Are Whitbread shares really worth another 13%?

27th June 2018 12:41

by Graeme Evans from interactive investor

Now that we have coffee shops on every street corner and a few more in between, today's update from Whitbread will only add to feelings that the UK is reaching a caffeine saturation point.

In its first quarter trading statement, UK like-for-like sales for Whitbread's Costa business declined 2% due to the impact of weaker footfall in traditional shopping locations and a downturn in consumer confidence overall.

It says a lot about the current marketplace when Costa feels the need to launch a Flat Black coffee to sell alongside its already popular Flat White. There's currently a similar bloated mood in the casual dining sector, where consolidation is on the cards following a period of over-expansion.

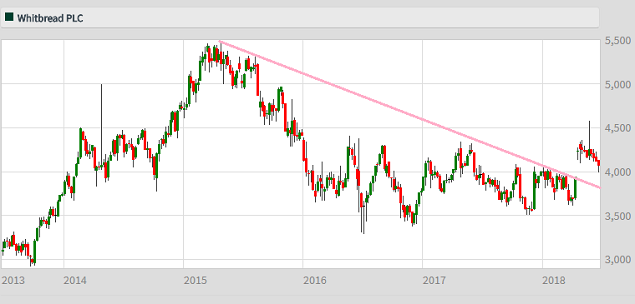

So where has this left Whitbread's long-awaited plan to demerge the Costa business from its Premier Inn sister business? There was a decent lift for Whitbread shares in April after it succumbed to pressure from activist investor Elliott and announced plans to list Costa as a separate entity.

But the steam has long since come out of the share price, partly because the coffee industry has already been stirred up by investment firm JAB's purchase of Pret a Manger and Nestle's licensing agreement with Starbucks.

Recent trends in the coffee and hotel markets haven't helped either, even though the FTSE 100 Index stock did rise today after Whitbread said it was still on track to meet full-year forecasts for profits of around £609 million.

However, analysts at Canaccord Genuity pointed out that all major UK metrics were negative in the quarter, something they had not seen this century.

They added that the statement was "frustratingly light" on detail about the demerger, with investors now having to wait a further three months to hear about the company's plans alongside half-year results.

Canaccord still has a 4500p price target, whereas Morgan Stanley is more cautious amid a change in the Whitbread business mix, with weaker revenues being offset by stronger margins and accelerating efficiencies.

They said: "On the one hand, the company has strong brands, market-leading positions, a strong roll-out story, efficiency gains, and the upcoming Costa demerger.

"On the other hand, underlying trading seems to be deteriorating, the shares are trading close to our £42 sum-of-the-parts estimate, and we think investors need to believe in a more radical break-up to deliver material value.”

They said shares looked fair value, trading as they are on a projected 2019 price earnings multiple of 15 times.

Source: interactive investor Past performance is not a guide to future performance

Despite the short-term uncertainties, Whitbread CEO Alison Brittain insists both the budget hotel market and the coffee market present "long-term structural growth opportunities".

She is sensibly taking steps to increase Costa's focus on selling coffee in higher footfall, more convenient locations, including through self-service machines.

This strategy meant Costa sales overall were 5.2% higher in the UK, driven by a rise of 9.6% for UK Express outlets. Whitbread points out that Costa's stores remain highly profitable and deliver an excellent return on capital.

Meanwhile, weak market conditions and strong comparatives against a year earlier contributed to 0.9% like-for-like sales decline at Premier Inn.

Total accommodation sales, however, were 4.3% stronger after the budget chain added 4,198 rooms over the last 12 months

Brittain added:

"We are confident that we have the right strategies in place to enhance our UK and international market positions and ensure each business is well-positioned to thrive as a separate entity."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.