AIM stocks for a recession?

Think a global recession is possible? Our award-winning AIM writer has found some potential boltholes.

13th March 2020 16:00

by Andrew Hore from interactive investor

Think a global recession is possible? Our award-winning AIM writer has found some potential boltholes.

Gold tends to be a haven for investors in tough times, and it has certainly been outperforming stock markets, even if there has been a downward move in recent days – apparently due to the need to meet margin calls for shares. AIM has a range of gold miners and explorers, some of which are generating cash and paying dividends.

Although some of the share prices of these gold companies have risen sharply, many have generally fallen back with the market. Even so, the basic resources AIM sub-sector’s fall of just over 5%, reflects significant outperformance to AIM as a whole, which is down by more than 20%.

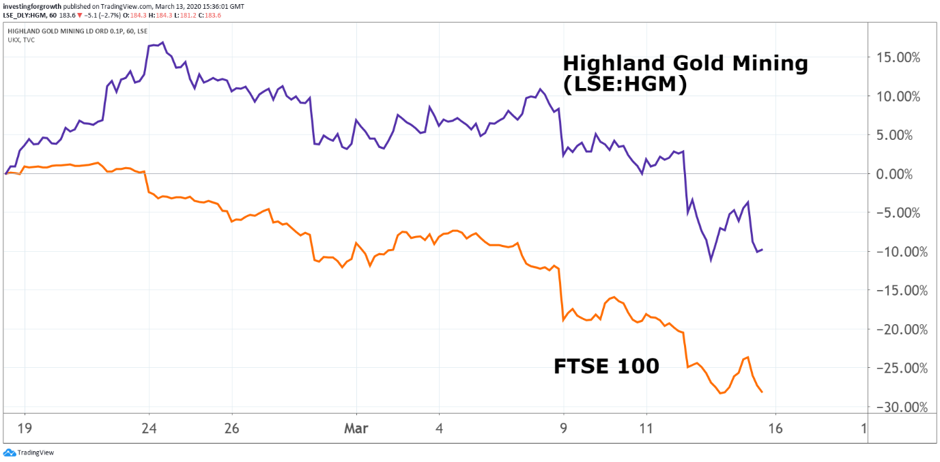

Highland Gold Mining (LSE:HGM) is the largest miner on AIM and its share price has fallen by a more modest figure.

Source: TradingView Past performance is not a guide to future performance

Low interest rates and economic uncertainty have increased the attraction of gold and the price rose by nearly one-fifth last year. Oil was one of the commodities that outperformed gold in 2018, but those gains and more have already been lost this year.

Gold hit a seven-year high recently. Concerns about the Middle East meant that gold started the year strongly and subsequently coronavirus worries have caused a further rise.

Despite falling from its subsequent high, the gold price is still just below $1,600/ounce. It appears that traders may be making sure they bank their profit. Central banks have been buyers of significant amounts of gold in the past couple of years and there are concerns that they may need to sell to raise cash due to the economic crisis that appears on the horizon as the pandemic takes hold.

The gold price has risen by around 8% so far this year in dollar terms. However, currency movements mean that it has risen by 13% in terms of sterling.

- Stockwatch: Ugly duckling gold miner becoming a swan

- Commodities outlook: Sellers attack both oil and gold again

- Biggest fallers during the crash and the shares to buy

- There’s a way to invest in gold via this ii Super 60 recommended fund

Cash appears to be King at the moment, even though it does not generate much in the way of income. Gold, though, is still more attractive than shares.

It appears that the gold price may not rise in the short-term, but, if it continues at around this level, then there will be companies generating additional cash from their production.

An example of the strength of the gold price is that Anglo Asian Mining (LSE:AAZ) expects its revenues to move above $100 million in 2020, up from over $90 million in 2019, even though production is set to decline from 81,399 gold equivalent ounces to between 75,000 and 80,000 gold equivalent ounces.

Anglo Asian operates the Gedabek gold, copper and silver mine in western Azerbaijan. The production decline is down to open pit production having lower grades and taking longer to process. The revenue figure assumes a gold price of $1,480/ounce, a silver price of $17/ounce and copper at $5,700/tonne. The gold price is much higher, but the copper price has drifted below that level and has fallen by around 10% this year.

This provides an example of how industrial metals are performing poorly, while gold continues to be on an upward trend.

Things may be changing, though. The initial weakness of copper and other industrial metals was due to fears about Chinese manufacturing levels. There had been a reduction in demand for copper, but Chinese manufacturing is getting going again so demand could improve in the second half of 2020. ANZ Research believes that $5,300/tonne should be a floor for the copper price, compared with a current price around $5,500/tonne.

It is not just the standard industrial metals where prices are declining. Platinum and palladium have fallen sharply. Palladium had reached record highs earlier this year.

