Important information: As investment values can go down as well as up, you may not get back all of the money you invest. If you’re unsure if an investment account is right for you, please speak to an authorised financial adviser. Tax treatment depends on your individual circumstances and may be subject to change in the future.

Comparison disclosure: We compared yearly charges of an ii ISA with other ISA providers. Results are based on published ISA charges as at 01/02/2026 for AJ Bell & Fidelity. Hargreaves Lansdown charges based on new pricing plan effective 01/03/2026. Verified as accurate by The Lang Cat.

Assumptions: 50% of ISA investments held in funds and 50% in equities, 2 equity and 2 fund trades per year, 12 regular equity and 12 regular fund trades per year. Other trading behaviours will result in different charges than those shown. This comparison covers a single year and does not account for investment growth or the impact of inflation over time. To ensure a fair comparison, fund manager charges have not been included. The information provided is for illustrative purposes only. For precise charges, we recommend contacting the ISA provider directly.

Our low, flat fee means the more your investments grow, the more you can save. Count on a simple, transparent and convenient cost every month.

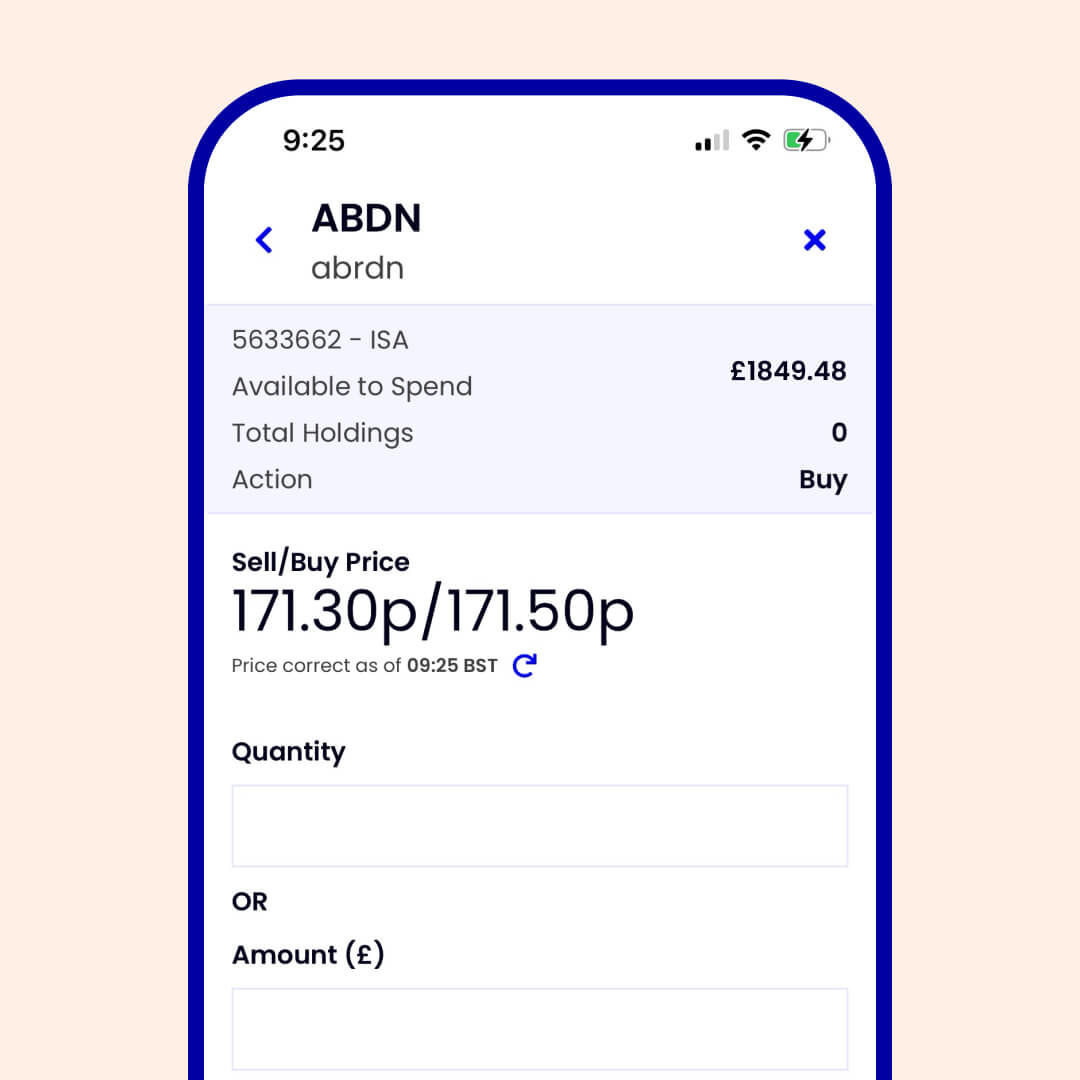

Manage your own investments, leave it to the experts - or a mix of both. With the ii ISA, you have access to both self-managed and managed investment options.

More and more people are choosing straightforward, flat-fee investing. It's why over 50% of our customers have trusted us with their investments for over 10 years.

Enjoy £100 towards your trading fees when you open an ii ISA. That’s up to 25 free trades to kick-start your year.

Offer ends 28 February 2026. Terms and fees apply.

“I’ve been really happy with ii’s ISA fees. They were the predominant reason I changed. It was just obvious. That’s why I’m with ii.”

Nick chose the ii ISA so he could rely on a simple, predictable flat fee. Hear why he joined over 500,000 investors taking greater control of their financial future with ii.

Open your ISA in as little as 10 minutes. With self-managed and managed options available, there’s something to suit your financial needs.

Don’t worry, you won’t be charged until you add money and start investing in your ISA.

Put your £20,000 annual ISA allowance to work. Choose from a wide range of UK and international options. Or leave it to our experts with our Managed ISA.

Rest easy knowing that your ISA protects any growth from tax. There’s no fixed term, so you can withdraw your money when you need to, fitting flexibly around your life.