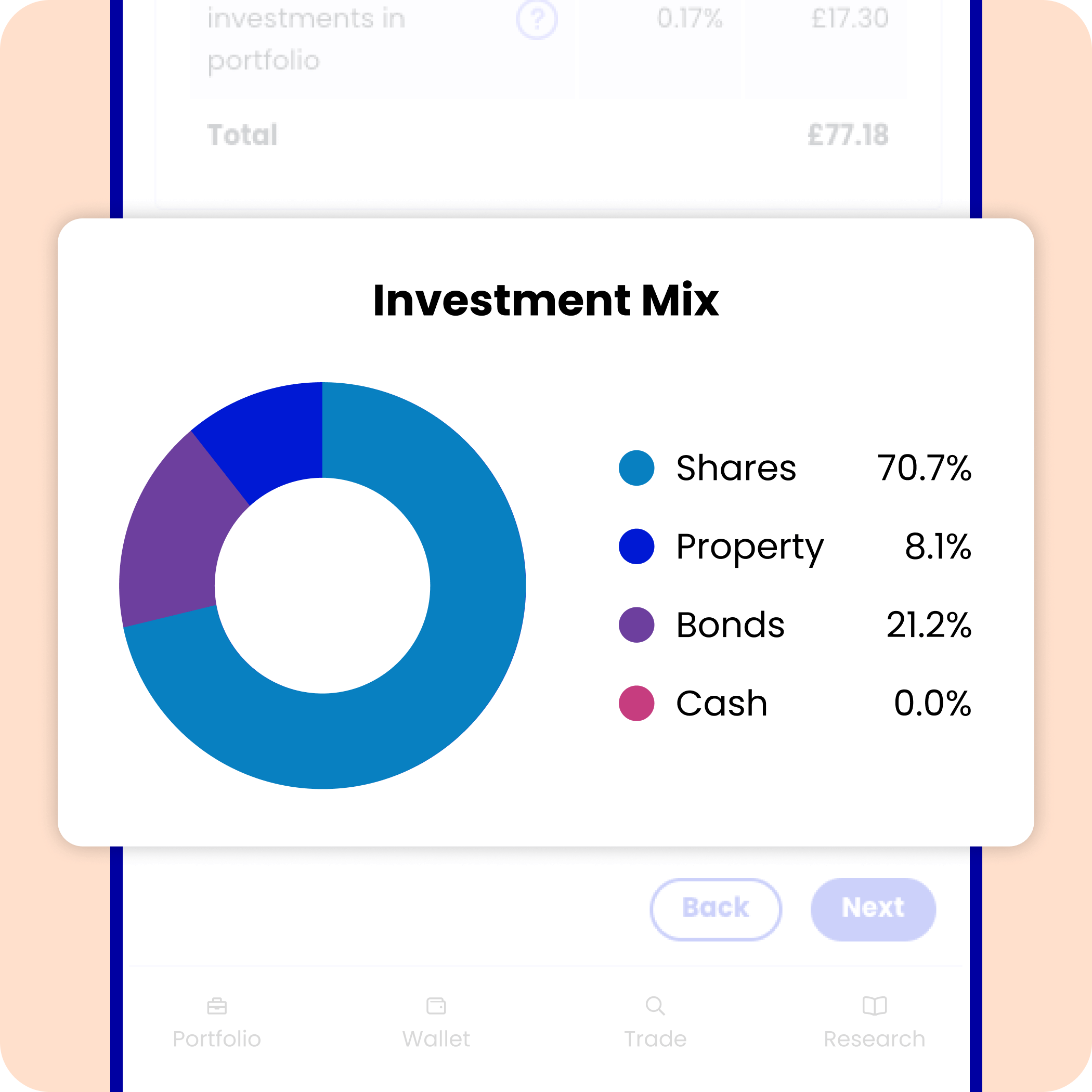

There are five levels of risk across these two styles, meaning there are 10 portfolios in total to choose from. The portfolios mainly invest in passively managed funds, which aim to replicate the performance of a market index.

Funds will hold different assets, such as UK and international shares and government and corporate bonds. The overall asset mix will depend on the portfolio you choose. You can read more about portfolios here.

Our experts are qualified investment managers with a wealth of experience in managing portfolios. Aberdeen advise ii on the fund selection for the Managed ISA portfolios. The portfolios contain funds mostly managed by Aberdeen, but may also include funds managed by other third-party managers.

You can rest assured that your investments are managed by humans, not algorithms. They reassess your portfolio regularly to make sure it’s doing as much for your money as possible.