A star performer

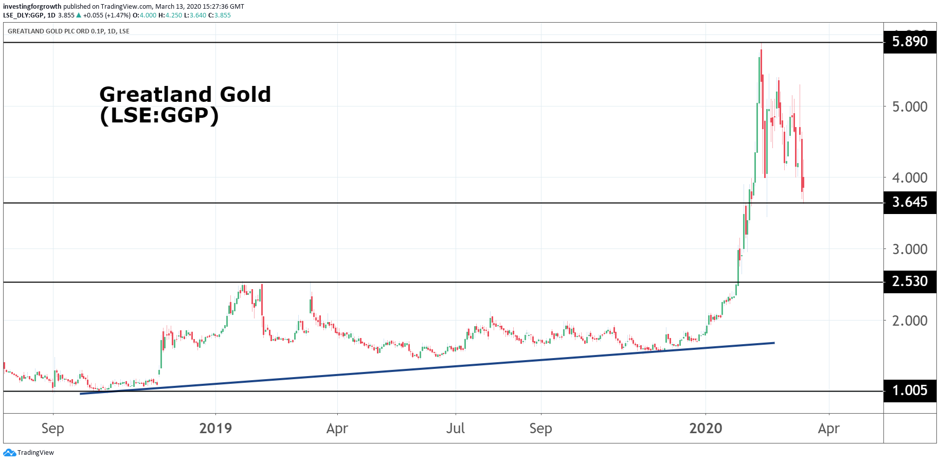

One of the best performing non-healthcare share prices this year is that of Greatland Gold (LSE:GGP). The share price has more than doubled on the back of a flow of positive drilling news from the Havieron deposit in the Paterson region of Western Australia. Newcrest Mining (ASX:NCM) is financing the drilling in order to earn up to 70% in Havieron.

Stage two of the earn-in should be completed this month. Newcrest believes that there is potential for commercial production to commence in 2023.

Mining investment company Starvest (LSE:SVE) has slightly outperformed Greatland with a 120% rise this year. Starvest is a very small company and the rise was on the back of the success of Ariana Resources (LSE:AAU), where it has a 1.7% stake. However, Ariana has lost all the gains made in the first seven weeks of the year. Starvest has hung onto most of its gains. It may be the lack of liquidity in the shares that has helped.

Ariana owns 50% of the joint venture owner of the Kiziltepe mine in Turkey, which generated revenues of $45.1 million last year. In the fourth quarter of 2019, the operating cash costs were $500/ounce, so this is a highly cash generative mine. Gold production was 27,985 ounces in 2019, which was higher than expected.

Source: TradingView Past performance is not a guide to future performance

Gold recovery business Goldplat (LSE:GDP) is unusual in that it produces gold from waste product from mines. The company moved back into profit in the six months to December 2019 thanks to greater efficiency and the higher gold price. This led broker WH Ireland to upgrade its full year pre-tax profit forecast from £1.3 million to £2.2 million. The forecast year-end cash was also upgraded from £2 million to £2.9 million, which is two-fifths of the current market capitalisation.

At 4.05p, Goldplat is trading on 10 times prospective 2019-20 earnings and that could fall to less than four if it can achieve 2020-21 estimates. Cash will build up if this target is achieved and a return to dividend payments could be on the cards.

The share price of Zimbabwe gold miner Caledonia Mining (LSE:CMCL) is one-fifth higher than at the start of the year. Caledonia increased earnings guidance for 2019, which led WH Ireland to raise its forecast to $1.61/share. This is due to strong production at the Blanket mine, and production levels continue to rise. The forecast yield is 3%.

Dividend does not guarantee success

Not all the dividend payers have outperformed. Anglo Asian started paying dividends in 2018 and it has a strong balance sheet. Yet, the share price has slumped by one-third this year. There was $21 million in the bank at the end of 2019 and the final debt repayment will be made this year.

Another company that has declined by around one-third is Russia-based Trans-Siberian Gold (LSE:TSG), which says that 2020 gold production at the Asacha gold mine will be between 38,000 ounces and 42,000 ounces. Cash costs will be between $780/ounce and $860/ounce, while all-in sustaining costs should be below $1,000/ounce. That is well below the current gold price.

- Trading the dip: Inside the mind of an emotional investor

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

A mineral resource estimate on one million ounces of gold has been reported for the Rodnikova deposit in Kamchatka, Russia.

Trans-Siberian pays a basic dividend of $3 million a year. There have also been special dividends. Capital investment is forecast at $12.1 million for the year, mainly due to drilling to expand the existing resource, but there could still be scope for a special dividend.

The 2019 total dividend was 2.54p a share, which is lower than previous years because of the increased investment in exploration. At 52p a share, that is a yield of 4.9%.

Pan African Resources (LSE:PAF) increased gold sales by 14% to 90,602 ounces in the six months to December 2019. Earnings per share more than doubled to 1.14 US cents a share. This was due to the improved performance of Evander Mines and the strong gold price. Pan African will commence mining the PC Shaft pillar at Barberton’s New Consort Mine during March.

Cash generation is strong, and borrowings are coming down at a rapid rate. There was a dividend of 0.12p a share last year and that could more than double this year. Chief executive Cobus Loots and other directors have bought shares since the interims.

A rocky road

By their nature, these gold miners do not provide a smooth progression of profit. Production at a mine and gold prices will always be volatile.

It is difficult to recommend any shares as a buy in these times, because of the continuing uncertainty. The cash generative and dividend paying gold companies are worth keeping an eye on, though, and they could provide attractive opportunities when confidence starts to return.

Andrew Hore is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.