This is the potential upside for Carpetright shares

26th June 2018 12:21

by Graeme Evans from interactive investor

Carpetright's beleaguered chief executive signed off a calamitous set of full-year results today by looking forward to 30 more years as the "nation's favourite" flooring retailer.

For all Wilf Walsh's optimism, it's hard for investors to look much beyond the next few weeks at the moment. True, the company is on track to jettison loss-making stores through a CVA process and is also in a healthier financial position thanks to a recapitalisation and £65 million fundraising.

But as Walsh himself points out, like-for-like sales trends in recent weeks remain negative even though suppliers have started to stock stores again.

So where does the current Carpetright situation leave long-suffering investors or those tempted by a punt on a potential recovery story?

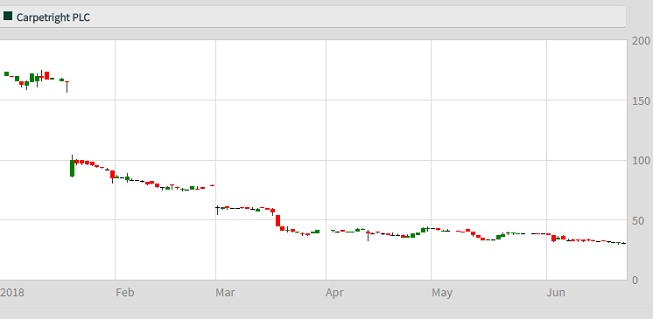

Broker Peel Hunt shares Walsh's optimism, even if it has relaunched its forecasts with a Buy recommendation that carries only a modest upside in price to 40p. The stock has lost more than 90% of its value in the past three years.

Of more significance are the upbeat comments from the Peel Hunt team, who believe the CVA process will be "transformational" for the business. They point to a potential £19 million earnings benefit based on a 20% sales transfer from closing stores.

Peel Hunt add: "Short term, we look for management to re-establish growth for autumn peak trading ahead of a return to group profitability in 2020."

Source: interactive investor Past performance is not a guide to future performance

That's quite a forecast for a company that today plummeted to an underlying loss of £8.7 million for the year to April 28, compared with the previous year's profit of £14.4 million.

At the start of this year, City analysts were looking for a profit of at least £13 million. However, the company's Boxing Day sale "never got going" and a series of profit warnings followed, driven by the slowdown in consumer spending and competition from new rival Tapi.

As a result, the company was left overexposed with the handicap of having an oversized and over-rented store estate.

The CVA, which was approved by landlords earlier this month, is expected to result in the closure of 92 stores by September, alongside significant rent reductions across a third of the remaining 300-plus store estate.

Carpetright will now look to build on strong brand awareness and the ongoing refurbishment of its store estate, with 55% of shops trading under a new brand identity.

Walsh said:

"Investment in our store estate has been crucial - our properties had been chronically under-invested for years and we have been implementing a programme of activity to get it fit for purpose."

He adds that completing the turnaround will take time and that the "road ahead remains a challenging one".

Peel Hunt thinks the disruption from the CVA will mean half-year like-for-like sales will fall 12% before the restructuring benefits start to flow. They eventually see the chain's UK businesses operating on margins in excess of 10%.

The team said:

"We see this as a three-year journey, with UK underlying earnings rising from £1.6 million in 2019 to £16.6 million in 2020 and £24.2 million in 2021, generating underlying profits of £5 million and £16.2 million respectively."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.