Saga: An undervalued income play

21st June 2018 14:49

by Graeme Evans from interactive investor

With December's profit warning fresh in the memory, frustrated Saga shareholders at the company's Folkestone AGM were no doubt relieved that the over-50s insurance and holidays firm spared them any more surprises today.

As analysts at UBS pointed out following a steady but underwhelming AGM trading update: "No bad news is good news".

And even though CEO Lance Batchelor reported "good momentum" across the travel and insurance businesses so far in 2018, today showed a reluctance among investors to climb aboard this particular turnaround story.

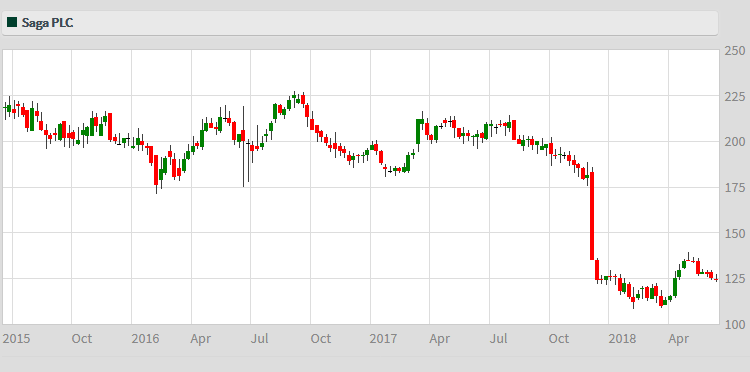

Shares edged up 1% and remain close to where they were following the profits warning. Saga joined the stockmarket at a price of 185p amid much fanfare in 2014, only to struggle to break clear of the 200p mark.

Source: interactive investor Past performance is not a guide to future performance

Frustrated by a static customer base, Batchelor took action in December by announcing a £10 million increase in spending set aside for growing customer numbers. This would have an impact on profitability in 2018/19, but should lead to a better base from which to return to sustainable growth in the long term.

Investors took fright, however, with shares plummeting to as low as 110p earlier this year. Batchelor's plans have also been hampered by a challenging trading environment in home and travel insurance.

Analysts worry about competition in home insurance from the likes of Admiral and Hastings, and that Saga's brand strength is not enough on its own to insulate the company from pressures in insurance broking.

The motor and home markets continue to remain competitive, but Saga pointed out today it is still writing new business on attractive terms. Saga-branded retail insurance policies increased by 1% year on year in the period since February.

Saga has also been renewing its shipping fleet, with bookings for Spirit of Discovery now over 55% of its sales target for the first nine months of sailings from next June. The Saga membership scheme Possibilities has also reached 740,000 members, compared with 536,000 at the end of March.

Numis Securities said today's update showed positive momentum, prompting the broker to reiterate its 'buy' recommendation and 180p price target.

Saga achieved a modest increase in underlying profits in 2017 and remains highly cash generative. That enabled it to increase the dividend by 5.9% to 9p in recent full-year results, offsetting fears that the pay-out may be at risk.

According to Numis forecasts, the dividend will yield 6.9% in 2019.

The company previously forecast a 5% profits drop this year due to the headwinds and the extra £10 million on customer acquisition costs. Batchelor believes the actions will be worthwhile if they result in a better quality of earnings and support a progressive dividend policy for shareholders.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.